Editor’s note: AGC Houston held their 2014 Annual Chapter Meeting in January where Ken Simonson offered attendees his update about the improving economy and what that means for construction companies in 2014. In part two of his presentation, he talked about construction spending in various sectors and about construction employment – comparing employment in Texas to that in the rest of the United States.

The biggest category in industrial construction spending is the one the census calls power. That includes not just coal, gas, and nuclear-fired power plants, but also those wind projects that have been popping up all over west Texas, solar power, and the transmission lines that you need to carry the power from where it's being generated to where it's being used. It also includes everything that is happening in the oil and gas fields and the pipeline work. It's surprising to see this category down 21%, but that's really kind of a policy-driven fluke. If you recall, back at the end of 2012, there was all of this hullabaloo about the so-called fiscal cliff pending the expiration of many tax provisions. One of those was wind production tax credit, so all of those contractors out in west Texas and elsewhere were working feverishly to make sure the blades were turning on those wind turbines by the end of the year. In 2013, we didn't have that same surge of work at the end of the year, so November to November figures look bad. However, looking past that, we're going to see a strong upturn again in both electric power, particularly transmission work, and in oil and gas work, so I think that category will be a big winner this year. It should be up more than 10%.

Manufacturing construction is growing strongly now and will continue right through 2014, partly because of those oil and gas-related manufacturing projects. Both the petrochemicals and the plants that are supplying steel parts and equipment, and even the fueling facilities for liquefied and compressed natural gas, trucks and bus fleets, but also automotive manufacturing is coming back in some parts of the country.

Transportation is a mix of private rail projects, which are going on as a result of both developing these unit trains to deliver oil and natural gas liquid from the fields to where they're being used, stored, or refined. For the public sector, there is transit rail, airport, and some port activity. I think in general, the funding for the public transportation is going to taper off or be level this year, so it won't see such strong growth. Although Houston may be an exception with major airport activity.

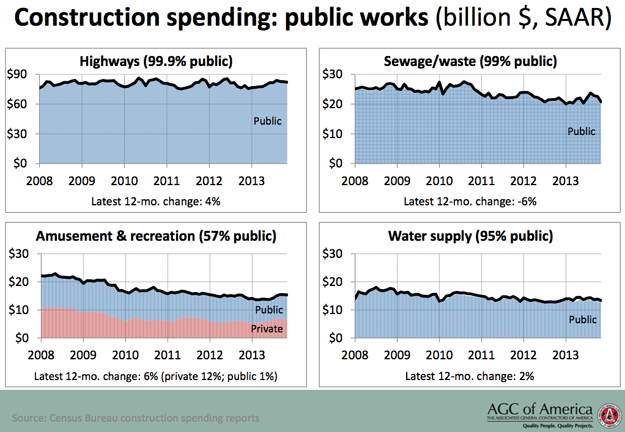

Highway and street construction should level through September, but after that we could see a big drop-off unless Congress can find a way to add more funds to the federal highway trust fund after the current bill, called MAP-21, expires at the end of September.

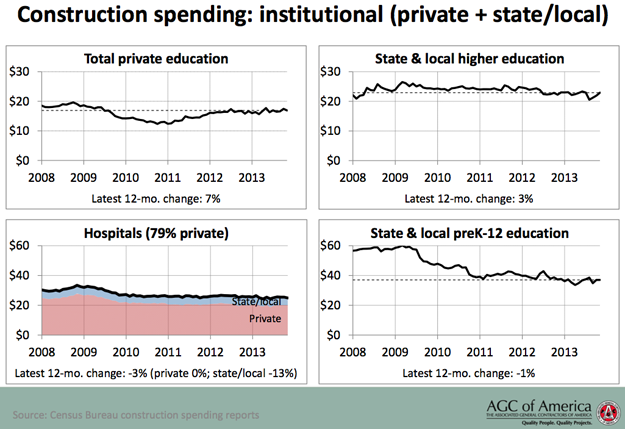

Educational construction has been just about flat in the past year, but it's really been declining for several years. The problem as we've seen it, with many of the ISDs, is that once their bond issues (that had been passed before the recession) ran out, they weren't even trying or weren't getting approval of school bond issues of the same magnitude as before. This has been true nationally, but now that we're having a revival of house prices, property tax receipts are starting to come up, and we'll see more of that by 2015. For this year though, I think that market is going to remain very sluggish.

