The following article originally appeared in the September newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the September newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

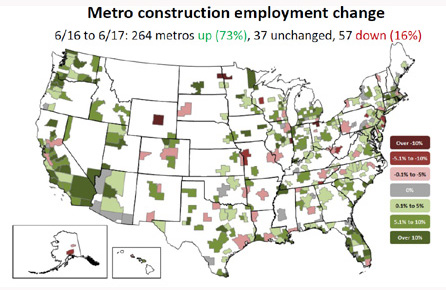

In looking at the Texas Workforce Commission’s latest employment numbers, the Houston metro area lost 18,300 jobs – a seasonal amount – in July, with construction accounting for 5,000 of those losses, in large part due to the wind down in the industrial/petrochemical work on the east side of Houston. This puts Houston’s construction employment down 4,800 jobs since the start of the year and negative year over year. The slide shown here from Ken Simonson, chief economist for the Associated General Contractors, shows Houston, overall, has had positive job growth in 2017, having added 6,900 jobs year to date. (Click on image to enlarge.) According to the Greater Houston Partnership, historically, Houston begins a hiring season in the fall as the educational institutions, much of the summer-time job losses, are brought back onto the payrolls. As such, we should see a positive employment number for year-end 2017.

The American Institute of Architects (AIA) Architectural Billings Index declined to 51.9 in July but remained above 50, thus signifying expansion. The southern region, where Houston is located, was tied with the Midwest for their strongest region at 53.8, and the new project inquiries index rose to 59.5, suggesting more work may be in the pipeline. Additionally, the AIA took a special look at the adoption of 3D printing in U.S. architecture firms. The responses show nearly 30% of architecture firms have some experience with 3D printing, with about half of those using it in-house and/or testing it. This is a higher response rate than when the topic was surveyed last year, suggesting the trend is growing. When asked, the architecture firms feel the application of 3D printing will continue to grow, though concerns around the quality of the models developed and low client demand remain.

CBRE released its second quarter findings for the Houston multifamily market in August. In the report, multifamily is showing signs of recovery, with net absorption rallying in the second quarter and occupancy landing at 88.9%. Class A had a strong showing as the concessions being offered have incentivized renters, creating the lion’s share of the absorption. While roughly 11,000 units remain under construction, according to CBRE, absorption is expected to be over 22,000 units in 2018 and 2019, which should put a significant dent in the oversupply that exists in the market.

On the commercial side, we continue to see the city of Houston permit dollar volume tracking below a year ago, with July’s numbers down 21% on the nonresidential side and 15.2% residentially as there continues to be a trend toward smaller projects. 2018 is shaping up to be another lean year for the Houston commercial construction industry.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: September 2017

by Candace Hernandez | September 11, 2017