More metros add jobs in September; architecture billings rise; retail outlook stays bleak Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Sign up now for Nov. 20 AGC/AIA/CMD (formerly Reed) webinar.

From September 2013 to September 2014, construction employment increased in 236 out of 339 metropolitan areas (including divisions of larger metros) for which BLS reports construction data, declined in 53 and was unchanged in 50, according to an analysis that AGC released last Wednesday. (BLS combines mining and logging with construction in most metros to avoid disclosing data for industries with few firms. Because metro data is not seasonally adjusted, comparisons with months other than September are not meaningful.) Houston-Sugar Land-Baytown added the most construction jobs in the past year (13,500 construction jobs, 7%), followed by the Los Angeles-Long Beach-Glendale division (10,100 construction jobs, 9%) and the Dallas-Plano-Irving division (9,900 combined jobs, 9%). The largest percentage gains occurred in Owensboro, Ky. (33%, 900 combined jobs), Crestview-Fort Walton Beach-Destin, Fla. (26%, 1,000 combined jobs) and Lake Charles, La. (25%, 2,700 construction jobs). Phoenix-Mesa-Glendale again lost the most jobs (-6,900 construction jobs, -7%), followed by the Bethesda-Rockville-Frederick, Md. division (-4,100 combined jobs, -12%). The steepest drop was again in Steubenville-Weirton, Ohio-W.Va. (-21%, -400 combined jobs), followed by the Gary, Ind. Division (-16%, -2,800 construction jobs) and Lewiston, Idaho-Wash. (-15%, -200 construction jobs).

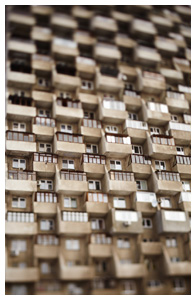

The Architecture Billings Index, which measures whether architecture firms’ billings rose or fell from the prior month (any score over 50 denotes more firms reported growth than reported decline) accelerated to a score of 55.2 in September from 53.0 in August, the American Institute of Architects (AIA) reported on October 22. “Strong demand for apartment buildings and condominiums has been one of the main drivers in helping to keep the design and construction market afloat in recent years,” said AIA Chief Economist Kermit Baker. “There continues to be a healthy market for those types of design projects, but the recently resurgent institutional sector is leading to broader growth for the entire construction industry.” AIA say the index “reflects the approximate nine-to-12 month lead time between architecture billings and construction spending.

The outlook remains bleak for most retail construction—but not all. “For the second consecutive quarter, the national vacancy rate for neighborhood and community shopping centers registered at 10.3%,” Brad Doremus and Victor Calanog of commercial real-estate data provider Reis wrote in National Real Estate Investor on October 21. “This represents a decline of just 20 basis points over the past 12 months. In the three years since reaching its cyclical high, retail vacancy has only mustered a decline of 80 basis points….Moreover, the fallout from store closures has not passed and continues to evolve. Dollar Tree’s acquisition of Family Dollar during the third quarter creates the potential for store closures from a sector of the market that has been performing well. The combined entity will have multiple stores within the same trade areas, which will likely lead to closures. Hundreds of stores could be closed in the future… Meanwhile, construction activity remains muted, totaling 1.4 million sq. ft. during the third quarter, which is roughly 16 percent lower than in the second quarter. With demand so depressed, investors and developers have little incentive to build new product in the current market. The few properties actually being constructed are greenlit due to the pre-leasing they obtain before developers break ground.” Wal-Mart Stores Inc. announced on October 15 that it expects to open between 60 and 70 supercenters next fiscal year, down from about 120 this year; 9-12 Sam’s Club stores, down from about 20; and 200 to 220 smaller-format stores, down from 240. “The number of U.S. bank branches has fallen to the lowest level since 2005,” the Wall Street Journal reported on September 30. “The branch drop was the fifth in a row and the biggest one-year decline recorded in at least two decades by the Federal Deposit Insurance Corp.” Bucking the trend, “luxury shops on busy urban streets like Fifth Avenue in Manhattan or Michigan Avenue in Chicago…remain bright spots in the retail industry,” the Journal reported on Wednesday. “Open-air luxury-retail projects are popping up in” Miami, Atlanta and Houston.

Real (net of inflation) gross domestic product (GDP) increased 3.5% at a seasonally adjusted annual rate in the third quarter (Q3) following a 4.6% jump in the second quarter (Q2), the Bureau of Economic Analysis (BEA) reported last Thursday. Real private fixed investment in new nonresidential structures (including mines and wells) increased at a 3.7% rate in Q3, down from a 12.6% rate in Q2, while real investment in new residential structures decreased at a 4.8% rate after rising at a 6.8% rate in Q2. Among nonresidential categories, real investment in commercial and health care structures declined at a 3.0% rate in Q3 after rising at a 16.5% rate in Q2; manufacturing structures, 38% and 32%, respectively; power and communication structures, -2% and -16.5%; and other nonresidential structures (“primarily…religious, educational, vocational, lodging, railroads, farm, and amusement and recreational structures, net purchases of used structures, and brokers' commissions on the sale of structures”), -7.2% and 19%. Real investment in new multifamily structures soared 13% and 42%, respectively; and new single-family fell at a 6.1% rate after rising at a 3.5% pace. Real government gross investment in structures climbed at a 3.3% rate in Q3 and 16.5% in Q2. The price index for real private investment in new nonresidential structures rose at a 2.2% rate in Q3 and 1.4% in Q2; new residential structures, 7.5% and 0.1%; and government structures, 2.5% and 1.5%.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.

AGC's Data DIGest: October 27-31, 2014

by Ken Simonson | November 03, 2014

Add new comment