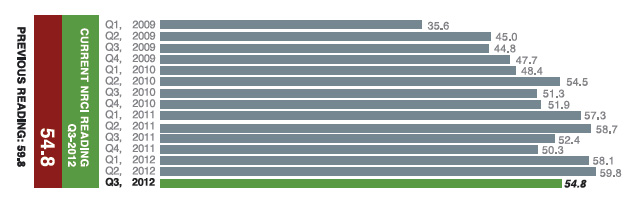

FMI (consultants and investment bankers for the engineering and construction industry) has released the results of their 3rd quarter survey alerting us to watch out for the rebound and recovery. The Nonresidential Construction Index (NRCI) dropped five points down to 54.8 (close to the 2010 3rd quarter level of 51.3), but it still remains in positive territory above the 50 mark which is considered the tipping point for the industry.

FMI (consultants and investment bankers for the engineering and construction industry) has released the results of their 3rd quarter survey alerting us to watch out for the rebound and recovery. The Nonresidential Construction Index (NRCI) dropped five points down to 54.8 (close to the 2010 3rd quarter level of 51.3), but it still remains in positive territory above the 50 mark which is considered the tipping point for the industry.

The report outlook tags the overall economy as down, the economy where the respondents do business as down, the expected backlog up to 9 months for the first time since 2010, and the cost of labor and materials lower for the next quarter.

There are a couple of points that struck a chord with me. First, on financing, the report states that:

“Panelists are seeing much less use of bank loans for construction and increasing use of contractors participating as project partners and owner/developer self-funded projects. Government-backed loans and grants are more prevalent.”

That indicates that the financing methods have changed and contractors are even more at risk. The “Hard bid, Low price” market that many firms find themselves in is putting an enormous strain on the bottom line, and profits are definitely shrinking. As the industry recovers, some firms will have stretched themselves to the breaking point, and that leads me to the second point in the report – Bankruptcies. The report asks:

“Is all this pressure finally causing an upturn in bankruptcies for industry firms? It is, and 27 percent of panelists noted there are fewer trade contractors in the market now with 16 percent seeing fewer contractors and 11 percent fewer design firms. While 18 percent note most firms seem to be surviving, 20 percent expect more business failures as the markets start to improve.”

One of the comments about the possible financial failure of General Contractors cautioned that the failure of cash-strapped trade contractors is pulling the GCs down with them. One of the comments stated, “Desperation pricing on bid jobs will take [down] some GCs and subs.”

The report suggests that those firms who have managed their cash and their talent during this downturn should be in an excellent position to thrive as the economy and the industry recovers. Those firms who are on the edge already had best be looking for an acquisition partner or for a good bankruptcy attorney.

The exhibits and comments make the report well worth reading, and I know that FMI is searching for additional respondents from around the country in order to ensure that the industry is being covered.

Chart courtesy FMI

Watch Out for the Rebound!

by Jim Kollaer | August 28, 2012

Add new comment