The coronavirus pandemic infused unprecedented levels of uncertainty into our economy. When the virus became more widely spread in March 2020, businesses closed, workers self-isolated, and customers abstained from the marketplace. Even today, operations are not back to normal, and many businesses are still struggling. These changes are going to affect each organization differently, but one thing is certain: businesses hit with adverse effects from COVID-19 will need to identify the consequences on their asset bases and reflect those outcomes in their financial statements.

The coronavirus pandemic infused unprecedented levels of uncertainty into our economy. When the virus became more widely spread in March 2020, businesses closed, workers self-isolated, and customers abstained from the marketplace. Even today, operations are not back to normal, and many businesses are still struggling. These changes are going to affect each organization differently, but one thing is certain: businesses hit with adverse effects from COVID-19 will need to identify the consequences on their asset bases and reflect those outcomes in their financial statements.

Triggering Events

External events and pressures can put an organization’s financial performance at risk. Management is required to evaluate their long-lived assets, intangibles, and goodwill for impairment when triggering events are identified, but at least annually. Determining the existence of one or more triggering events, which requires significant judgment and weighing any mitigating factors, may lead a business to evaluate their assets for impairment. Triggering events can be as simple as unfavorable changes in raw material availability and prices, or as severe as a natural disaster. Some of the common indicators of triggering events are:

Shifts in market forecasts

Fluctuations in materials or labor costs

Increases in costs of borrowing

Changes in availability of financing

Company is experiencing or expecting future net losses in operations

Shifts in stock prices

Changes in management or losses of key employees

Changes in foreign exchange rates

Supply chain shortages

The downturn in economic conditions caused by the coronavirus pandemic may or may not be considered a triggering event for your business. The criteria for a triggering event is met when it is more likely than not that your asset or reporting unit’s recoverable amount (or fair value) is less than its book (or carrying) value. Even if you determine that no triggering event occurred, it’s important to analyze what impact the event had on your operations and document the factors considered that lead to your conclusion.

Impairment Testing

On its face, impairment testing is not very complex: businesses should record an impairment loss if the carrying amount of their asset or reporting unit exceeds its recoverable amount. For most assets, carrying costs are calculated as the acquisition cost less accumulated depreciation or amortization. However, the recoverable amount may be more difficult to ascertain, since it is often based on inputs that require significant knowledge and judgment to be exercised by management. Three acceptable asset valuation methods are:

- Market Approach

The recoverable amount is determined by considering recent sales transactions of similar assets or by using market information available to the public (like a stock exchange or sale listing).

- Cost Approach

The recoverable amount is determined using the cost it would take for you to build or replace the asset.

- Income Approach

The recoverable amount is determined by calculating the discounted cash flows anticipated from the asset.

With these two values (carrying and recoverable amounts) at hand, you can perform the calculations to see if there has been impairment, but you must do so systematically in the following order: After testing all regular assets first, you should test indefinite-lived intangible assets, then long-lived assets, and finally goodwill.

Regular Assets

Assets not included in the other three categories should be tested (and, if necessary, adjusted) first. This includes receivables, debt and equity securities, other investments, and inventories. Groups of similar assets can be tested together, but others (like many investments) may need to be tested separately.

Indefinite-Lived Intangible Assets

Indefinite-lived intangibles (like trademarks, brand names and licenses with no expiration date) have to be tested for impairment as soon as indicators of impairment are identified, at least annually.

Long-Lived Assets

Long-lived assets include tangible assets (like property and equipment) and finite-lived intangible assets (like patents and copyrights). The new lease accounting standard made this section of asset impairment testing all the more relevant since many leases are now reflected on your balance sheet: If leased equipment is reflected on your balance sheet as a right of use asset, you may need to record an impairment if you determine that it is unlikely the leased asset will be used at the same frequency as you expected before.

Goodwill

While certain accounting elections relieve management from the requirement of an annual impairment assessment, goodwill must be tested as soon as indicators of impairment are identified. But goodwill needs to be valued last, because a reporting entities’ carrying value is the sum of all asset values. Only once all the other assets are reflected at their recoverable values can you determine impairment of goodwill.

