The following article originally appeared in the February newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the February newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The latest Texas Workforce Commission employment numbers show a stronger than expected 2017. After adding only 18,700 jobs in 2016, Houston rebounded with a healthier 46,000 employment growth December over December, thanks, in large part, to Harvey recovery efforts. Construction employment, which was trending to be down 10,000 jobs for the year pre-Harvey, ended the year only 800 jobs below December 2016. Patrick Jankowski, vice president of research at the Greater Houston Partnership, feels that his employment forecast of 45,500 for 2018 may be too low if oil continues to hover around the $60 mark for the first half of the year. While benchmark revisions in March will adjust these numbers, the trend is right.

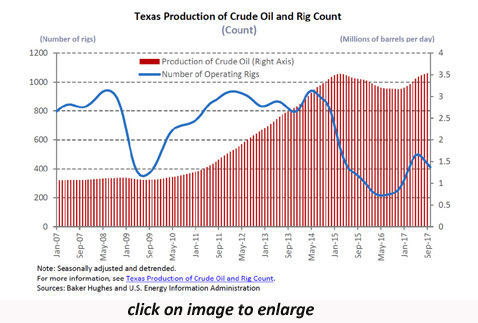

And oil producers have certainly gotten more efficient. As shown in the chart above, while the number of rigs has been reduced by half, our production levels in Texas are relatively equal to our previous peak. In a recent meeting, a representative of Halliburton felt the rig count was no longer a good indicator as companies drill longer and increase fracking. He noted that the drilling length is 30% more than in 2014, and the amount of sand pumping has increased 50% and that, while fully staffed on the rig, there is a shortage of fracking crews. Additionally, Halliburton is projecting investments in U.S. shale to grow 18% year over year through 2020, reaching $150 billion. For Houstonians, it will be a bit longer before we see the impact. Companies like Halliburton are hiring in the field but not yet hiring in their Houston headquarters. Taking a more disciplined approach to their spending, they are focusing on their shareholders first. Interestingly, Jesse Thompson, business economist at the Federal Reserve Bank of Dallas, Houston Branch, noted that while the East Houston petrochemical construction has begun to wind down, refineries are ramping up along the Gulf Coast and is expected to increase over the next five years globally.

Turning to construction, single family is expected to increase its home starts this year, with the busiest communities along the Grand Parkway to the west and north. There are reports of builder cycle times increasing one to two months due to workforce shortages, and there is a trend toward smaller lots as developers try to offer affordable housing options. Multifamily will have a weaker year when looking at new units delivered and anticipates negative absorption for the year as Harvey victims move out of their apartments and back into their homes. The office market, according to CBRE, saw a bump in demand as sublease space starts to burn off and still sees a lot of outside investor interest in coming to Houston. For our full Houston forecast for 2018, please email chernandez@fminet.com.

Material costs continue to escalate on a national scale. The Associated General Contractors of America (AGC) is tracking price increases for rebar, wallboard, glass fiber, cement board and more. Future prices for copper, crude oil and diesel have also hit multiyear highs repeatedly in recently weeks, according to Ken Simonson, chief economist for the AGC. Labor costs are also escalating. The Bureau of Labor Statistics reported a record high number of construction job openings in December along with the lowest December number of unemployed jobseekers whose last job was in construction. Combined, these suggest that construction firms are looking to hire more workers but having difficulty finding them. It also supports the increased discussion around prefabrication and technology, as contractors find ways around the workforce shortage.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: February 2018

by Candace Hernandez | February 19, 2018