Some employers mistakenly believe that wage and salary information can be kept confidential. In my law practice, I occasionally see policies stating that employees may not discuss compensation with their co-workers. Such policies are illegal. The National Labor Relations Board (NLRB) takes the position that discussing compensation and benefits is “protected concerted activity” under the National Labor Relations Act. An employer who tells employees not to discuss such matters is risking an unfair labor practice charge and sanctions by the NLRB.

The Texas Uniform Trade Secrets Act (TUTSA) became effective on September 1, 2013. Texas was the 48th state to adopt a version of the model Uniform Trade Secrets Act.Texas businesses should welcome the consistency offered by TUTSA, since it brings our law in line with that of most other states (the exceptions are New York and Massachusetts).The statute defines “trade secret” as: “information, including a formula, pattern, compilation, program, device, method, technique, process, financial data, or list of actual or potential customers or suppliers, that:(A) derives independent economic value, actual or potential, from not being generally known to, and not being readily ascertainable by proper means by, other persons who can obtain economic value from its disclosure or use; and

July 16, 2014

Summer has arrived, and enthusiastic high school and college students are looking for summer internships. Internships are not a problem if you are paying interns at least minimum wage, and are paying overtime hours (any hours worked over 40 in a work week) at one and one-half times their regular wage rate.If you are considering unpaid internships, however, you may be exposing your company to a lawsuit.Under the Fair Labor Standards Act, if you allow a person to perform services for you, in most instances that person must be paid and will be subject to minimum wage and overtime requirements. There is a narrow exception for true unpaid internships, which must meet the following six criteria:

May 29, 2014

The Texas Payday Law, Chapter 61 of the Texas Labor Code, governs how workers are paid in Texas. The law applies to all private employers, and is enforced by the Texas Workforce Commission. Payment of Wages: Wages must be paid at least twice per month to employees who are non-exempt under the Fair Labor Standards Act (i.e. those employees who are eligible for overtime pay). Exempt-level employees must be paid at least once per month. Deductions from Pay: An employer can deduct money from an employee’s paycheck under very limited circumstances.

March 18, 2014

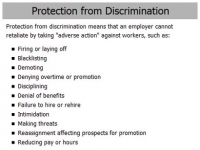

When you think of OSHA (Occupational Safety and Health Administration), you probably think of technical workplace safety regulations. However, don’t forget that OSHA is also responsible for enforcing the whistleblower provisions of twenty-two federal laws with anti-retaliation provisions.OSHA maintains a separate website section for whistleblower issues at www.whistleblowers.gov.OSHA received 2,787 whistleblower complaints during the last fiscal year. More than half were complaints of retaliation for reporting workplace safety issues. Complaints are expected to increase this year, because as of December 5, 2013, individuals may file a whistleblower complaint with OSHA using a simple online form.

February 20, 2014

New regulations affecting federal contractors are scheduled to go into effect on March 24, 2014. The regulations involve federal contractors’ affirmative action and recordkeeping obligations for veterans and disabled workers.The agency issuing the regulations is the U.S. Department of Labor’s Office of Federal Contract Compliance Programs (OFCCP). OFCCP regulates federal contractors.Application to Construction ContractorsIn general, contractors and subcontractors who hold a Federal or federally-assisted construction contract in excess of $10,000 are subject to regulatory requirements under one or more of the laws enforced by OFCCP.

January 17, 2014

The holiday season is upon us, and many workers are looking forward to receiving a Christmas bonus. Depending on the nature of the bonus, it may or may not have an effect on employees’ overtime rates.In most cases a Christmas bonus is essentially a gift from management. The bonus amount is not agreed upon in advance and is not based on specific criteria. This kind of bonus is not included in the calculation of the employee’s “regular rate” for overtime purposes.In other cases, however, a bonus may have been promised in a collective bargaining agreement or similar contract. Or the bonus may be calculated in a specific manner, such as a bonus of 50 cents for each hour worked during the year. Bonuses owed by agreement, as well as bonuses based on hours worked, production or efficiency, are included when calculating an employee’s “regular rate.”

December 24, 2013

When people think about sexual harassment, they usually envision a male co-worker or supervisor targeting a female employee. Most people know that this scenario can be reversed, with a female harasser and a male victim. But what about same-sex harassment? Same-sex harassment is equally unlawful, and this may come as a surprise to unwary employers. A recent example is the case of Boh Brothers Construction, LLC v. Equal Employment Opportunity Commission (EEOC), which was decided by the Fifth Circuit Court of Appeals on September 27, 2013.This case involved a five-man work crew. The crew superintendent, Wolfe, apparently thought that one of the crew members, Woods, didn't fit in and wasn't manly enough. According to testimony in the case, Wolfe routinely called Woods names like “princess” and “pussy”, pretended to hump him, and engaged in other abuse. Wolfe testified that he did not think Woods was homosexual (he was not), and was just joking and giving him a hard time.

November 19, 2013

One of my clients, an industrial construction company, recently asked me to conduct their annual employment law training. Here are my observations and lessons learned.The Nike Rule: Just do it. Training is often a back-burner project, and if you don't make a priority, it won't get done. So pick several days, schedule multiple sessions, require all supervisors to attend, and be sure to keep the sign-in sheets. This is good evidence in a lawsuit or Equal Employment Opportunity Commission (EEOC) charge, and is also good business – your company is only as strong as your first-line supervisors. The More the Merrier: Be sure those first-line supervisors are included. I know the working foremen in my sessions didn't think they needed to be there.

October 21, 2013

Real independent contractors are easy to identify. They are hired to perform a specific project, they bring their own tools, they have their own business cards, and they send you an invoice when the work is done.If you hire people to perform ongoing work for your company, tell them when to show up and what to do, those people are not independent contractors.I am oversimplifying things to make a point: the concept of “contract labor” is overused in the construction industry. Contrary to popular opinion, hiring people as “contract labor” is not a legal option if you control when, how and where they perform the work. You can’t fix the problem by having each individual sign an independent contractor agreement. Government authorities do not have to accept your paperwork: they will look at the reality of the arrangement and decide whether there is an employer-employee relationship.

September 30, 2013