The following article originally appeared in the March newsletter to clients of FMI Corporation. Reprinted with permission.

The following article originally appeared in the March newsletter to clients of FMI Corporation. Reprinted with permission.

Discovering meaningful data can be powerful and provocative. Gaining access to The Perryman Group’s projections for the Greater Houston Partnership (GHP) and the traditional FMI “Construction Put in Place” report provided such an energizing experience. The blend of these insightful documents, which cover the exact same geographic area, unleashes fact-based optimism and stimulates many questions for all contactors and construction-related firms.

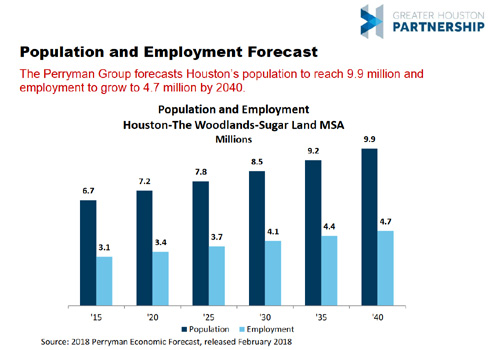

The Perryman report, done during summer 2016, projects GDP growth and population and employment growth, in five-year increments, thorough 2040. The projections are staggering! By 2040 GDP is forecast to grow from its current $500 billion to $1.123.4 trillion; population, from the current 6.7 million people to 9.6 million; and employment, from the current 3.2 million jobs to 4.7 million jobs.

The annual FMI report breaks the dollar amounts of construction into three categories: nonresidential buildings (commercial and industrial), nonresidential structures (roads, bridges, utilities) and residential buildings (single family and multifamily dwellings). The revelation occurs when you take the aggregate amount of construction put in place in the Greater Houston area, now about $25 billion to $26 billion a year and divide it by the current level of GDP, $500 billion to $520 billion. The result is that construction put in place is 5% of GDP, a number validated by both the FMI economic team and a report from the Boston Consulting Group. As a matter of fact, it is on the low side from a historical perspective. The amount of construction put in place normally runs 5-6% of GDP.

When you do the math for 2040, ($1.123.4 GDP x 5%), the overall construction market reaches the $55 billion to $56 billion level, an almost incomprehensible number. Even if the Perryman projections are off by 20%, the amount of growth will be enormous and enviable. And it will be available to those companies that begin right now to prepare to prosper by asking the big questions, often hard, but that lead to a strategy that separates the organization positively.

To get started, the senior leadership team, perhaps with outside assistance, might begin regular sessions to think about questions. What do we want 2040 to look like for our organization? What will the industry look like? Will there be the same traditional roles there are today? Or will technology totally disrupt, creating a new value chain? Which firms are our likely competitors then? What about our current strategic direction (markets, customers, delivery methods)? Will this focus and the choices required for this strategic direction still be relevant? What will be driving customer value then?

Once a point of view on the future is formed, then the envisioned future for the organization can begin to develop with an additional set of even tougher questions related to talent, leadership, ownership and many more topics, which will be discussed in coming articles. But with this highly credible data from The Perryman Group and the FMI research team, then the next 22 years, about the active cycle of a CEO and his senior team, can bring exceptional prosperity to those who act now.

Powerful Data, Big Questions

by Pat Kiley | March 30, 2018