The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

Despite reports that continue to worsen, the current construction market is still vibrant in Houston.

CBRE’s first quarter reports for office, industrial (warehouse) and retail were recently released, showing a continuation of the strong 2014 market into 2015. In the first quarter office market, 15.9 million square feet (msf) was under construction, with 64% of that pre-leased - a continued sign that the office market is not overbuilding. Vacancy rates inched up to 12.6%, but rental rates continue to rise as supply remains tight.

Similarly, the industrial (warehouse) market remains strong, with 2 msf absorbed and 1.5 msf delivered in the first quarter. Vacancy rates dropped another basis point to 4.9%, which helped drive up average asking rates. An amazing 8.9 msf is currently under construction, spanning 85 projects. The impact of oil prices has been mixed in this market, as those who serve upstream markets were hit heavier than those serving midstream or downstream markets.

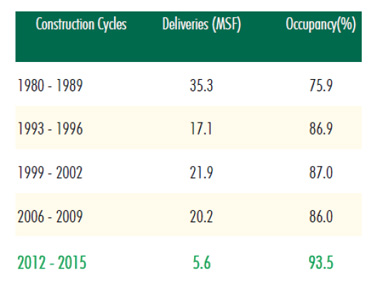

The first quarter retail market report reveals a new record low 6.5% vacancy rate. With nearly 1.7 msf under construction and over 950 ksf delivered, of which over 97% was leased upon completion, the retail market is strong after several years of low deliveries, as the CBRE chart shows. However, despite demand outpacing supply, the retail market is beginning to see a pullback. In fact, all three segments, when looking toward the year-end, expect construction to stall out as the uncertainty around oil prices remain.

The Architecture Billings Index, a national leading indicator for construction, is up, particularly in the southern region, where Texas is located. The City of Houston permits recorded a strong March year over year 13.6% increase in nonresidential permits for a total $480 million. The increase was driven primarily from increased retail and school construction, while residential permits saw a decline due to the reduced number of multifamily projects being permitted – a welcome sign for a segment at risk of overbuilding.

Economists are still forecasting the end of 2015 to be the earliest sign of recovery. With the current US oil rig count continuing to drop, Jesse Thompson, Federal Reserve Bank of Dallas, Houston Branch, expects the rig count to bounce back to 1,000 by year end and is now forecasting a 0.5% to 1.5% growth rate in Houston, which puts job growth at an estimated 15,000 – 45,000 jobs.

Houston’s Monthly Metrics: May 2015

by Candace Hernandez | May 15, 2015