The following article was authored by Charles Frantes and originally published on TexasGOPVote.

The following article was authored by Charles Frantes and originally published on TexasGOPVote.

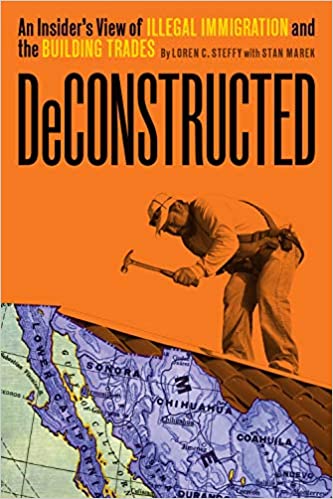

Stan Marek, CEO of MAREK, and Loren C. Steffy, Award-Winning Author and Business Journalist, discussed their book Deconstructed: An Insider's View of Illegal Immigration and the Building Trades, during a recent webcast hosted by Gilbert A. Herrera and Douglas Hidalgo with LaPorte CPAs and Business Advisors.

Authors Marek and Steffy explained how a dysfunctional and outdated US immigration system has fostered an unethical, inefficient, and unsafe shadow economy that threatens the sustainability of the construction industry. One solution they recommended is ID and Tax.

Steffy explained that the failure of the immigration system to help meet workforce demands in industries like construction has contributed to millions of immigrants coming to the US without legal status in order to meet those demands.

“Because the immigration system has been neglected since 1986, we have this sort of de-facto amnesty where we’ve got 11 million people who are here working and living in the shadows. They can’t fully participate in the economy but they’re here, and the system has continued in this state of neglect and gets less and less effective for everyone involved. We have all of these construction companies struggling to find the workers they need, and our immigration system has failed to reflect that,” said Steffy.

Marek explained that his industry’s workforce issues started to get much worse during the end of the last century, around the time that ICE started doing I9 audits, which encouraged construction companies to contract for labor and misclassify workers as contractors instead of treating them as employees.

“A lot of employers said ‘wait a minute, I don’t want to have employees anymore, I’m going to hire independent subcontractors or labor brokers, but I’m not going to take the risk of having an undocumented person on my payroll,” said Marek.

Because roughly half of Texas’ construction workers are unauthorized immigrants, they are unable to work for legitimate employers like MAREK, and are forced to work as independent contractors where often times they do not pay income taxes, are cheated out of payments, and do not have healthcare insurance or proper training in what has the potential to be a dangerous career.

“If you’re undocumented, you’re not going to go work as an employee on a W2 payroll for a company that uses I9s and is subject to ICE audits,” said Marek.

Today there are fewer and fewer construction companies like Marek that use I9s, pay payroll taxes, and provide workers comp and health insurance for all of their employees. Many construction companies have very few employees, and use mostly labor brokers and independent contractors, which significantly lowers their cost of labor and helps them to undercut and underbid contractors like MAREK that pay their taxes and follow the law.

“That’s the problem for employers that play by the rules. ICE is auditing companies like mine, and if you go back to when we were audited 12 years ago, we lost 100 people. Those people weren’t deported, they were told they couldn’t work at MAREK and went down the street and worked for our competitors for a much lower wage,” said Marek.

This type of worker misclassification and treatment of the construction workforce as disposable has created a sort of race to the bottom in the construction industry that greatly concerns Marek, who believes in investing in the future workforce and holding the industry and its projects to the highest standards.

“What is a company? It’s just employees; it’s the workers. One thing our industry has always been proud of doing is getting people, training them, retaining them, and building pride in riding for the brand, as they say it. I sincerely believe that our workers who get extensive training and mentoring are much more efficient and will save money in the long run. If you have an uneducated, untrained, unsafe workforce that does it again and again because they did it wrong the first time, it costs money,” added Marek on the importance of proper training and building a sustainable workforce.

As a solution, Marek and Steffy called for Congress to pass immigration reform that would allow unauthorized immigrants in the US to earn legal status and work permits so that legitimate employers can hire them and the federal government can ID and tax them properly. They also said that the government needs to make it more clear on who qualifies as an employee vs. a subcontractor.

“Every million workers that you can take out of the underground economy and put on a W2 payroll would account for $4.75 billion going into social security per year… It just makes sense for national security to know who is in our country, and if they’re working in our country they need to pay taxes like the rest of us. Payroll taxes are the fiscal backbone of this country. Especially for us senior citizens getting social security, we’d like to know it’s going to continue,” said Marek about some of the benefits of an ID and Tax policy.

To learn more about the ID and Tax solution, Marek recommended viewing Episode 12 of the Rational Middle of Immigration Docuseries: Finding Solutions - The ID & Tax Proposal.