Starts show mixed pattern in January, Dodge says; office campuses return, CoStar finds

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

The value of new construction starts in January increased 2% from December's level at a seasonally adjusted annual rate, Dodge Data & Analytics reported on February 19, based on data it collected. "The gain for total construction relative to December reflected moderate growth [5%] for housing. At the same time, nonresidential building retreated slightly [–1%] in January, as increases for commercial building and manufacturing plant construction were offset by diminished activity for institutional building. The nonbuilding construction sector also retreated slightly [-2%] in January, as modest improvement for public works was offset by a downturn for the electric utilities/gas plant category. On an unadjusted basis, total construction starts in January were...down 14% from the same month a year ago, which featured the start of two massive liquefied natural gas (LNG) terminal projects in Texas. If these two LNG terminal projects are excluded, total construction starts in January would be up 1% from last year's corresponding amount....Useful perspective is made possible by looking at 12-month moving totals, in this case the 12 months ending January 2016 versus the 12 months ending January 2015, which lessens the volatility present in one-month comparisons. For the 12 months ending January 2016, total construction starts were up 6%, due to this pattern by sector—residential building, up 15%; nonresidential building, down 7%; and nonbuilding construction, up 11%."

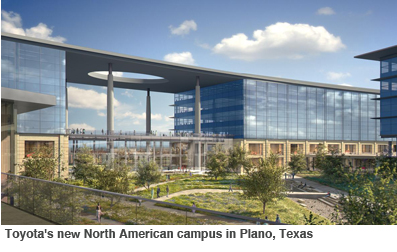

"Two-thirds of U.S. office markets had above-average levels of office construction at the beginning of 2016," real-estate research firm CoStar reported on February 17, based on data it collected. "Tampa is among a handful of U.S. office markets, a group that also includes San Diego, Atlanta, Pittsburgh, Raleigh, Miami, Phoenix and even Washington, D.C., where the amount of new supply remains well below their average norms, with demand growth clearly outstripping available supply, according to CoStar's recent 2015 office market review and outlook. Other markets such as Austin, Philadelphia and Los Angeles are at or near average construction levels, while fast-building metros such as Dallas, Denver, San Francisco, Seattle and San Jose are seeing development activity that's well above average annual growth levels 'When we look at office construction, we're seeing a clear sign that office campuses are back,' said Walter Page, CoStar director of U.S. office research, citing large build-to-suit corporate headquarters under construction such as tire and rubber company Bridgestone America's 514,000-square-foot, $220 million tower and campus under construction in downtown Nashville; and Toyota Motor Corp.'s 2.1 million-square-foot, $350 million corporate campus headquarters on 100 acres in Plano near Dallas, expected for delivery in 2017....Not all suburban office markets are thriving. Page noted that several office campus properties remain vacant in Northern New Jersey, where buildings were constructed for pharmaceutical firms or other previous occupiers in such a way that the space may not appeal to other types of tenants."

The U.S. Small Business Administration's Office of Advocacy has posted 2012 firm-size data by employment size for all states and by receipts size for detailed industry (NAICS) codes. For all industries, 90% of firms had fewer than 20 employees. There were 641,000 construction firms with employees (including single-family homebuilders and remodelers), of which 93% had fewer than 20 employees. An AGC analysis found that Montana had the highest concentration of small (under-20 employees) construction firms (96%). The lowest concentrations were in the District of Columbia (78%) and Nevada (86%). There were 652,000 construction establishments (permanent locations), meaning that nearly all (98%) firms operated from a single location. The National Association of Home Builders posted a detailed analysis of data on residential NAICS codes.

Consultancy IHS and the Procurement Executives Group (PEG) reported on Wednesday that "construction costs fell again in February....The headline current IHS PEG Engineering and Construction Cost Index...registered 41.3 this month, down from 43.3 in November. The headline index has been consistently below the neutral mark [in which a reading higher than 50 represents upward pricing strength; below 50, downward pricing strength] for 14 months. The current materials/equipment price index deteriorated once again, slipping from 39.6 in January to 36.9 this month. February's level is the lowest recorded since the survey began four years ago. All underlying material and equipment components showed falling prices except turbines, which showed prices unchanged. Compared to last month, fabricated structural steel had the largest drop and registered the lowest reading among equipment and materials. In addition, falling prices in almost all other categories demonstrate that weak pricing continues to migrate downstream. [The subcontractor labor index] retreated from 52.1 in January to 51.5 this month. [It] has been above the neutral mark for the last four months, although still significantly lower than its historical average."

The U.S. Census Bureau announced in the February 17 Federal Register that it asked the Office of Management and Budget permission to modify the Construction Progress Reporting Surveys, which are sent to a sample of contractors and public agencies to collect information about projects for calculating construction spending each month. "There are two changes planned to the content of these questionnaires. The first is the elimination of the data item for square footage of the construction project. This information was used for editing but is no longer needed. The second change is the addition of a data item to collect the projected completion date to assist with imputation if a response is not obtained in future months....Written comments and recommendations for the proposed information collection should be sent [by March 18] to OIRA_Submission@omb.eop.gov or fax to (202) 395-5806." Comments may also be sent to simonsonk@agc.org for forwarding.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.