Seasonally adjusted construction employment in May topped the February 2020 level in 31 states, lagged in 17 states and the District of Columbia, and was flat in Arkansas and Vermont, according to AGC’s analysis of BLS data posted on Friday. (February 2020 was the month in which employment peaked nationally before plunging during widespread shutdowns in March and May 2020.) Utah added the most construction jobs since February 2020 (16,100 jobs, 14%), followed by Tennessee (16,000, 12%) and Florida (11,300, 2.0%). Utah had the largest percentage gain, followed by Tennessee and South Dakota (11.3%, 2,700 jobs). New York shed the most construction jobs over 27 months (-34,600 jobs, -8.4%), followed by Pennsylvania (-15,200, -5.7%) and New Jersey (-6,700, -4.1%). The largest percentage losses were in North Dakota (-8.5%, -2,400 jobs), New York, Kentucky (-5.7%, -4,600 jobs), and Pennsylvania. For the month, 22 states added construction jobs, 25 states lost jobs, and there was no change in three states and D.C. Texas added the most construction jobs (10,600 jobs, 1.4%), followed by California (7,100 jobs, 0.8%) and Minnesota (4,100 jobs, 3.2%). Minnesota had the largest percentage gain, followed by Tennessee (1.8%, 2,600 jobs) and Texas. (For D.C., Delaware, and Hawaii, with few mining or logging jobs, BLS posts combined totals with construction. AGC treats the totals as construction only.)

Seasonally adjusted construction employment in May topped the February 2020 level in 31 states, lagged in 17 states and the District of Columbia, and was flat in Arkansas and Vermont, according to AGC’s analysis of BLS data posted on Friday. (February 2020 was the month in which employment peaked nationally before plunging during widespread shutdowns in March and May 2020.) Utah added the most construction jobs since February 2020 (16,100 jobs, 14%), followed by Tennessee (16,000, 12%) and Florida (11,300, 2.0%). Utah had the largest percentage gain, followed by Tennessee and South Dakota (11.3%, 2,700 jobs). New York shed the most construction jobs over 27 months (-34,600 jobs, -8.4%), followed by Pennsylvania (-15,200, -5.7%) and New Jersey (-6,700, -4.1%). The largest percentage losses were in North Dakota (-8.5%, -2,400 jobs), New York, Kentucky (-5.7%, -4,600 jobs), and Pennsylvania. For the month, 22 states added construction jobs, 25 states lost jobs, and there was no change in three states and D.C. Texas added the most construction jobs (10,600 jobs, 1.4%), followed by California (7,100 jobs, 0.8%) and Minnesota (4,100 jobs, 3.2%). Minnesota had the largest percentage gain, followed by Tennessee (1.8%, 2,600 jobs) and Texas. (For D.C., Delaware, and Hawaii, with few mining or logging jobs, BLS posts combined totals with construction. AGC treats the totals as construction only.)

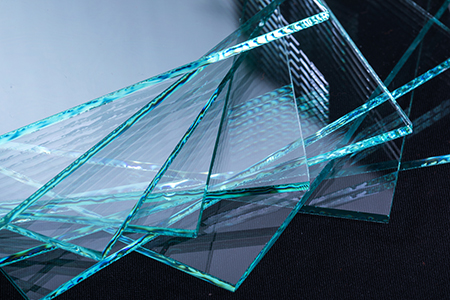

Materials prices and availability continue to be problematic. Flat glass manufacturers on Friday announced “unprecedented price increases up to 40%,” one distributor reported to customers. “Additional price increases have been received in the last week raising laminated input materials by 30%.” Wallboard manufacturers notified distributors on Friday of unspecified price increases to take effect on July 18 (GP Gypsum) or 25 (National Gypsum). Ready-mix concrete suppliers announced increases of $10 per cubic yard, effective September 1 (South Carolina); $10, effective July 15 (North Carolina); $8, effect August 1 (North Carolina); and $4, effective July 1, plus a fuel surcharge of $25 per load (Ohio). The Portland Cement Association issued a “Tight Market Conditions Briefing” in May that reported, “Tight cement supply conditions vary by region but some evidence of tightness prevails in portions of 43 states according to PCA’s survey of cement manufacturers. In comparison, 28 states reported tightness in the spring of 2021.” Readers are invited to send information about materials prices and availability to ken.simonson@agc.org.

The value of construction starts in May soared 77% year-over-year (y/y) in current dollars (i.e., not inflation-adjusted) and increased 29% year-to-date for the first five months of 2022 compared to January-May 2021, not seasonally adjusted, data firm ConstructConnect reported on June 14. Nonresidential building starts jumped 32% year-to-date, with institutional starts up 9.0%, commercial starts up 4.0%, and industrial (manufacturing) starts up 266%. Engineering (civil) starts leaped 25% year-to-date, with road/highway up 33%, water/sewage up 21%, power and other miscellaneous down 16%, bridges up 44%, dams/marine up 45%, and airports up 48%. Residential starts edged up 1.6% year-to-date, with single-family up 2.8% and apartments down 1.6%.

Total construction starts rose 4% from April to May in current dollars at a seasonally adjusted annual rate and 6% year-to-date, data firm Dodge Construction Network reported on Friday. Residential starts decreased 4% from April but gained 8% year-to-date. Nonbuilding starts fell 2% and 5%, respectively. Nonresidential building starts leaped 20% and 17%. “The construction sector has become increasingly bifurcated over the past several months,” said Chief Economist Richard Branch. “Nonresidential building construction is clearly trending higher with broad-based resilience across the commercial, institutional, and manufacturing spaces. However, growth in the residential market has been choked off by higher mortgage rates and rapidly falling demand for single-family housing. Nonbuilding starts, meanwhile, have yet to fully realize the dollars authorized by the infrastructure act.”

The Architecture Billings Index (ABI), which the American Institute of Architects calls “a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months,” registered a score of 53.5 in May, down from 56.5 in April but the 16th consecutive reading above 50, the institute reported today. The ABI is derived from the share of responding architecture firms that report a gain in billings over the previous month less the share reporting a decline in billings, presented on a 0-to-100 scale. Any score above 50 means more firms reported increased billings than decreased billings. Scores by practice specialty (based on three-month moving averages) all declined from April but still topped 50: 57/7 for firms with a predominantly commercial/industrial practice (down slightly from 57.8 in April); 56.2 for mixed-practice firms (down from 59.0); 54.5 for multifamily residential (down from 56.3); and 51.7 for institutional (down from 52.3). Indexes rose to 63.9 (from 62.3) for inquiries and 56.9 (from 55.4) for design contracts.

Housing starts (units) in May plunged 14% at a seasonally adjusted annual rate from the April rate and 3.5% y/y but increased 8.2% year-to-date, the Census Bureau reported on Wednesday. Single-family starts slumped 9.2% for the month and 5.3% y/y but rose 3.2% year-to-date. Multifamily (five or more units) starts fell 27% for the month and 3.3% y/y but soared 20% year-to-date. Residential permits declined 7.0% from April but rose 0.2% y/y and 2.7% year-to-date. Single-family permits slid 5.5% for the month, 7.9% y/y, and 2.5% year-to-date. Multifamily permits tumbled 10% from April to May but climbed 20% y/y and 15% year-to-date. The number of authorized multifamily units that have not started soared 30% y/y. While a rising backlog frequently indicates a likely rise in near-term starts, the rapid rise in both financing costs and construction costs could cause some developers to hold off on starting projects.