The following article originally appeared in the February newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

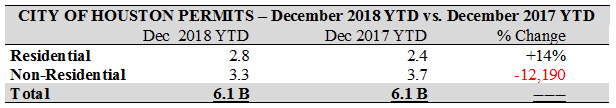

Here is the way the permits wound up for 2018; it was a decent year and 2019 is off to a stronger start.

The Dodge Data and Analytics New Contract Awards Report for the 10 county Houston MSA reflect a slightly more positive picture: Residential up 25.2 %; Nonresidential down 6.7%; Overall construction up 9.1%. The growth is in the suburban areas.

2018 was a very good year for residential, especially single-family homes in the $ 200,00 to $400,000 range. Over 30,000 houses were started, over 5000 of them “build to rent” as married millennials want space for children and pets, but they do not want mortgages. For multi-family builders, it was a year of rebalancing as the displaced Hurricane Harvey residents returned to their restored homes. By the end of the year, overall occupancy had climbed back to 89.6%. This should be another decent year for the residential sector. The Greater Houston Partnership is projecting both population and employment growth of 71,000 net new jobs. Higher interest rates may create some mild headwinds for new home sales, units started will still be respectable. The multi-family segment should gain strength, as five to seven new jobs will support one apartment unit. Apartment Data Service projects 13, 000 new units will be started in 2019. The Heavy Industrial sector has two major projects, both chemical plants, just breaking ground: the $2.4 Billion LyondellBasel plant in Channelview, Texas and the $1.6 billion Conservo plant in Baytown, Texas. There are reports of several other large plants in the early stages of design with construction expected to begin in 2021 or 2022. These large projects will strain an already tight labor market. The Highway/Civil/Municipal market will be stronger with projects flowing from the $2.5 billion Flood Control Improvement Bond Program. The work on Highway 290 and the Grand Parkway is leveling out, and TEXDOT is in the early planning phase of the mega-project that will reroute Highways 59 and 45 around downtown and create 8 lanes each way for both. This project projected to start in 2020 will be one of the largest in the country. There is also a projection that work will begin in 2019 on the privately-funded, $15 billion “Bullet Train” between Houston and Dallas.

The Heavy Industrial sector has two major projects, both chemical plants, just breaking ground: the $2.4 Billion LyondellBasel plant in Channelview, Texas and the $1.6 billion Conservo plant in Baytown, Texas. There are reports of several other large plants in the early stages of design with construction expected to begin in 2021 or 2022. These large projects will strain an already tight labor market. The Highway/Civil/Municipal market will be stronger with projects flowing from the $2.5 billion Flood Control Improvement Bond Program. The work on Highway 290 and the Grand Parkway is leveling out, and TEXDOT is in the early planning phase of the mega-project that will reroute Highways 59 and 45 around downtown and create 8 lanes each way for both. This project projected to start in 2020 will be one of the largest in the country. There is also a projection that work will begin in 2019 on the privately-funded, $15 billion “Bullet Train” between Houston and Dallas.

The Commercial and Light Industrial Sector have a better picture this year. Two major segments, relatively dormant for the past two years, will show increased activity. The general-purpose office space category ended 2018 with positive absorption for the year of 433, 246 square feet thanks to a terrific 4th quarter when 1, 652, 979 sq. ft. were absorbed. Overall occupancy remains at 78.8%. Absorption should continue to grow as energy prices remain favorable to Houston -based energy companies. They can continue reinstating workers laid off in the downturn. The two new office projects just getting underway downtown are driving major renovations in two existing complexes trying to remain competitive. Other office buildings are so competitively obsolete they may be forced to convert to residential living. The medical segment should see major construction on the TMC3 project, the 1.5 million square foot research facility shared by four major institutions. Also, the $1 billion, St Luke’s/Catholic Health Initiatives replacement hospital and new medical office building project, postponed two years ago, is now viable. The office portion could start in 2019. Several suburban, small medical office buildings should be built as well.

Other segments that will remain strong are light industrial warehouses, retail, education, both K-12 and Higher-Education. Hotels will see a turnaround in their key metrics, occupancy and revenue per available room, leading to an increase in supply of about 3.5%, and religious construction remains steady, albeit a bit flatter this year.

The major challenges remain: skilled worker shortages, succession issues, and the march of technology. Contractors are showing increasing support for the Construction Career Collaborative (C3) and Rational Middle/Immigration Video Series, both initiatives aimed at increasing the construction workforce.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: February 2019

A Decent Finish – A Stronger Start

by Pat Kiley | March 13, 2019