Accounting for Anticipated Losses

Accounting for Anticipated Losses

Generally accepted accounting principles or GAAP require the recognition of loss provisions in the period during which the loss becomes evident (Financial Accounting Standards Board Accounting Standards Codification [FASB ASC] 605-35-25-46 // FASB ASC-606-10-65-1). That is, when the current estimates of total revenue (i.e., consideration) and total contract cost remaining to fulfill the job indicate a loss upon completion, the entire value of the loss would be recorded against a loss provision (i.e., an “accrued” contract expense and a liability) in the period that determination is made.

Although the wording changed slightly in the recently effective ASC 606 Revenue Recognition guidance, the concept remains the same. A company will want to make sure that it considers all direct cost types that are applicable to the contract’s performance obligations in computing the loss. Additional cost factors to consider include variable consideration, non-reimbursable costs on cost-plus agreements, and costs on change orders defined as contract modifications. If a company is unable to estimate and record such loss provisions reasonably on a job-by-job basis, the company is not meeting the requirements of GAAP.

Example

Company ABC has one contract in progress at December 31, 2021 which contains a single performance obligation and no variable consideration or other unique terms. Work began during the year ended December 31, 2021. The contract price is $1,000,000 and the estimated total contract cost is $800,000. Total cost to date at December 31, 2021 is $100,000.

From contract inception through December 31, 2021, Company ABC recorded $125,000 in revenue over time based on the formula below. This results in gross profit of $25,000.

(Total cost to date of $100,000 / Estimated total cost of $800,000) * Total contract price of $1,000,000 = $125,000 of revenue earned

One year later at December 31, 2022, that same contract in progress with the contract price of $1,000,000 now has an estimated total contract cost of $1,250,000 due to job inefficiencies, material price increases, and bidding errors. Total cost to date at December 31, 2022 is $800,000.

From contract inception through December 31, 2022, Company ABC recorded $640,000 in revenue over time based on the formula below.

(Total cost to date of $800,000 / Estimated total cost of $1,250,000) * Total contract price of $1,000,000 = $640,000 of revenue earned

From contract inception through December 31, 2022, Company ABC has recorded $800,000 of total cost resulting in a gross loss of $160,000.

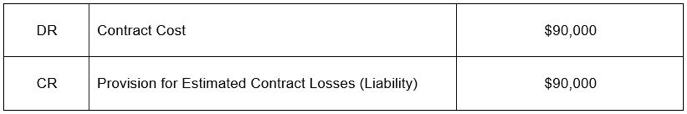

However, because the contract is estimated to generate a loss upon completion of $250,000 (contract price of $1,000,000 compared to estimated contract costs of $1,250,000), Company ABC must recognize the remaining amount of the projected loss during the year ended December 31, 2022 with the following entry. The $90,000 represents the difference between the total estimated gross loss and the actual gross loss already recognized in the financial statements.

The above entry would be reversed during the year ended December 31, 2023 and would offset the actual costs recorded to complete.

Assuming no other changes were made to the contract or the estimates through completion in the following year, here is how Company ABC’s financials would be impacted:

Notice how the entire estimated loss of $250,000 was recognized as of December 31, 2022 and no profit or loss was recognized afterward.

Contract Combination

In general, if GAAP allows for the combination of multiple contracts for revenue recognition purposes, then these contracts could also be combined for assessing and estimating the loss provision. Contracts that are not combined are analyzed for provision at the contract level.

However, with the addition of the “performance obligation” term in ASC 606 guidance, loss provisions can now be computed on an individual performance obligation level, if elected in accordance with company policy. This would be applicable to all contracts, including those that have been combined per ASC 606-10-25-9. The performance obligations would have to meet the criteria defined in GAAP (ASC 606-10-25-14 – 22).

Presentation

If significant to the financial statements, provisions for estimated losses are shown as a separate liability on the balance sheet. The contract provision would generally be shown as a contract cost on the income statement.

If you are interested in learning more about the provisions for estimated contract losses or ASC 606, our Construction Industry Group members welcome the opportunity to talk to you and answer your questions.