For years, employee benefit plans (EBPs) have been under a regulatory microscope. In November 2021, the Department of Labor (DOL) will begin to assess the quality of audit work by independent qualified public accountants (IQPAs) regarding audits of EBPs covered under the Employee Retirement Income Security Act of 1974 (ERISA) for the 2020 Form 5500 filing year. It has been ten years since the last time the DOL formally performed such an assessment.

For years, employee benefit plans (EBPs) have been under a regulatory microscope. In November 2021, the Department of Labor (DOL) will begin to assess the quality of audit work by independent qualified public accountants (IQPAs) regarding audits of EBPs covered under the Employee Retirement Income Security Act of 1974 (ERISA) for the 2020 Form 5500 filing year. It has been ten years since the last time the DOL formally performed such an assessment.

Investigations and audits have been increasingly successful at identifying and penalizing plan administrators for failure to meet their fiduciary responsibilities, including failing to hire qualified firms to provide EBP audits. Plan administrators who view the audit as a commodity and select a firm based on the lowest fee may pay far more through substantive penalties.

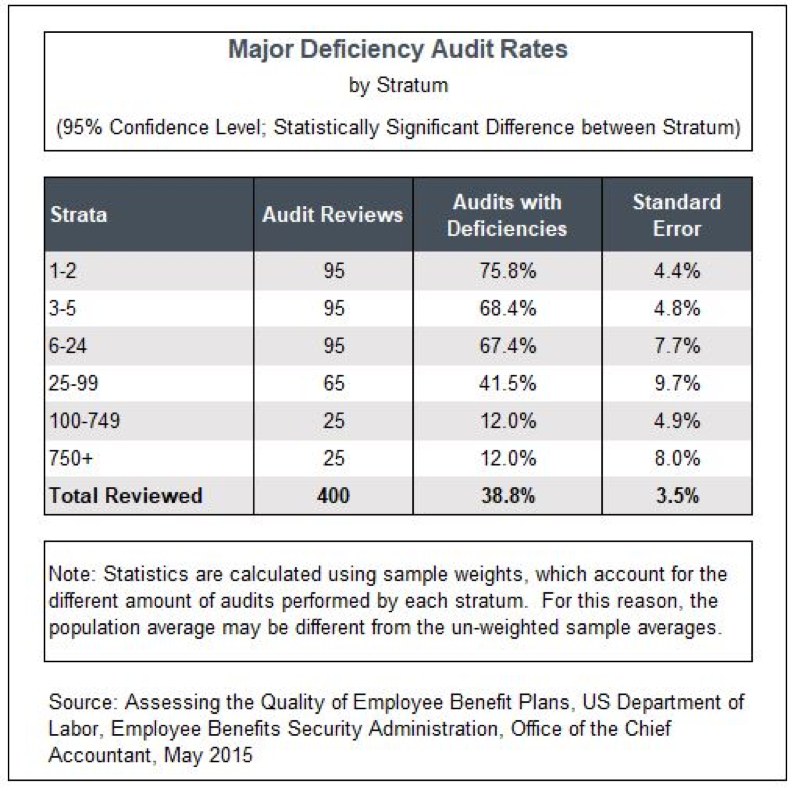

The DOL and the AICPA EBP Audit Quality Center, through its publication The Importance of Hiring a Quality Auditor, have stressed above all the importance of bringing only highly qualified and credentialed auditors to the table. And, as the DOL 2011 Assessment Report chart below indicates, “the results … clearly indicate a link between the number of employee benefit plan audits performed by a CPA and the quality of the audit work performed…. CPAs who performed only one or two employee benefit plan audits annually had a 76% deficiency rate.” The deficiency rate for firms performing over 100 plan audits was only 12%.

As a growing firm in five cities and two states, we are proud that LaPorte numbers among those firms auditing over 100 employee benefit plans, giving our clients even greater confidence in our ability to provide high-quality EBP audits. Members of the EBP Group annually audit employee benefit plans with participants ranging from 100 to over 10,000 and assets ranging from less than $1 million to over $500 million. Our EBP practice also meets the additional criteria set by the AICPA and DOL.

