Contractors are generally optimistic about the outlook for nonresidential and multifamily construction in 2022, based on the 2022 AGC-Sage Construction Hiring and Business Outlook Survey, which AGC released on Wednesday. The survey included 1,031 responses submitted November 9-December 14 from every state, the District of Columbia, and Puerto Rico. Respondents were asked whether the dollar value of projects they compete for would be higher or lower in 2022. The net reading (the percent of respondents expecting a higher dollar value less the percent expecting a lower amount) was positive for 15 out of 17 project types. The broadest optimism was for highway and bridge projects: 63% of respondents expect a higher dollar value, vs. 5% expecting a lower value, for a net reading of 57%, based on unrounded percentages. (The remaining 32% expect little change.) There were also high net readings for transportation facilities, 51%; water and sewer projects, 50%; warehouses, 41%; other health care (such as clinics, labs, and testing facilities), 41%; and hospitals, 38%. The only two negative net readings, both -8%, were for retail and private offices. Three-fourths (74%) of firms expect to add employees in 2022, though 83% report having a hard time filling positions. Costs were higher than anticipated in 2021 because of the pandemic for 84% of firms, while 72% reported projects took longer than anticipated. As a result, 69% have put higher prices into bids or contracts and 44% have quoted longer completion times. Breakouts of the answers by respondents in 20 states, the four Census regions, three revenue sizes, and by union/open-shop showed broadly similar results.

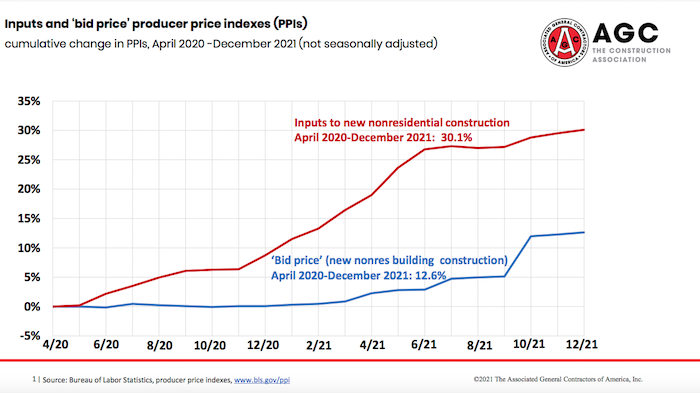

The monthly and year-over-year (y/y) increase in construction input costs slowed in December but still exceeded the rise in contractors’ bid prices, according to BLS data posted on Thursday. The producer price index (PPI) for material and service inputs to new nonresidential construction climbed 0.5% for the month (down from 0.9% in November) and 18% for all of 2021. The PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—increased 0.3% for the month and 13% y/y, the most in the series’ 12-year history. Several input PPIs declined in December or increased less than in recent months but still rose sharply for the year. The PPI for steel mill products rose 0.2% for the month (a 15-month low) and 127% y/y; diesel fuel, -5.3% in December and 55% for the year; plastic construction products, 1.3% and 34%, respectively; aluminum mill shapes, -4.9% and 30%; copper and brass mill shapes, -3.3% and 23%; gypsum products, 0% and 21%; truck transportation of freight, 0.4% and 18%; insulation materials, 0.2% and 17%; architectural coatings, 0.6% and 14%; and asphalt felt and coatings, -4.2% and 12%. In contrast, the PPI for lumber and plywood jumped 13% in December, ending the year up 18%. The PPI for construction machinery and equipment rose 0.9% for the month and 10% y/y, the largest y/y increase since 1982. Bid prices, as measured by PPIs for new buildings, rose 0.2% for the month and a record 21% y/y for new warehouse construction; 0.5% and 14%, respectively for industrial buildings; 0.7% and 13% y/y for offices; 0.1% and 11% for health care buildings; and 0% and 10% for school buildings. PPI increases for new, repair, and maintenance work by subcontractors amounted to 0.2% for the month and 17% y/y for concrete contractors; 0.6% and 9.8%, respectively, for roofing; 0.1% and 9.2% for electrical; and 0.6% and 8.9% for plumbing contractors. AGC posted tables and graphs of construction PPIs.

Construction starts, not seasonally adjusted, decreased 1.2% y/y in December but increased 5.9% for 2021 as a whole, data firm ConstructConnect reported on Friday. Nonresidential starts rose 7.0% y/y but slipped 0.5% for the year. Nonresidential building starts soared 22% y/y but decreased for the year, with commercial starts up 46% y/y but down 2.5% for the year, institutional starts up 16% y/y but down 8.5% for the year, and industrial (manufacturing) starts down 53% y/y but up 42% for the year. Heavy engineering (civil) starts slumped 14% y/y but edged up 0.9% for the year, with road/highway, up 6.3% y/y and 6.0% for the year; water/sewage, -2.7% and 9.1%, respectively; power and other miscellaneous, -48% and 0.1%; bridges, -62% and -21%; dams/marine, 157% and 3.4%; and airports, 58% and -14%. Residential starts declined 8.8% y/y but rose 15% for the year, with single-family down 1.5% y/y but up 17% for the year, and apartments down 34% y/y but up 8.1% for the year.

On Wednesday, the Federal Reserve released the latest “Beige Book,” a compilation of informal soundings of business conditions in each of the 12 Fed districts, based on information collected November 20-January 3. The U.S. summary noted, “Economic activity across the United States expanded at a modest pace in the final weeks of 2021. Contacts from many Districts indicated growth continued to be constrained by ongoing supply chain disruptions and labor shortages.”

“…state finances continue to exceed expectations. Improved collections, now well surpassing pre-COVID results, are allowing states to propose record budgets for FY’22-23,” investment analyst Thompson Research Group reported on Thursday. “Whilst state finances continue to improve, DOTs could also see record funding levels to support billions of dollars of project backlogs. Recent conversations with contacts suggest DOTs are in ‘pretty good shape’ given 1) improved economies post COVID, 2) federal stimulus dollars that more than offset revenue losses from COVID, and 3) potential new funding from the new [Infrastructure Investment and Job Act (IIJA). However,] DOTs are still waiting for guidance from FHWA on IIJA and are therefore holding off on making budget changes. They expect to have clarity in January.”