Editor’s note: AGC Houston held their 2014 Annual Chapter Meeting last month where Ken Simonson offered attendees his update about the improving economy and what that means for construction companies in 2014. After talking about Texas’s positive construction employment growth during part two of his presentation, he concludes with more construction employment data and summaries of producer price indexes for several key materials.

Editor’s note: AGC Houston held their 2014 Annual Chapter Meeting last month where Ken Simonson offered attendees his update about the improving economy and what that means for construction companies in 2014. After talking about Texas’s positive construction employment growth during part two of his presentation, he concludes with more construction employment data and summaries of producer price indexes for several key materials.

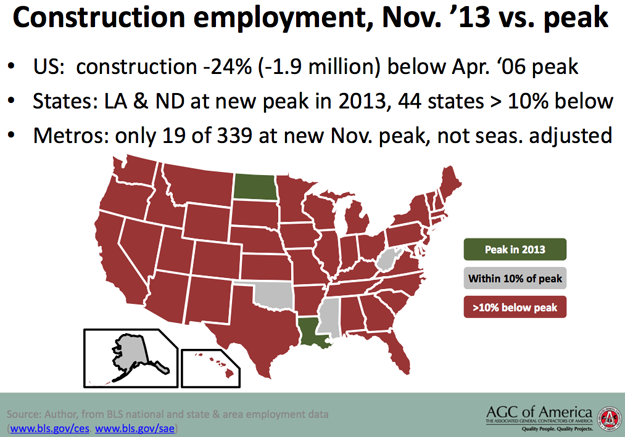

In spite of every metropolis in Texas showing positive growth or at least level employment over the past year, Texas still isn't even within 10% of its previous peak construction employment, so I think you have quite a ways to go. Does that mean that you'll be able to keep on hiring?

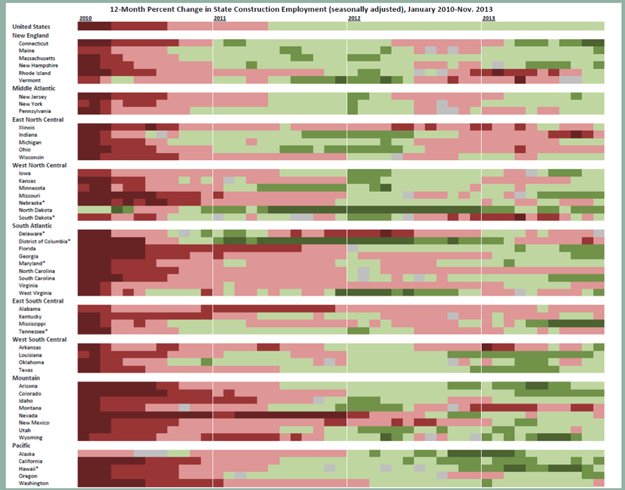

Next is a map (in which I don't expect you to find Texas) which shows where each state was in March of 2012. [Click on image to enlarge.] This isn't meant to be an eye chart. It's meant to show how employment has improved through the whole country from 2010, when you had all these states in deep red, gradually fading to pink, and then more and more green showing up. It's still not universal, and it's not consistent in most states for month after month. In fact, Texas turned green in the middle of 2011 and stayed some shade of green ever since. That is a lot better than most states, but nevertheless, the construction industry is still facing challenges.

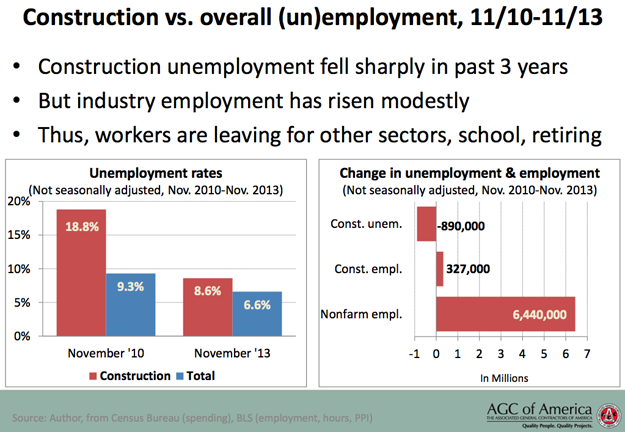

The question is whether there will be enough workers left to do the additional work that I see coming.

The unemployment rate in construction has dropped very sharply in the past three years: from 18.8% to 8.6%. That means that 890,000 workers – who were previously unemployed, had worked in construction, or were looking for work – are no longer reporting in the monthly survey that they are unemployed. The industry has added only 327,000 workers, so that means that the rest have either found jobs in other industries, went back to school, retired, left the workforce, or perhaps, left the country. In any case, they're not out there waiting for you to call them back to work. So that is the number one concern that contractors have expressed to us.

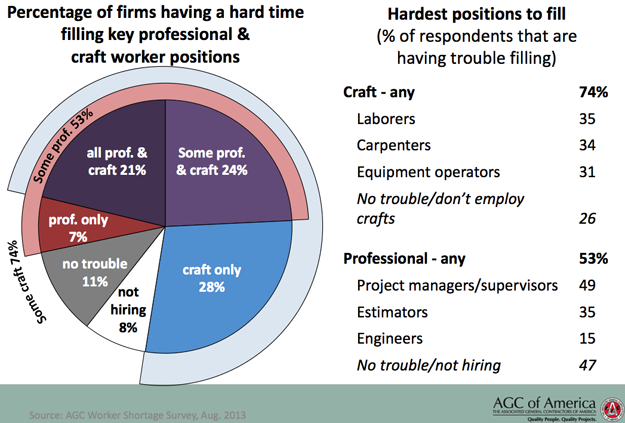

In a survey we did in August, and the results were largely confirmed by the one we released last week, three-quarters of companies said they were already having trouble finding craftworkers, and over half the companies said they were having trouble finding professional workers.