Health care construction has not yet come back nationally. Hospital construction has remained pretty weak as more and more of the health care spending as well as patients are going to stand-alone, urgent care centers or in-and-out surgical centers for outpatients and so-called doc-in-the-box clinics where you can see someone in a strip shopping mall, big box store, or drug store rather than go to an emergency room. That's been good for holding down the growth for health care expenditures, but it has meant a pause in hospital and some other health care spending. Also, the cutback in federal funding, whether it's for the defense department, hospitals, veteran's affairs hospitals, or NIH research facilities, has held down the hospital category, and that will continue to be true this year.

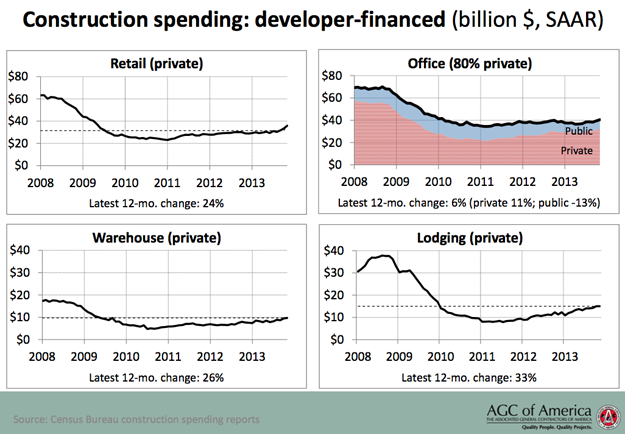

Commercial is a term that everyone uses differently. In the case of the census bureau, it refers to retail, warehouse and farm construction. While this is up strongly in this particular twelve-month period, I think that's a bit of an illusion. On the retail side, we're actually seeing more and more stores closing, just in the last week. JCPenney, Sears, and some other chains have announced store closings, and I think that's going to continue. We are getting new retail in places where you have large multi-purpose buildings going up, in which you have retail on the first floor with office, hotel, or residential above it. You're also going to see some renovation of retail, but the growth segment here is in warehouse construction. More and more firms are trying to put in distribution facilities close to where the population is. I think for those multi-million square foot distribution centers which serve a whole region and for local fulfillment centers, warehouse construction will be a hot market.

Office construction is up for the moment. Once again, Houston is leading the parade. There are only about four cities that are seeing major new office construction: Houston, San Jose, San Francisco, and Seattle. The suburban office market for the most part remains very dead, but there is a lot of office renovation work as firms crowd more employees into existing space, or they move into buildings that have been renovated. So office construction I think will be pretty weak nationally.

One other category worth mentioning is lodging, which has had a tremendous comeback with new hotels and extended stays in places like the Eagle Ford Shale, where there isn't a lot of excess housing and there is a flood of new workers. There are some new business hotels and some renovation of resort hotels that have been allowed to languish until business and leisure travel come back, but that category should be very strong this year.

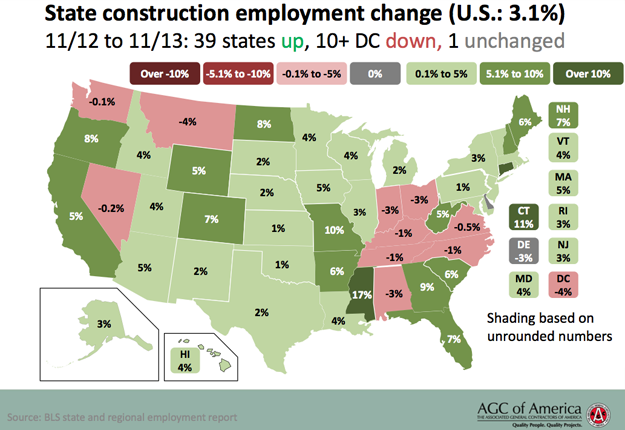

Employment is already a worry. I update the map shown above each month to show states in green that have an increase in construction employment relative to a year before, and states in pink or deep red with a decline. Fortunately, this map has gotten greener and greener over the course of the last few months and the deep red has completely disappeared from the map. Texas right now is up only 2%, but in fact, Texas has been doing quite well.

