Click on image to view more information.

Click on image to view more information.

Value of starts jumps in October, Dodge says; costs edge up in November, IHS finds Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

The value of new construction starts in October increased 13% from September's level at a seasonally adjusted annual rate, Dodge Data & Analytics reported on November 20, based on data it collected. "The increase follows the lackluster performance for construction starts during August and September, when activity fell to the lowest levels reported so far in 2015. Much of October's gain for total construction was due to a sharp [32%] rebound by nonresidential building, with additional support coming from a moderate [9%] upturn for housing as the result of further strengthening by multifamily housing...The nonbuilding construction sector (public works and electric utilities/gas plants) settled back [-3%] in October, reflecting a decreased amount of power plant projects. During the first 10 months of 2015, total construction starts on an unadjusted basis were...up 10% from the same period a year ago. Leaving out the volatile electric utility and gas plant category, which was boosted in early 2015 by the start of several massive liquefied natural gas terminals, total construction starts during the first 10 months of 2015 would be up 4% relative to last year," with nonbuilding up 2%, residential building up 15% and nonresidential building down 6%.

Consultancy IHS and the Procurement Executives Group (PEG) reported on November 23 that "construction costs rose in November....The headline current IHS PEG Engineering and Construction Cost Index (ECCI) registered 43.7 this month, up from 40.9 in October. The headline index remains well below the neutral mark [in which a reading greater than 50 represents upward pricing strength and a reading below 50 represents downward pricing strength], indicating that costs are still falling, just not as broadly as in October. The headline index has not indicated rising costs for 11 months. The current materials/equipment index increased to 40.5, from 39.0 in October. Despite this slight uptick, the pricing environment remained weak—this month's current materials/equipment index was the second lowest reading in the last four years. All underlying material and equipment components showed falling prices except ready-mix concrete. Carbon steel pipe, alloy steel pipe and exchangers registered a lower index figure compared to last month. Carbon steel pipe showed a particular weakness, registering its lowest reading since the beginning of the survey in 2011. 'Steel buyers are in fear of price hikes in early 2016 based upon anti-dumping penalties on imports. We believe these fears are overdone. While there will be some boost, we see almost as much downward pressure from the collapse in iron ore and scrap prices,' said John Anton, principal economist at IHS Pricing and Purchasing. The current subcontractor labor index increased to 51.1 in November, signifying that labor costs are rising once again. The sub index had recorded its lowest level ever in October. 'Tight supply and improving demand from downstream energy projects will keep pressure on subcontractor labor,' said Emily Crowley, senior economist at IHS Pricing and Purchasing."

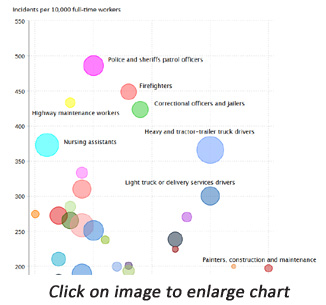

The overall incidence rate of nonfatal occupational injury and illness cases requiring days away from work to recuperate was 107 cases per 10,000 full-time workers in 2014, down from the 2013 rate of 109.4, the Bureau of Labor Statistics (BLS) reported on November 19. The incidence rate for construction was 133 in private industry and 296 in state and local government. BLS presented incidence rates for 30 occupations, including construction laborers (310, 8th highest); heating, air conditioning and refrigeration mechanics and installers (285); carpenters (238); and operating engineers and other construction equipment operators (178). Tables presenting these figures break down the rates by event or exposure and by nature of injury or illness. BLS also posted interactive charts comparing incidence rates and totals for these 30 occupations by incidence types and days away from work.

"Both private equity firms and more institutional players are seeing the need for more suburban medical office development and even large-scale medical campuses as the health care industry consolidates, according to ULI Emerging Trends 2016," the online news site GlobeSt.com reported on November 19. "The provision of insurance to millions of additional Americans under the Affordable Care Act actually appears to be accelerating healthcare consolidation, for reasons of economies of scale, while simultaneously creating small-space demand for medical offices specializing in urgent care....Neil J. Carolan, senior vice president, business development and leasing for Rendina Healthcare Real Estate,...provides some specifics: As in-patient lengths of stay shorten, developers must be ready to develop facilities that can handle a higher level of patient delivery services. Many of the services formerly offered in a hospital setting are now being placed in a medical office building/ambulatory center that is not hospital-centric. Developers must become flexible in terms of placement and location of new facilities. Again, much of the non-urgent care delivery can be more community based rather than on the hospital campus. Developers must be prepared to develop facilities within the financial restrictions of both physicians and healthcare facilities. Reimbursement for patient care continues to decrease. As a result, physicians and hospitals have less monies available and therefore, developers must be able to develop facilities that are both cost and patient efficient."

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.