AGC Data DIGest: September 21-24, 2021 [1]

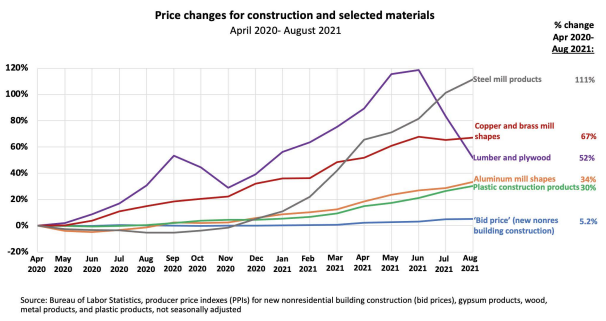

AGC posted [8] the fifth edition of the Construction Inflation Alert today, a document to help owners, officials, and others understand what contractors are experiencing regarding materials costs, production lead times, and supply-chain bottlenecks. As for supply-chain disruptions, the Wall Street Journal reported on Wednesday, “Newly arriving vessels are adding to a record-breaking flotilla waiting to unload cargo that on Sunday reached 73 ships, according to the Marine Exchange of Southern California, nearly double the number a month ago…Before the pandemic, it was unusual for more than one ship to wait for a berth…. In recent weeks, the Port of Savannah has had 20 or more ships at anchor waiting for a berth. Griff Lynch, executive director of the Georgia Ports Authority, said he expected the congestion would last for at least a couple of more weeks as shipping’s peak season continues. ‘This has never happened before,’ he said.” Another source of disruption is from Hurricane Ida, which destroyed the power grid in southeast Louisiana nearly a month ago, leaving plants that produce chemicals for construction plastics offline.

The prices of commodities used to make construction inputs remain extremely volatile. The price of iron ore “has fallen more than 50% since mid-July,” the Journal reported today. “The iron-ore price fell to $94 a metric ton on Monday, its lowest level in 14 months, according to S&P Global Platts, which publishes daily prices. The commodity, which traded above $233 a ton as recently as May, bounced to $107.55 a ton on Wednesday,” an increase of 15% over two days. But another article today (appearing side-by-side in the print edition) reports, “Investors are ramping up wagers that a global push to lower carbon emissions will hamper commodity production, pushing up prices for everything from natural gas to aluminum.” The November lumber futures contract on the CME commodities exchange closed on Thursday at $639 per thousand board feet, an increase of $184 (41%) in the past five weeks (though $1032 or 62% less than the record high close on May 7). The national average retail price for on-highway diesel fuel was $3.385 on Monday, the highest level since October 2018, the Energy Information Administration reported [9] on Monday.

Total construction starts (in dollars) fell 9% from July to August at a seasonally adjusted annual rate, the third monthly decline in a row, Dodge Data & Analytics reported [10] on Monday. However, total starts rose 11% year-to-date for January-August compared to the same months of 2020. Nonbuilding starts were down 2% for the month and up 1% year-to-date: environmental public works, up 23%; utility/gas plants, up less than 1%; highway/bridge, -2%; and miscellaneous nonbuilding sectors such as pipelines, -19%. Nonresidential building starts fell 13% in August but rose 3% year-to-date: commercial, 2%; manufacturing, 33%; and institutional, -1%, Residential starts were 9% lower for the month but 24% higher year-to-date: single-family, 29%, and multifamily, 13%.

Housing starts (units) rose 3.9% at a seasonally adjusted annual rate from July to August and 17% year-over-year (y/y) from the August 2020 level, the Census Bureau reported [11] on Tuesday. Year-to-date starts for January-August 2021 rose 21% from the same months in 2020. Single-family starts fell 2.8% for the month but rose 24% year-to-date. Multifamily (five or more units) starts soared 22% for the month and 17% year-to-date. Residential permits increased 6.0% from July and 26% year-to-date, as single-family permits edged up 0.6% for the month and 26% year-to-date, while multifamily permits climbed 20% and 27%, respectively. The number of authorized multifamily units that have not started--an indicator of potential near-term starts--jumped 44% y/y.

The Architecture Billings Index (ABI) climbed from 54.6 in July to 55.6 in August--the seventh consecutive reading above 50, the American Institute of Architects reported [12] on Wednesday. The ABI is derived from the share of responding architecture firms that report a gain in billings over the previous month less the share reporting a decline in billings, presented on a 0-to-100 scale. Any score above 50 means that firms with increased billings outnumbered firms with decreased billings. AIA says, “The ABI serves as a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months.” Scores by practice specialty (based on three-month moving averages) topped 50 for the seventh time in a row: mixed practice, 56.0 (up from 55.1 in July); commercial/industrial, 54.7 (down from 57.0); institutional, 54.4 (down from 55.5); and multifamily residential, 54.3 (unchanged). A design contracts index slipped to 56.6, down from 58.0.

Regarding office reopening plans, AIA reported that 65% of responding firms “indicated that their office is now fully reopened, with 46% reporting that all/most employees have returned to the office and 19% indicating that some of their employees are back. [18%] indicated that their office has partially reopened, while just 3% of firms reported that their office remains fully closed. Of the firms that have [reopened partially or not at all], 66% indicate that they do plan to fully reopen their office at some point. Most of those firms, 47%, expect that even when their office fully reopens, some employees will continue working remotely on a permanent basis, while 19% plan to have all employees back in the office once they fully reopen. An additional 14% of firms have still not decided when, if, or how their office will reopen. Firms have also made, or are planning to make, a variety of adaptations in order to reopen their firms in the post-pandemic world. Four in 10 firms indicated that masks are required in common areas of the office, and an additional 27% are considering implementing that requirement. Although this data was collected before the government’s vaccine mandate for large companies was launched, 38% of firms reported that they will require employees returning to the office be vaccinated, and an additional 25% are considering it.”