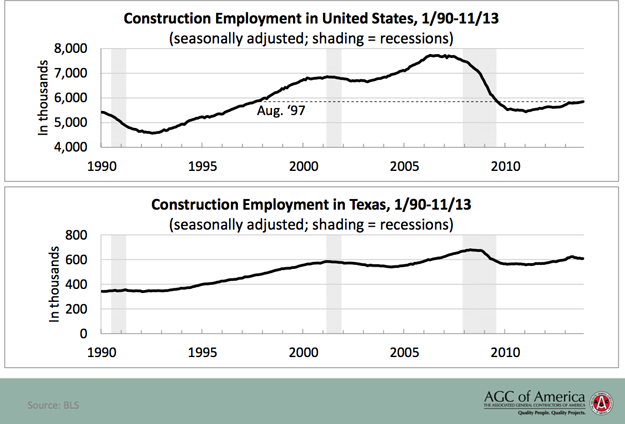

The above graph shows a comparison back to the beginning of the series in 1990 that shows that Texas never had that huge run-up in construction employment last decade and so had a much milder drop-off during the recession.

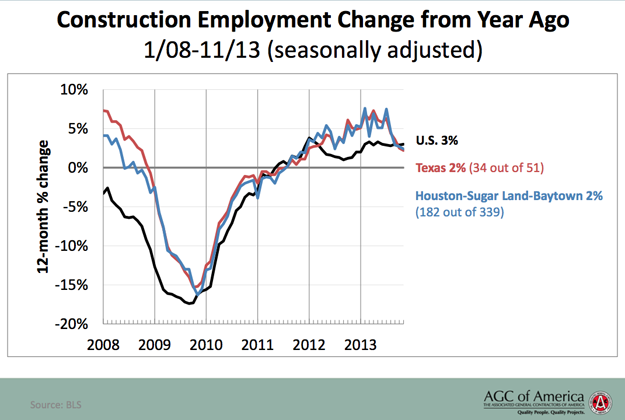

Above is a comparison with the United States as a whole. Texas is in red, and you can see, until the latest month, Texas was doing much better on a year over year growth basis than the U.S. There was a sudden cooling off in Texas and in the Houston market, and the grayish blue tracks very closely to the state as a whole. Both were up about 2% from November to November, and before that, had been adding jobs at about 6-7% rate.

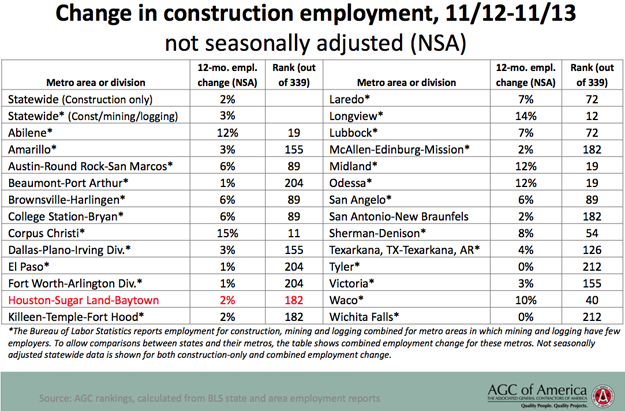

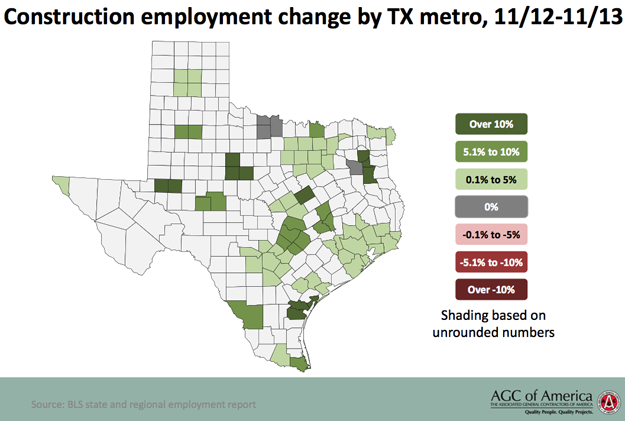

Below are the rest of the metros in Texas and their ranking out of 339. What's striking is that every one of these has positive growth or at least is breaking even on a year over year basis, and that's not true nationwide. We are up to about 60% having had growth, but this is far better in terms of every one of Texas' metros being level or ahead.

Read the conclusion of Simonson’s report next week here on Construction Citizen.

Add new comment