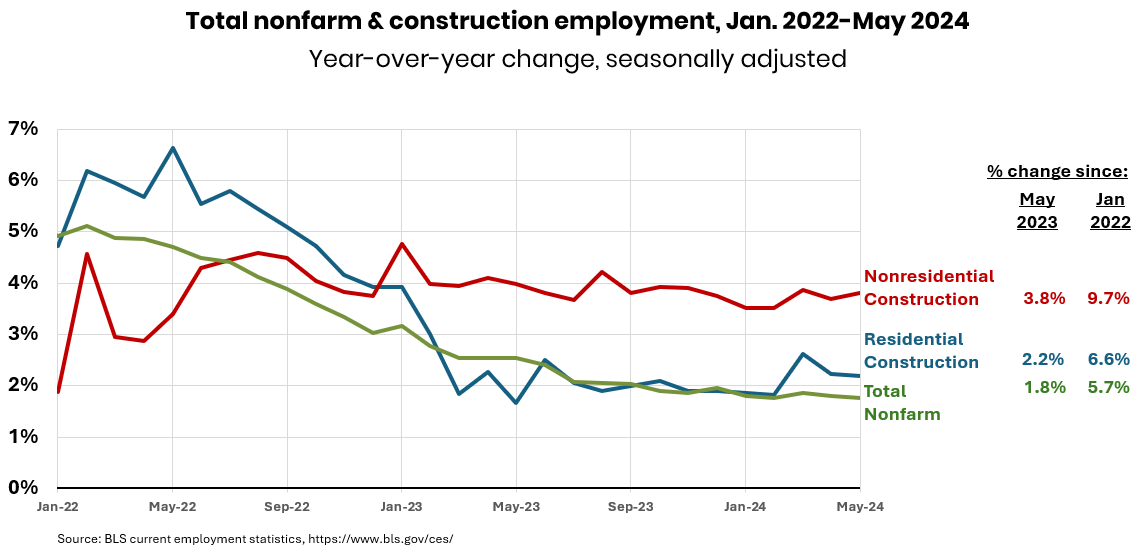

Construction employment, seasonally adjusted, totaled 8,228,000 in May, a gain of 21,000 from April and 251,000 (3.8%) year-over-year (y/y), according to AGC’s analysis of data the Bureau of Labor Statistics (BLS) posted today. The y/y growth rate outpaced the 1.8% increase in total nonfarm payroll employment. Residential construction employment (at residential building and specialty contractors) rose by 3,500 in May and 71,900 (2.2%) y/y. Nonresidential construction employment (at building, specialty trade, and heavy and civil engineering construction firms) increased by 17,100 for the month and 179,000 (3.9%) y/y. Seasonally adjusted average hourly earnings (AHE) for production and nonsupervisory employees in construction (i.e., most craft and office workers) rose 4.3% y/y to $35.45 per hour. The “premium” for nonsupervisory construction workers was 18.2% over the private sector average of $29.99 but remains considerably below the average premium in 2000-2019 of 21.5%. The number of unemployed jobseekers with construction experience totaled 406,000, not seasonally adjusted, an increase of 51,000 (14%) from May 2023.

Construction employment, seasonally adjusted, totaled 8,228,000 in May, a gain of 21,000 from April and 251,000 (3.8%) year-over-year (y/y), according to AGC’s analysis of data the Bureau of Labor Statistics (BLS) posted today. The y/y growth rate outpaced the 1.8% increase in total nonfarm payroll employment. Residential construction employment (at residential building and specialty contractors) rose by 3,500 in May and 71,900 (2.2%) y/y. Nonresidential construction employment (at building, specialty trade, and heavy and civil engineering construction firms) increased by 17,100 for the month and 179,000 (3.9%) y/y. Seasonally adjusted average hourly earnings (AHE) for production and nonsupervisory employees in construction (i.e., most craft and office workers) rose 4.3% y/y to $35.45 per hour. The “premium” for nonsupervisory construction workers was 18.2% over the private sector average of $29.99 but remains considerably below the average premium in 2000-2019 of 21.5%. The number of unemployed jobseekers with construction experience totaled 406,000, not seasonally adjusted, an increase of 51,000 (14%) from May 2023.

Construction spending (not adjusted for inflation) totaled $2.10 trillion in April at a seasonally adjusted annual rate, down 0.1% from the upwardly revised March rate but up 10% y/y, the Census Bureau reported on Monday, as declines in public and private nonresidential and multifamily construction outweighed growth in manufacturing projects. Private residential construction inched up 0.1% for the month and 8.0% y/y. Single-family homebuilding rose for the 12th-straight month, by 0.1%; multifamily construction spending declined 0.3%; and owner-occupied improvements rose 0.3%. Private nonresidential construction spending dipped 0.1% for the month but climbed 8.3% y/y. The largest private nonresidential segment—manufacturing construction—rose 0.9% for the month (with computer/electronic/electrical up 2.8%, chemical and pharmaceutical down 0.6%, and transportation equipment up 6.4%). Commercial construction fell 1.1% (comprising warehouse, down 1.4%; retail, down 1.0%; and farm, unchanged). Power and energy construction ticked up 0.1%. Private office and data center construction rose 0.4%. Public construction spending decreased 0.3% for the month but rose 19% y/y. The largest public segment, highway and street construction, declined 0.5% for the month, education spending slipped 0.2%; and outlays for transportation facilities increased 0.5%.

There were 351,000 job openings in construction, not seasonally adjusted, at the end of April, a decline of 23,000 (-11%) y/y, BLS reported on Tuesday. Hires for the full month totaled 434,000, a drop of 30,000 (-6.5%). Layoffs totaled 119,000, a drop of 51,000 (-30%). While declining openings and hires may imply cooling demand, the steep drop in layoffs indicates contractors expect to need current workers in the near future. Many firms still report difficulty filling positions.

The Dodge Momentum Index (DMI) increased 2.7% in May from April but declined 7% y/y, “following an abnormally strong May 2023,” Dodge Construction Network reported on Tuesday. “Over the month, commercial planning progressed 5.5% [and 8% y/y] and institutional planning slowed by 3.4%” and 32% y/y. The index is “a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year…Data center planning supported growth on the commercial side of the index in May, alongside a steady acceleration in retail planning over the last six months. Marginal increases in project activity were also seen in hotel and warehouse planning. For the third consecutive month, healthcare and education planning activity slowed [. Public project planning activity also slackened], while the value of amusement planning projects has been picking up speed recently.”

“Economic activity in the services sector grew in May after contracting in April for the first time since December 2022,” the Institute for Supply Management (ISM) reported on Wednesday. Construction was listed first among 14 sectors (out of 18) reporting paying higher prices, first among seven sectors reporting an increase in employment, and was among sectors reporting growth (13 sectors), growth in business activity (13 sectors), new orders (10), and order backlogs (7). Construction was one of six sectors that reported faster supplier deliveries. Items significant for construction reported up in price include construction contractors (5 months in a row); aluminum, copper-based products, wire (3 months), and tubing; diesel fuel (3); and heating, ventilation and air conditioning equipment (4); lumber. Price declines were reported for lumber and steel products. Items listed in short supply include switchgear (3) and construction contractors and labor.

Download the Data Digest click here.