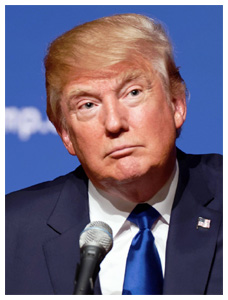

Economic and political uncertainty call into question the durability of this week’s Wall Street rally, but the election of Donald J Trump as the next President of the United States has not inflicted the kind of damage to markets that many analysts expected.

Economic and political uncertainty call into question the durability of this week’s Wall Street rally, but the election of Donald J Trump as the next President of the United States has not inflicted the kind of damage to markets that many analysts expected.

That is in large part thanks to Trump’s tone on election night.

In the early morning hours of Wednesday after Democratic Nominee Hillary Clinton called the Republican candidate to concede, Trump gave a victory speech in which he thanked his former political opponent for her service and even said the nation owes her a debt of gratitude.

“I mean that very sincerely. Now it is time for America to bind the wounds of division; have to get together,” Trump said. “To all Republicans and Democrats and independents across this nation, I say it is time for us to come together as one united people.”

“I pledge to every citizen of our land that I will be President for all of Americans, and this is so important to me,” Mr. Trump said. “For those who have chosen not to support me in the past, of which there were a few people, I'm reaching out to you for your guidance and your help so that we can work together and unify our great country.”

Prior to Trump’s speech, Dow futures were off more than 800 points. The moment he began to talk in such a gracious tone – something he had rarely if ever done during the 18 months leading up to Election Day – the markets reversed themselves and began trending up.

By Wednesday afternoon, traders had pushed markets to double-digit gains.

The stock market, of course, is not a reflection of current economic conditions as much as it is a projection of where investors are willing to bet the economy is going.

President-elect Trump has pledged to spend $1 trillion over 10 years on infrastructure projects, an idea that's long been a priority of Republican and Democratic leaders alike. In many ways, this promise is not unlike the economic stimulus package passed under the Obama Administration.

Most of the resistance to that kind of investment has come from certain elements within the Republican Party, namely self-identified Tea Party supporters.

Trump’s pledge to prioritize infrastructure spending helped send stocks in building firms higher, per the Wall Street Journal (subscription required):

The prospect of more federal and state spending drove shares in engineering and construction specialist Aecom almost 13% higher, and rival Jacobs Engineering Group Inc. closed up nearly 10%.

Suppliers of concrete, sand and gravel soared in heavy trading, with Vulcan Materials Co. and Martin Marietta Materials Inc. ending up 10% and 12%, respectively. Companies that make construction equipment, cranes and other machinery also jumped, led by a 14% rise at Manitowoc Co. and a nearly 15% increase by Terex Corp.

“Upgrading the infrastructure we have, and advancing what’s necessary to meet the demands of new growth will require national support for alternative delivery methods, including public and private partnerships,” Aecom Chief Executive Mike Burke said in prepared remarks.

Trump has painted with a broad brush and rarely talked about specifics when outlining his various policy initiatives. That is why it will likely be the responsibility of leaders in Congress, Speaker Paul Ryan and Senate Majority Leader Mitch McConnell, to drill down on the details of how to carry out this plan.

Photo credit Michael Vadon