The following article originally appeared in the August newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

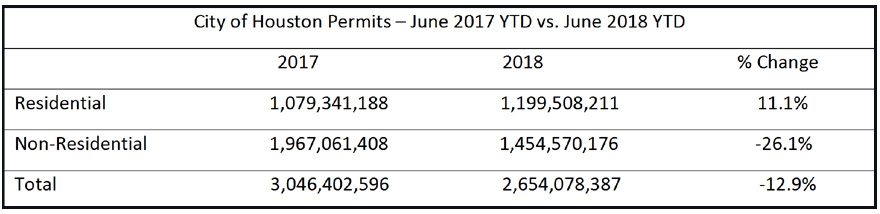

The chart above, reflecting year-to-date permits issued by the City of Houston, confirms what all commercial building contractors sense and feel: the market is off substantially. However, beginning in mid-July 2018, several large projects were awarded and should begin soon. These involve office building, both downtown and in suburban campuses. Perhaps, during the third quarter, the market will close the current negative gap with 2017 numbers.

The office market remains problematic. There was negative absorption again in the second quarter. The sublease market remains a major drag on new construction; there is still 9.7 million square feet available, despite the creation of over 90,000 jobs in the last 12 months and favorable energy markets. The office and employment numbers puzzle even the most seasoned Houston economists. Despite oil production in the United States being at record levels, the Houston-based office jobs are returning very slowly. Dr. Bill Gilmer of the Center for Regional Forecasting at the University of Houston indicates that about 75,000 Houston-based energy jobs were lost in the recent downturn, and it appears only 15,000 have been added back. Technology has eliminated some office jobs as well. There is a sense that energy-related manufacturing companies will ramp up their hiring soon. Prices are now favorable for all shale fields to be profitable, and global energy demand is projected to remain strong. Rigs and equipment that had been “cold-stacked” are being put back into service; new ones will be needed.

Despite oil production in the United States being at record levels, the Houston-based office jobs are returning very slowly. Dr. Bill Gilmer of the Center for Regional Forecasting at the University of Houston indicates that about 75,000 Houston-based energy jobs were lost in the recent downturn, and it appears only 15,000 have been added back. Technology has eliminated some office jobs as well. There is a sense that energy-related manufacturing companies will ramp up their hiring soon. Prices are now favorable for all shale fields to be profitable, and global energy demand is projected to remain strong. Rigs and equipment that had been “cold-stacked” are being put back into service; new ones will be needed.

CBRE has begun a special Houston medical office report covering 317 Medical Office Buildings (MOBs). This first such report indicates the vacancy rate is 12.7% and the square footage under construction is 620, 508. It also indicates that there are 15 MOBs, totaling 855,00 square feet, now underway or in late-stage planning. Other commercial markets remain healthy, but not robust. However, residential construction, especially single-family dwellings, is very strong. The number of new homes to be built in 2018, originally projected to be 28,500, has now been increased to 28,800, and the raw land lot supply is dwindling.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: August 2018

by Pat Kiley | August 09, 2018