The uncertainties of the past few years have impacted our nation’s economy and many businesses have faced financial pressures. Businesses of all types are struggling, and for some, there is no end in sight. The effects of the pandemic will likely persist long after the threat to our health has been dismantled, so business leaders should take time to assess their entity’s viability. How will the financial slump affect their enterprise in the near and distant futures? Most importantly, is the downturn a true threat to going concern?

The uncertainties of the past few years have impacted our nation’s economy and many businesses have faced financial pressures. Businesses of all types are struggling, and for some, there is no end in sight. The effects of the pandemic will likely persist long after the threat to our health has been dismantled, so business leaders should take time to assess their entity’s viability. How will the financial slump affect their enterprise in the near and distant futures? Most importantly, is the downturn a true threat to going concern?

Why Going Concern Matters Now

Going concern is the assumption that an organization can meet its financial obligations. Most businesses operate under a going concern assumption, but economic uncertainties like a global pandemic, supply chain issues, and labor shortages can threaten this status quo. As business leaders consider these external pressures, they should familiarize themselves with reporting requirements and ascertain whether the future success of their business has been jeopardized.

Management’s Responsibility

Management is responsible for evaluating and disclosing their entity’s ability to continue as a going concern under Accounting Standards Update (ASU) 2014-15, Presentation of Financial Statements – Going Concern. While many still think of going concern reporting requirements as an auditor driven concept, with the passage of ASU 2014-15, that burden was extended to management, and as a result, users of the financial statement were given a much clearer view of the organization’s financial future from management’s perspective.

A Step Toward Greater Transparency

With both auditors and management attesting to an entity’s ability to continue as a going concern, users of the financial statement have an unambiguous, behind-the-scenes view of the organization’s financial viability. While the face of the financials will not change unless an entity is in liquidation proceedings, what is written into (or omitted from) the footnote disclosures will reveal much about the entity’s going concern.

For both interim and annual reports, management should consider all events and circumstances that raise substantial doubts about their ability to continue meeting their obligations. This could – for some entities – include economic pressures resulting from the pandemic. However, according to ASU 2014-15, substantial doubt only exists when it is probable that an entity will be unable to meet its financial obligations. If an entity is likely to survive the following year, disclosures specific to going concern uncertainties are not needed.

If substantial doubts about going concern do exist, management must:

- Disclose the threats or conditions that helped them come to that conclusion

- Reveal management’s plans to mitigate those threats

- Predict how probable it is that their plans will be effective

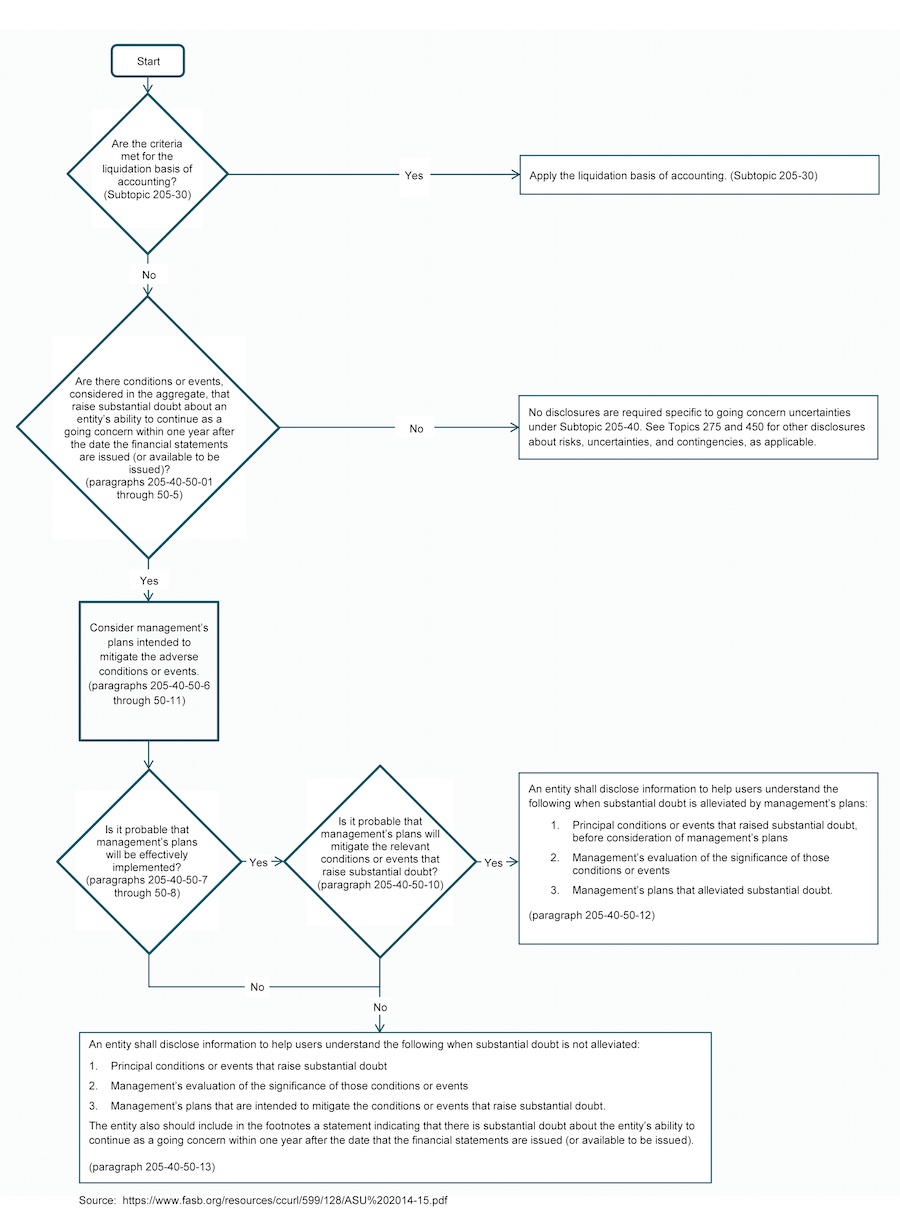

The following flow chart can help management determine what disclosures are necessary.

Though this is not a new reporting requirement, management is up against unique threats during this time and should take the steps to evaluate going concern. If you need help crafting your evaluation criteria or have questions about how best to estimate your financial viability, contact a member of LaPorte’s Audit and Assurance Services Group. We can help guide you to the right resources.