Construction employment stalls in June; raw materials prices slip but product prices rise

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Nonfarm payroll employment increased by 223,000 in June, seasonally adjusted, and by 2,935,000 (2.1%) over 12 months, the Bureau of Labor Statistics (BLS) reported on July 2. Construction employment was flat for the month and rose by 259,000 (4.2%) from a year ago to 6,380,000. Residential construction employment (residential building and specialty trade contractors) slipped by 2,400 for the month but increased by 127,000 (5.5%) over 12 months. Nonresidential employment (building, specialty trades, and heavy and civil engineering construction) increased by 2,700 and 131,800 (3.5%), respectively. The number of unemployed jobseekers who last worked in construction fell from 710,000 in June 2014 to 522,000 in June 2015, the lowest June total since 2001. The unemployment rate for such workers fell from 8.2% to 6.3%, the lowest June rate since 2006. (Industry unemployment data are not seasonally adjusted and should only be compared year-over-year, not across months.) Average weekly hours for construction craft workers and other "production and nonsupervisory employees" rose to 39.9 hours, the highest June level since the series began in 1947. Average hourly earnings of such employees rose to $25.26, a gain of 2.4% over the past year, up from 1.9% in the previous 12 months and 1.2% from June 2012 to June 2013. Average hourly earnings for all construction employees increased 2.5%. The acceleration in wages and decline in the pool of experienced jobseekers suggests that contractors soon may have even greater difficulty finding qualified new hires. Readers who work for contractors are invited to report their hiring experience anonymously in an AGC survey; the survey will close in a few days.

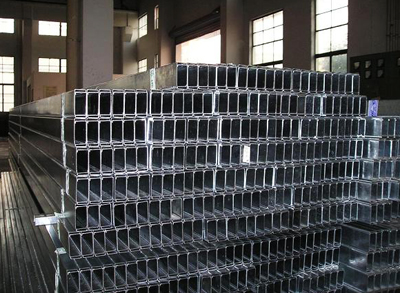

The price of primary metals and ores to produce construction materials has tumbled recently. The price of "near-month" copper futures "fell this week to a six-year low, dropping to around $2.45 a pound," down more than 20% from a year ago, the Wall Street Journal reported on Thursday. "Iron ore, a steelmaking ingredient, fell to $44.10 per metric ton this week, the lowest price in just over a decade from highs of $191 in 2011. Prices for aluminum...have declined 10% since the beginning of the year and nearly 2% this week." Prices for scrap steel, which is a more common ingredient than iron ore in construction steel, are nearly 25% below year-ago levels but have risen recently.

Despite falling prices for oil, natural gas and raw materials, rising construction demand is pushing up some materials prices. Two window suppliers sent letters to customers this week announcing price increases effective this month. One of them, Viracon, reported, "glass and coated float glass price increases of 5-12% which are effective inside the next 30 days....The glass primaries within our industry have been very consistent in their messaging that we should expect glass shortages in early 2016." On Tuesday, investment advisory firm Thompson Research Group reported in its quarterly building products survey that steel stud "volumes are unbelievable [and] manufacturers are attempting to raise pricing, but it will be difficult to gain traction until outlook is clearer with the federal anti-dumping legislation. [For wallboard,] 69% of contacts reported increases in wallboard volumes. 73% respondents reporting "flat" sequential pricing changes over the past 30 days, and we are hearing of less pushback on pricing erosion. [For roofing,] May volume flat to modestly up [year-over-year] and price flat sequentially. [For flooring,] commercial trends have been strong in 2015, and the multi-family wave momentum is still moving forward." Demand for natural-gas pipeline construction has pushed up steel pipe prices, according to one major gas utility. On June 30, construction consultant Rider Levett Bucknall reported in its quarterly USA Construction Cost Report that its national construction cost index in April rose 1.2% from January and 5.5% over 12 months. "The index "tracks the 'true' bid cost of construction, which includes, in addition to costs of labor and materials, general contractor and subcontractor overhead costs and fees (profit). The index also includes applicable sales/use taxes that 'standard' construction contracts attract." Among the 12 cities for which the index is computed, first-quarter increases ranged from 0.5% in New York and 0.6% in Boston to 3.0% in Honolulu.

Data center construction is evolving. E-newsletter Data Center Knowledge reported on July 3 that a recent report by 451 Research said "nearly 90% of data center operators surveyed in North America and Europe had plans to increase data center facility spending. About one-quarter of them said they will increase spending over the next 90 days. Enterprises are consolidating smaller data centers into larger centralized ones. They are generally reluctant to build new data centers, so those larger data centers are older facilities that have to be upgraded to support the consolidated capacity....Still, while enterprises are planning to spend more on data center infrastructure, there will be fewer actual data centers. Companies are actively consolidating smaller data centers and server rooms, replacing them with larger centralized facilities, supplemented by colocation and cloud services. As a result, there will be fewer facilities, but the total overall footprint will remain about the same, the analysts concluded." On June 30, the newsletter reported on data-center construction in Colorado and Minnesota and also reported, "CyrusOne announced it has started construction of a third building on its massive campus in Chandler, a Phoenix suburb, in a sign of strong demand in the Phoenix data center market....eBay has a data center in Phoenix, Apple is building one in nearby Mesa, and Microsoft is eyeing a data center build there, according to local news reports earlier this year." On June 25, the newsletter reported that Google announced it would turn part of a coal-fired power plant in Alabama into a data center. Google is "spending about $5 billion per quarter on building and operating data centers [including] a $300 million data center expansion in the Atlanta metro [and] a $1 billion commitment to data center build-out in Iowa" this year.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at http://store.agc.org.