The following article originally appeared in the November newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the November newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

While Harvey remains a popular topic of conversation, the numbers surrounding the devastation from Harvey continue to be revised downward. The latest revised numbers from Moody Analytics bring the number down to $65 billion, much less than originally reported. Unlike storms from the past, which brought wind damage and prolonged power outages, Harvey was a rain event, primarily affecting residences. Most businesses were down only a handful of days, minimizing their losses. The September employment numbers from the Texas Workforce Commission reflect this, with a 16,000-job loss across the city compared to the previous month. That number is expected to jump back up when the October numbers are released, as those businesses who were directly impacted by the storm get back on their feet, with 2017 ending with approximately 40,000 additional jobs.

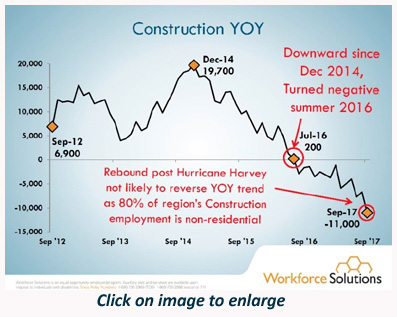

Construction employment, however, has continued its downward descent. As shown in the chart, construction employment year over year peaked in December 2014, turning negative in mid-2016. This is, in part, due to the drop in oil prices, coupled with construction markets like office and multifamily having fallen from their previous highs. The Harvey-related repairs are viewed as a temporary blip by contractors we’ve spoken to, and many are expecting a flat 2018. Harvey’s restoration will create, however, a spike in materials cost, and the ever-increasing war for talent is expected to drive labor costs up as well.

City of Houston nonresidential permits continue to track approximately 20% less in dollar volume compared to this time a year ago, and, nationally, the American Institute of Architects (AIA) Architectural Billings Index dipped below 50 for the first time this year, landing at 49.1 (anything below 50 signifies contraction; anything above 50 signifies expansion). Both new project inquiries and new design contract indices both softened as well, albeit still well north of 50. The Purchasing Manager’s Index for Houston also remains below 50, at 48.6 in September, with engineering and construction firms reporting further contraction.

CBRE’s third quarter reports show both retail and light industrial remain tight, with low vacancy and limited supply, while the office market is showing some signs of life with leasing picking up speed. However, the sublease space remains around 18 million square feet, with many of these leases expiring next year; so this market still has a long road to recovery. The multifamily market got a temporary, and needed, boost in occupancy after Harvey, with roughly 18,000 units leased since the storm, according to Apartment Data Services (ADS). While concessions can still be found in select areas, for the most part, they have disappeared across the city. Of the 16,000 apartment units that ADS has verified have storm damage, only two apartment communities will likely be shut down permanently due to flood damage.

While the full impact of the storm and its subsequent recovery won’t be known for a few more months, the consensus of the top economists in our region is that Harvey’s damage was significantly less than initially reported and that the recovery will be temporary.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: November 2017

by Candace Hernandez | November 08, 2017