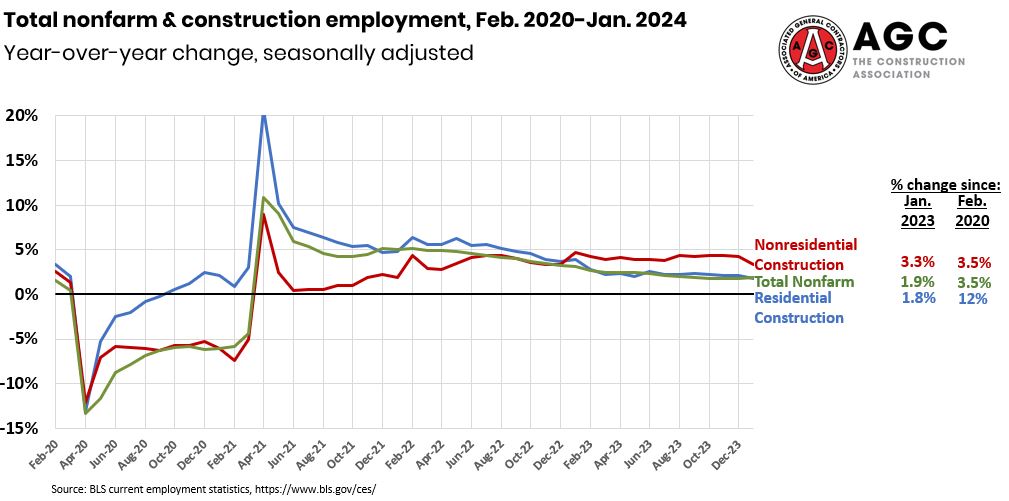

Construction employment, seasonally adjusted, totaled 8,137,000 in January, a gain of 11,000 from December and 216,000 (2.7%) year-over-year (y/y), according to AGC’s analysis of data the Bureau of Labor Statistics (BLS) posted today. The y/y growth rate outpaced the 1.8% increase in total nonfarm payroll employment. Residential construction employment (at residential building and specialty contractors) rose by 2,700 in January and 60,100 (1.8%) y/y. Nonresidential construction employment (at building, specialty trade, and heavy and civil engineering construction firms) increased by 7,600 for the month and 155,100 (3.3%) y/y. Seasonally adjusted average hourly earnings for production and nonsupervisory employees in construction (craft and office) rose 5.3% y/y to $35.21 per hour. The “premium” for nonsupervisory construction workers rose to 18.7% over the private sector average of $29.66 but remains considerably below the average premium in 2000-2019 of 21.5%. The number of unemployed jobseekers with construction experience totaled 699,000, not seasonally adjusted, a decline of 21,000 (2.9%) from January 2023, and the unemployment rate for such workers was unchanged at 6.9%.

Construction employment, seasonally adjusted, totaled 8,137,000 in January, a gain of 11,000 from December and 216,000 (2.7%) year-over-year (y/y), according to AGC’s analysis of data the Bureau of Labor Statistics (BLS) posted today. The y/y growth rate outpaced the 1.8% increase in total nonfarm payroll employment. Residential construction employment (at residential building and specialty contractors) rose by 2,700 in January and 60,100 (1.8%) y/y. Nonresidential construction employment (at building, specialty trade, and heavy and civil engineering construction firms) increased by 7,600 for the month and 155,100 (3.3%) y/y. Seasonally adjusted average hourly earnings for production and nonsupervisory employees in construction (craft and office) rose 5.3% y/y to $35.21 per hour. The “premium” for nonsupervisory construction workers rose to 18.7% over the private sector average of $29.66 but remains considerably below the average premium in 2000-2019 of 21.5%. The number of unemployed jobseekers with construction experience totaled 699,000, not seasonally adjusted, a decline of 21,000 (2.9%) from January 2023, and the unemployment rate for such workers was unchanged at 6.9%.

Construction industry wages and salaries rose 1.2% seasonally adjusted in the fourth quarter (Q4) of 2023, up from 1.1% in Q3, BLS reported on Wednesday. The Q4 increase topped the 0.9% rise for the overall private sector (down from 1.1% in Q3). From Q4 2022 to Q4 2023 wages rose 4.5% in construction vs. 4.3% overall.

The “first year of new settlements reached in 2023 for union craft workers in the construction industry had an average increase of 4.7%,” up from 3.1% in 2022 and 2.8% in 2021, the Construction Labor Research Council (CLRC) reported on January 24. “The most common percentage (the mode) moved dramatically higher from 2021[(2.6-3.0%] to 2022 [3.6-4.0%] to 2023 [6.1+%].” Among CLRC’s nine regions, increases ranged from 6.2% (Northwest) to 3.8% (New England). Increases “were higher than in 2022 for every region except New England, where they averaged the same as in 2022.” Increases averaged more than in 2022 for all 17 crafts and ranged from 5.8% (teamsters) to 3.5% (glaziers).

There were 374,000 job openings in construction, not seasonally adjusted, at the end of December, down 4.1% y/y, BLS reported on Tuesday. Hires for the full month totaled 227,000, down 3.4% y/y. The large excess of openings over hires, as well as the increase in construction spending (see below), suggests that the small y/y declines in openings and hires more likely reflect difficulty in filling positions than a weakening of demand.

Construction spending (not adjusted for inflation) totaled $2.10 trillion in December at a seasonally adjusted annual rate, up 0.9% from November and up 14% y/y, the Census Bureau reported on Thursday. Full-year spending rose 7.0% from 2022. However, without a deflator it is impossible to say how much of the gain is in units vs. price. Private residential construction rose 0.6% for the month and 6.8% y/y, but declined 5.8% for the full year. Single-family homebuilding rose 1.6% (the eighth monthly gain in a row); multifamily construction spending, 0.3%; and owner-occupied improvements, 1.7%. Private nonresidential construction spending declined 0.2% for the month but jumped 19% y/y and 22% for the full year. The largest private nonresidential segment—manufacturing construction—dipped 0.1% for the month (including computer/electronic/electrical, up 1.3%, and chemical and pharmaceutical, down 1.9%). Commercial construction fell 0.5% (comprising warehouse, down 0.9%; retail, up 0.2%; and farm, down 0.6%). Power construction rose 0.3%. Private office and data center construction decreased 0.2%. Public construction spending rose 1.3% for the month, 21% y/y, and 16% for the full year. The largest public segment, highway and street construction, jumped 4.1% for the month. Public education dipped 0.1%. Public transportation construction rose 1.1%.

The number of union members in construction firms declined from 1,019,000 (11.7% of industry employment) in 2022 to 954,000 (10.7%) in 2023, BLS reported on January 23. Total employees represented by unions (including nonmembers whose jobs are covered by a union contract) fell from 1,076,000 (12.4% of employment) to 1,017,000 (11.4%). Union members in construction and extraction (such as mining) occupations totaled 1,124,000 (16.3%) in 2023, nearly unchanged from 1,120,000 (16.4%) in 2022.

Download the Data Digest click here.