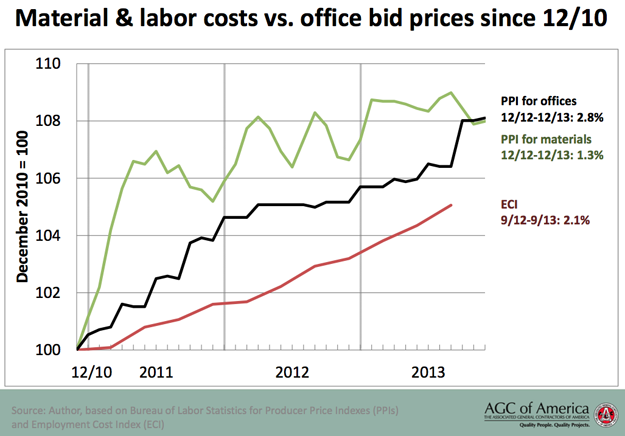

Costs have been much less of an issue than they were before the recession. In 2011, we saw a sharp run-up on the producer price index for materials, shown by the green line. Since mid 2011, it's been up and down. Last year, there was a very minor increase, 1.3% overall. Gypsum and lumber were exceptions, but things like steel and copper actually had price declines. Diesel fuel, by the end of the year, was just about flat. Meanwhile, the employment cost index, wages, benefits, and required payments, like worker's comp and unemployment comp, has had a very mild and steady increase. As a result, contractors have gradually been increasing their prices. That's shown by that block stair-step line. By the end of last year, the increases in materials were matched to stay ahead of labor costs. With this increase in difficulty finding workers, you'll have companies pay a lot more overtime and more signing and relocation bonuses, so that red employment cost index is going to start turning up much more steeply.

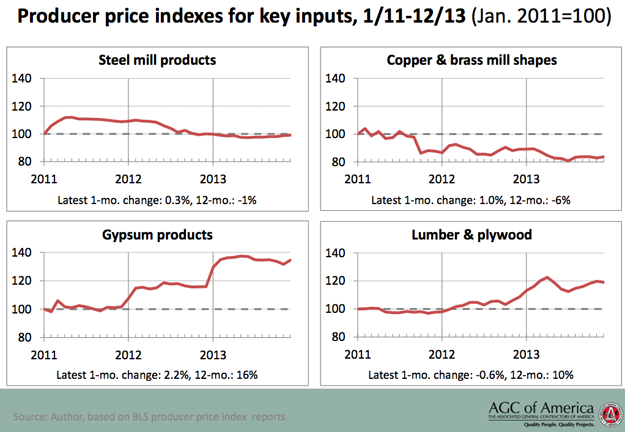

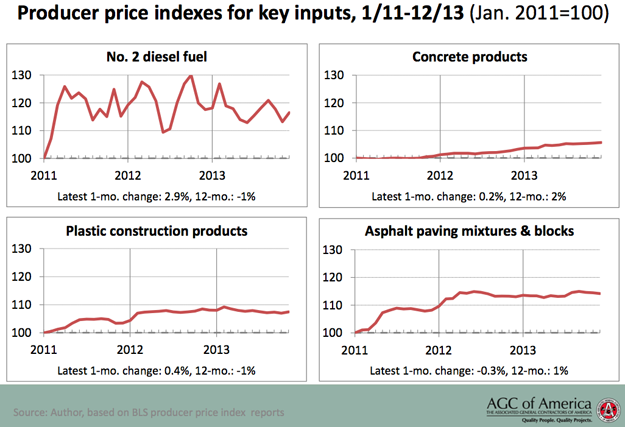

Here's what's happened to various materials costs over the last three years. In the above graphics, you can see steel is just back to where it was at the beginning of 2011. This year we've had a lot of announcements by the steel producers. We'll see if it flows through to the product. I would think this would be up, but not as sharply as in 2011. Copper is still going nowhere. It's well below its high set in February of 2011. Gypsum prices did jump in the beginning this year, but if I'm right about housing slowing down, we may see that flatten out. Lumber and plywood are always volatile, which is not a big deal for most contractors. Diesel fuel is always jumping up and down. The Energy Information Administration predicts that the average for the year will be lower than last year. I think they have that right. Concrete products had a slow upper drift, while plastics and concrete have had no strong trend either way.

So to wrap up, we finished last year with a 4-7% increase. There was a big slow down with private nonresidential construction, and a continued decline in public construction. For 2014-2017, we should do a little better with high single-digit growth overall, but less of it going into single-family housing and retail and actual declines, or at best, level each year on public spending. Instead, that “shale gale” will continue to create construction opportunities all over the country, and especially, here in the Gulf Coast. The Panama Canal widening will drive more projects for at least another year, and the changing demographic with more elderly, more young kids and fewer high school graduates, fewer going into college, fewer coming into the workforce – that will create new challenges both in terms of finding projects and finding workers to do them as more older workers retire. Labor costs, therefore, I think are going to escalate over the next few years, even while materials costs stay pretty flat.

Read the previous two portions of Construction Spending, Labor, and Materials Outlook.

Add new comment