35 states add jobs in September; Dodge predicts starts will rise in 2017; ABI slips againEditor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.Seasonally adjusted construction employment rose in 35 states from August 2015 to August 2016 and fell in 15 states and the District of Columbia, an AGC analysis of Bureau of Labor Statistics (BLS) data released on Friday showed. Iowa again led in percentage gain (18%, 13,700 jobs), followed by Colorado (13%, 19,400), Hawaii (11%, 3,900) and Idaho (11%, 4,200). The most jobs added were again in California (30,900 jobs, 4.2%), Florida (22,800, 5.2%) and Colorado. Wyoming had the steepest percentage loss (-9.2%, -2,100), followed by Kansas (-7.7%, -4,700), Montana (-6.9%, -1,800) and North Dakota (-6.3%, -2,100). Kansas lost the most jobs, followed by Alabama (-3,500, -4.3%) and Pennsylvania (-2,600, -1.1%). For the month, employment rose in 21 states and D.C., shrank in 24 states and was unchanged in five. (AGC's rankings are based on seasonally adjusted data, which in D.C., Hawaii and five other states is available only for construction, mining and logging combined.)Dodge Data & Analytics released its 2017 construction outlook on Thursday, forecasting that "total U.S. construction starts for 2017 will advance 5%..., following gains of 11% in 2015 and an estimated 1% in 2016.

Reshaping the Construction Industry

Experts are downplaying any possible link between the recent vote by the United Kingdom to leave the European Union and the slowdown of British construction in August.Construction output fell by 1.5% in August after it had gone up just a tick in July, according to the Office of National Statistics. A Reuters poll of economists had shown an expectation of an increase of .2%. The Guardian put it this way:The ONS cautioned that monthly data could be choppy and noted that the drop in construction in August had been driven by a 5.1% fall in infrastructure output.

October 25, 2016

This is the first in a series of posts that will focus (sometimes with a bit or bite of humor) on the games that some GCs and subs play on your jobsite while they are working on your projects.We are interested in exposing some of the dangerous, costly, and frankly, stupid practices in an attempt to make you aware and to encourage the industry to improve its practices in the future.Let me start by relating a simple story that I saw happen on one of my first multifamily projects. Let me call it “now you see it, now you don’t.”As a rookie architect, I was sent to a site in Dallas where a client was building a garden apartment project for our biggest private client. Not only was this particular developer the firm’s largest client, he was also the “most profit-minded client” (read cheapest).

October 24, 2016

Last month, I visited Lone Star College North Harris (LSC-North Harris) and spoke with Erica Jordan, Executive Director of Career and Technical Education about the skilled trades training programs at LSC and about the Construction and Skilled Trades Technology Center which is currently being constructed on that campus.In her office on the Lone Star College-Tomball campus, Jordan advises students and works with representatives from the industry to advise them of potential hires which are coming out of the LSC programs and what particular skill sets each of them have.Jordan works with a variety of programs offered by Lone Star College, including their Allied Health programs, Construction Trade programs, ATCP (Alternative Teacher Certification Program), and FastTrack non-credit programs.

October 21, 2016

PPIs edge mostly higher; starts reports are mixed; union pay agreements trend upEditor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.The PPI for final demand in September, not seasonally adjusted, increased 0.2% from August and 0.7% year-over-year (y/y) from September 2015, the Bureau of Labor Statistics (BLS) reported on Friday. AGC posted tables and an explanation focusing on construction prices and costs. Final demand includes goods, services and five types of nonresidential buildings that BLS says make up 34% of total construction. The PPI for final demand construction, not seasonally adjusted, edged up 0.1% for the month and 0.8% y/y. The PPI for new nonresidential building construction—a measure of the price that contractors say they would charge to build a fixed set of five categories of buildings—rose 0.7% y/y. Changes ranged from 0.1% y/y for industrial building construction to 0.4% for schools, 0.5% for healthcare buildings, 1.1% for warehouses and 1.2% for office buildings.

October 20, 2016

The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC. Reprinted with permission.Recently, Larry Brookshire, the former owner and leader of Fisk, the large electrical contractor, offered some deeply insightful comments, to a group of both general and specialty contractors. Many in the Houston Commercial Construction Community know Larry. He is respected as one the most successful leaders, by all standards used to judge business executives. And, he is very deserving; his is an “up from bootstraps” story. Raised by a single mom, he put himself through the University of Texas to get an Electrical Engineering Degree and then later though law school. Clients, employees, and peers all admire and celebrate his success.

October 19, 2016

Under a deal with prosecutors, a construction firm based in Manhattan will pay out $9 million to avoid prosecution for over-billing clients over the years. The company will also be forced to establish a hotline that employees can call to report ethics violations.We get the news via the New York Daily News:Plaza Construction billed more than $2.2 million for hours not worked by laborers on projects that included the Brooklyn Navy Yard, Bronx Terminal Market, Federal Reserve Bank, and New York University, authorities said Thursday.Under the deferred prosecution agreement with the Brooklyn U.S. Attorney's office, Plaza will repay its clients which were defrauding in the scheme going back to 1999.“The company defrauded its clients and abused the trust placed in it to provide construction services at some of New York's most storied sites,” said U.S. Attorney Robert Capers.

October 18, 2016

The “most twisted tower” underway today is the Diamond Tower in Jeddah, Saudi Arabia. It is a 432-meter tall, 93-floor residential tower that is planned for completion in 2019.

October 17, 2016

The Greater Houston Partnership’s new space will be used to show visiting CEO’s and government dignitaries why the Houston region is so special for business and living.

October 14, 2016

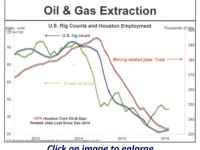

The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Did Houston already go into a recession? Jesse Thompson, Business Economist at the Federal Reserve Bank of Dallas - Houston Branch, noted the Houston Business Cycle Index shows that Houston entered a recession late 2015/early 2016. He provided a chart (right) showing the correlation between rig count and Houston’s core oil and gas related employment noting “further revisions will like confirm what we’ve already observed: that Houston’s economy is contracting, and that Houston may or may not be out of it yet.”However, fueling the recovery discussion is the renewed optimism in the Purchasing Managers Index’s oil and gas respondents, who for the first time in several months, seemed happier and more upbeat. The PMI itself increased to 46.1 in August – still in an overall contraction phase, but production, sales and new orders were all noticeably up, a leading indicator.

October 13, 2016

.jpeg?itok=6uFZXEBH)

.jpeg?itok=4Vi_1nJG)