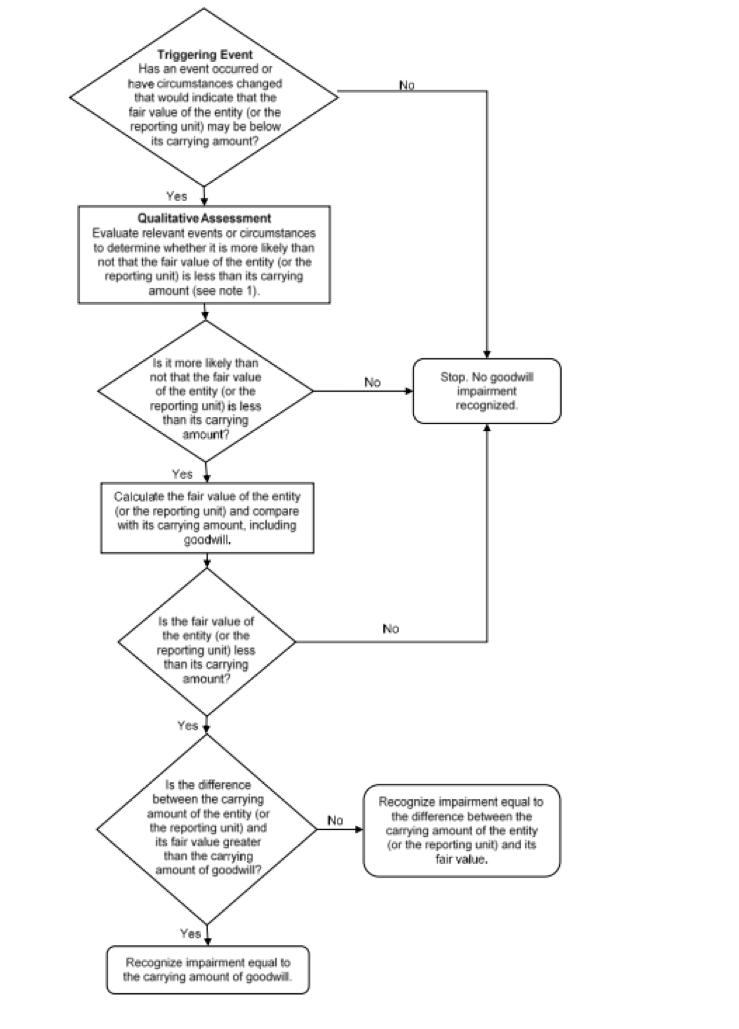

Traditionally, the goodwill impairment test is a two-step approach, where a shortfall of fair value over carrying value requires a hypothetical purchase price allocation. However, companies who elected to adopt ASU 2014-02 “private company alternative” or ASU 2017-04 “Simplifying the Test for Goodwill impairment” may use the following decision tree obtained from FASB as a roadmap when performing asset impairment testing:

Reporting Requirements

Recording impairment losses will affect both your balance sheet and your income statement. Most impairment adjustments are recorded as an impairment charge (loss) on the income statement, offset with a reduction to the asset or with a credit to a contra-asset account. If a contra-asset account is used, the asset and contra-asset accounts should be netted on the face of the financials. Impairment charges are reflected as a separate line item if material. Classification as operating or non-operating is determined by the character of the underlying asset.

In addition to recording the actual impairment losses, you will be required to disclose information about how the impairment charge was determined. You should disclose in the footnotes to the financials information about the triggering events, how you determined it was a triggering event, and the methods you used to calculate the impairment.

Impairment testing is a particularly difficult task right now. Triggering events related to the pandemic likely occurred over a series of weeks or months. Should you take advantage of the simplified impairment tests? Or if you already determined that your assets have been impaired, should you report those losses in the first, second, or third quarter of 2021? And if the triggering event hit in the first quarter, should you report a subsequent event on your 2020 financials? Answers to these questions will look different for each organization. For help in addressing questions specific to your situation, contact a member of LaPorte CPAs & Business Advisors’ Construction Industry Group.