Briefly, here are other reasons drawn from AICPA’s The Importance of Hiring a Quality Auditor regarding why a quality audit is important to EBPs, what the risks are to plan sponsors if a quality audit is not performed, and how to identify qualified audit firms.

Why financial statement audits are important

Independent EBP financial statement audits provide valuable accountability as independent, third-party reports to interested parties, including participants, plan management, and the DOL, among others. The audit helps assess the plan’s present and future ability to pay benefits and protect the financial integrity of the EBP, which in turn helps users know whether funds are going to be available for retirement, health, and other benefits.

Depending on the auditors’ findings, the audit can also help plan management improve and streamline operations by evaluating the strength of the plan’s internal control over financial reporting and identifying control weaknesses or plan operational errors. Finally, the audit helps plan administrators carry out their legal responsibility to file a complete and accurate Form 5500 for the plan with the DOL.

Under ERISA, plan administrators are held responsible for seeing that plan financial statements are properly audited according to generally accepted auditing standards, and hiring a plan auditor is considered a fiduciary function.

Risks to plan sponsors if a quality audit is not performed

As with all fiduciary responsibilities, there is potential liability:

- Fiduciaries who do not follow the basic standards of conduct may be personally liable to restore any losses to the plan.

- There is a significant amount of risk to plan administrators associated with the audits of their ERISA plans. The DOL has implemented various enforcement strategies and penalties with respect to audit deficiencies, based on the number of significant deficiencies identified in DOL studies.

- The DOL Employee Benefits Security Administration (EBSA) has significantly stepped up its enforcement of the audit requirement for employee benefit plans, with the right to reject plan filings and assess penalties of up to $2,529 per day, without limit, on plan administrators for deficient filings. The Internal Revenue Service may also assess penalties of $250 per day, up to $150,000.

- An incomplete, inadequate, or untimely audit report may result in a rejection of a filing and penalties being assessed against the plan administrator

- Hiring a firm that lacks knowledge of the specialized nature of the industry and skills necessary to perform plan audits conflicts with the stated goal of ERISA to protect plan participants.

Results of various DOL reviews of the quality of plan audits show that accounting firms with limited employee benefit plan audit practices have a higher rate of deficient professional work. The DOL has also identified certain factors that can affect whether or not employee benefit plan audits comply with established professional standards. Cited from the DOL, these factors include:

- The adequacy of technical training and knowledge on the part of auditors conducting employee benefit plan audits

- The awareness of auditors of the uniqueness of employee benefit plan audits

- Whether auditors have established quality review and internal process controls

- The perception by plan administrators and/or auditors of the importance of employee benefit plan audits beyond fulfilling a governmental regulatory requirement

- The amount of employee benefit plan audit work in the auditor’s overall practice

- The failure of auditors to perform necessary audit work

- The failure of auditors to understand the limited scope audit exception

- The period of time available to adapt to new technical guidance

Identifying quality audit firms

As a plan administrator, you should make the selection of the plan auditor a high priority and exercise care during every phase of the auditor selection process. Frequently, audits are found to be deficient because of the failure of the auditor to conduct tests in areas unique to employee benefit plans. Your auditor should have knowledge and experience in the following areas:

- Evaluating whether plan assets covered by the audit have been fairly valued

- Unique aspects of plan obligations

- Timeliness of plan contributions

- How plan provisions affect benefit payments

- Allocations to participant accounts, if applicable

- Issues that may affect the plan’s tax status

- Transactions prohibited under ERISA

It’s clear that evaluating whether or not your plan auditor is qualified according to AICPA and DOL guidelines is essential, as the earlier chart has demonstrated. If you are selecting an EBP auditor for the first time or you believe you need to reevaluate the quality of your current auditor, we encourage you to read the AICPA’s plan advisory.

We also invite you to learn more about LaPorte’s Employee Benefit Plan Services Group by visiting our website or contacting a LaPorte professional.