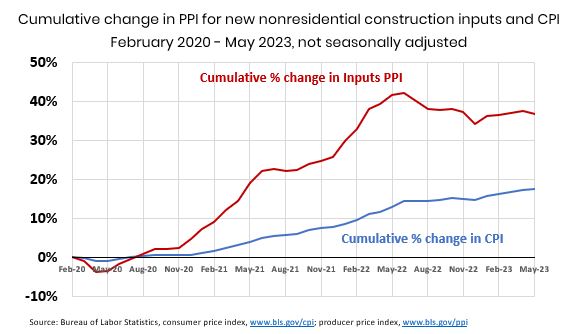

The producer price index (PPI) for material and service inputs to new nonresidential construction fell 0.6% from April to May and 3.4% year-over-year (y/y), according to Bureau of Labor Statistics (BLS) data posted on Wednesday. The y/y decline reflected the unwinding of huge price spikes in the spring of 2022 following Russia’s invasion of Ukraine and the slump in single-family homebuilding. The PPI for diesel fuel tumbled 6.2% in May and 38.3% y/y. The PPI for lumber and plywood was flat for the month but plunged 31.4% y/y. In contrast, the index for ready-mixed concrete rose for the 30th month in a row (by 1.1%) and 12.9% y/y. The PPI for steel mill products jumped 5.2%, following a 3.6% rise in April, but remained down 18.9% y/y. The PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—climbed 0.1% for the month and 11.6% y/y. Nevertheless, this “bid price” index is still below its January level. PPIs for new, repair, and maintenance work by subcontractors were mixed: roofing contractors (flat for the month and up 18.5% y/y), electrical contractors (0.1% and 11.2%, respectively); plumbing contractors (0.9% and 10.0%); and concrete contractors (-0.2% and 3.6%). AGC posted tables of construction PPIs. Readers are invited to send information on price and supply-chain changes to ken.simonson@agc.org.

The producer price index (PPI) for material and service inputs to new nonresidential construction fell 0.6% from April to May and 3.4% year-over-year (y/y), according to Bureau of Labor Statistics (BLS) data posted on Wednesday. The y/y decline reflected the unwinding of huge price spikes in the spring of 2022 following Russia’s invasion of Ukraine and the slump in single-family homebuilding. The PPI for diesel fuel tumbled 6.2% in May and 38.3% y/y. The PPI for lumber and plywood was flat for the month but plunged 31.4% y/y. In contrast, the index for ready-mixed concrete rose for the 30th month in a row (by 1.1%) and 12.9% y/y. The PPI for steel mill products jumped 5.2%, following a 3.6% rise in April, but remained down 18.9% y/y. The PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—climbed 0.1% for the month and 11.6% y/y. Nevertheless, this “bid price” index is still below its January level. PPIs for new, repair, and maintenance work by subcontractors were mixed: roofing contractors (flat for the month and up 18.5% y/y), electrical contractors (0.1% and 11.2%, respectively); plumbing contractors (0.9% and 10.0%); and concrete contractors (-0.2% and 3.6%). AGC posted tables of construction PPIs. Readers are invited to send information on price and supply-chain changes to ken.simonson@agc.org.

Seasonally adjusted construction employment rose from May 2022 to May 2023 in 42 states and the District of Columbia, declined in seven states, and held steady in Vermont, according to AGC’s analysis of recent BLS data. Texas added the most jobs (21,100, 2.7%), followed by New York (12,900, 3.3%), Ohio (8,400, 3.6%), and Oregon (8,000, 7.0%). Arkansas had the largest percentage gain (10.2%, 5,800 jobs), followed by Nebraska (7.8%, 4,400) and Oregon. Colorado lost the most jobs (-1,800, -1.0%), followed by Connecticut (-1,600, -2.6%). Connecticut had the largest percentage loss, followed by South Dakota (-1.6%, -400 jobs). For the month, construction employment increased in 24 states, declined in 22, and was flat in four states and D.C. California added the most jobs (6,500 jobs, 0.7%), followed by Virginia (2,600, 1.2%), Georgia (1,800, 0.8%), and Louisiana (1,700, 1.3%). The largest percentage gain was in Louisiana, followed by Virginia, and Arkansas (1.1%, 700 jobs). Indiana lost the most construction jobs in May (-2,500 jobs, -1.5%), followed by Illinois (-2,400, -1.0%) and North Carolina (-2,400 -0.9%). Rhode Island had the largest percentage loss for the month (-4.9%, -1,100 jobs), followed by South Dakota -2.7%, -700). (For D.C., Delaware, and Hawaii, which have few mining or logging jobs, BLS posts combined totals with construction; AGC treats the changes as all from construction.)

“During Q1 [first quarter of 2023] vacancy rates ticked higher in the industrial, multifamily and office markets,” Wells Fargo Economics reported on recently, based on data from MSCI Real Capital Analytics and CoStar Inc. “Retail vacancy rates were steady in Q1, while hotel occupancy improved slightly compared to prior year levels….Against a backdrop of moderating demand, supply continues to expand, notably in the multifamily market. More than 113,000 multifamily units were delivered in Q1 and even more are underway. Over 1 million new units were under construction in Q1, representing 5.6% of total inventory. Industrial is another market where new development is running strong. Net completions came in at a near-record high of 123.5 million square feet in Q1. As demand wanes and credit access tightens, new construction is likely to downshift. Industrial starts pulled back in Q1, which suggests a cooldown is already underway. By contrast, retail construction remains fairly sluggish, although it picked up slightly in Q1. While new office starts have slowed considerably as future occupancy needs remain in question, new completions rose in Q1.”

“On paper, the Inflation Reduction Act is transformative for electricity generation in the United States,” the New York Times reported on recently. “But guidance rolling out from the Biden administration—presaging formal rules—has raised alarm among energy companies that some of the credits might be difficult if not impossible to use, at least in the near term. The resulting frustration is emblematic of the current stage of climate action: an eye-straining haze of technical rule-making that reflects a tension between urgency and ensuring that the benefits of the energy transition are widely shared….The impact of the climate law is already evident, with announcements of 47 new plants to make batteries, solar panels and wind turbines since it was passed, according to American Clean Power, a trade association….clean energy companies are digesting the administration’s guidance on how the tax credits will be allocated, and finding some unworkable in ways that may slow deployment.

Download the Data Digest click here.