The following article originally appeared in the December newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the December newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

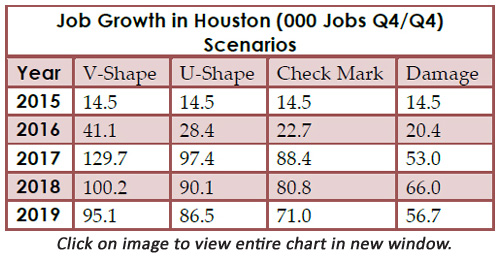

On November 12th, Dr. Bill Gilmer gave his forecast for 2016, and despite Houston's attempts to diversify since the 1980's, oil remains a dominant factor in the Houston economy. As such, the price of oil will directly impact how fast Houston recovers from the recent downturn. And while Dr. Gilmer does not yet see a recession for the Houston area, he does expect continued slow growth going forward, with lower job growth and population growth projections in 2016. Of the four scenarios that Dr. Gilmer outlines, he feels that the U-shaped recovery is the most likely scenario at this point, though he notes the increasingly popular theory of a checkmark recovery, which would have a longer, slower recovery. The “damage” scenario is if fracking was seriously damaged by sustained low prices and experienced no real recovery, a scenario Dr. Gilmer gives a 15% probability.

In construction, multifamily has yet to really slow down (currently 28,576 units under construction), but that is expected to quickly change as the risk of overbuilding increases. What has, in part, kept multifamily afloat in 2015 is the lack of single family availability combined with rising home prices which have priced many potential homebuyers out of the market. Metrostudy estimates only 38% of Houstonians can afford a new home at today's interest rates. CBRE reports an increase in transactions, but for much smaller spaces than seen in the past, likely due to energy transactions down 60%. CBRE also sees a slowdown in light industrial as projects are being put on hold as owners wait to see where oil lands. Retail continues to be a bright spot with lifestyle centers and smaller concepts becoming more prevalent, including a push to group local restaurants and boutiques together, particularly in downtown. Overall, the commercial construction market appears to be slower, but not dead, in 2016.

Houston’s Monthly Metrics: December 2015

by Candace Hernandez | December 03, 2015