The following article was co-written with Ralph Gentile, Ph.D., Senior Economist, CLMA. The past six months have witnessed escalating rounds of a trade war, which is the threat and imposition of tariffs on goods traded among the United States and its major trading partners. In January 2018, the skirmishes began when the Trump Administration imposed duties on solar panels and washing machines, aimed primarily at China and South Korea. Subsequently, President Trump added $34 billion in tariffs on steel and aluminum, targeting Mexico, Canada, and the European Union. Another $16 billion came soon after.

The past six months have witnessed escalating rounds of a trade war, which is the threat and imposition of tariffs on goods traded among the United States and its major trading partners. In January 2018, the skirmishes began when the Trump Administration imposed duties on solar panels and washing machines, aimed primarily at China and South Korea. Subsequently, President Trump added $34 billion in tariffs on steel and aluminum, targeting Mexico, Canada, and the European Union. Another $16 billion came soon after.

At least three initial targets, Mexico, Canada and the European Union, have responded in-kind. Subsequent rounds have been focused on the Peoples Republic of China. On July 10, the Trump Administration announced a $200 billion in 10% tariffs on Chinese goods adding to the $50 billion total, to which the Chinese Secretary of Commerce vowed further retaliation. That escalation is due shortly, since the $200 billion in tariffs are under review, part of a two-month process with hearing set for late August 2018.

The dispute between the Trump Administration and leadership of the People’s Republic of China has the potential to become a bruising trade war that could recast the international trading system. The U.S. is particularly concerned with the China 2025 industrial policy which explicitly targets advanced technology industries. It is a specific case of the more general problem under the World Trade Organization rules. Industries in private enterprise systems can be put at a disadvantage by administrative barriers, export subsidies, targeted investment, and dumping (selling goods below their cost of production to drive competitors out of business).

The reasons why the trade conflict could be brutal lie in the priorities of Presidents Trump and Xi Jinping. The Chinese leader is committed to leading his country toward becoming a cutting edge industrial power as quickly as possible. The Trump Administration, however, is unlikely to back down from its commitment to fight what it views as “unfair” trade practices. So the stage appears set for a difficult few years. The stakes are high since technological leadership is at issue, along with its implication for national wealth and military power. Additionally, despite President Trump’s declarations to the contrary, winning a trade war is not “easy.” At the close of this conflict, the United States, by some combination of its own choices and the disgruntlement of its trading partners, could potentially find itself estranged from the international trading system. Membership in the World Trade Organization generally entitles countries to “most favored nation” trade status, meaning they enjoy the lowest tariffs imposed on any trade partner.

Any outcome in which the U.S. is partially estranged from the international trading system could have unfortunate effects. U.S. manufacturers would both buy and sell less abroad, U.S. consumers would pay higher prices for goods, and decreased levels of competition would slow the development of new products and the growth of new industries. The implications are clear – protectionism very likely means less capital spending and less construction activity (e.g. fixed domestic investment), at least over the long-run. Competition creates new products, drives down prices, and grows markets; and rising production fuels the construction of new capacity. In the near term, the uncertainties surrounding an escalating trade war should lead to a slowdown in investment, since perceptions of increased risk lift hurdle rates and raise required returns. But the subsequent adjustment of supply chains and relocation of foreign facilities to produce basic and intermediate products domestically could for a time lead to higher industrial construction. Nearly all the specific industries examined here have domestic capacity utilization rates at or above 80%, which, as a rule of thumb, is the rate at which companies within those industries begin adding productive capacity. However, the story is complicated.

U.S. tariffs will raise the price of commodity, intermediate and final goods to American firms and households and to the rest of the world, which will decrease total demand even if the U.S. share of that total increases. The imposition of tariffs by foreign nations will raise the price of American goods, leading to additional losses in U.S. competitiveness. In the end, U.S. industry will face multiple challenges – reworking their supply chains, adjusting to higher input costs, and absorbing retaliatory tariffs. For the construction stakeholder focused on the skilled trades, the most important question remains: “What does the U.S. shift toward protectionism mean for construction activity, particularly for industrial and heavy construction along the Gulf Coast?”

Construction Consequences of Tariffs

The Gulf Coast economy comprises a network of industries and subsectors that ship commodity, intermediate, and final goods among themselves. These shipments are both domestic and cross-border, dictated by supply chain networks. For example, Texas imports insulated wiring sets for vehicles, ships and aircraft, safety airbags with inflator systems, and passenger vehicle spark and ignition systems for producing automobiles. It exports compression ignition and combustion systems along with parts and accessories for motor vehicles. In addition, Texas imports iron and steel, which it transforms into specialized oil field drilling equipment, among other products. It also imports crude petroleum and exports refined petroleum and chemicals. More recently, Texas and Louisiana are using low cost domestic natural gas to produce commodity chemicals like acyclic ethers, polyethylene, styrene, and butane.

These complicated flows are typically built on personal relationships, small cost advantages, or on one company’s willingness to produce specialized products for another. Such relationships make companies and industries mutually dependent. A group of metal fabrication firms may rely on each other’s output to create a finished good, but the mutual dependence also means changing course is difficult and costly. Therefore, determining exactly how a set of initial and retaliatory tariffs will affect a given product can be complicated.

This analysis considers three types impacts from imposing tariffs:

- Input Cost Effects: Domestic tariffs imposed on imported goods will lift their prices, raising their costs to American households and businesses, and encouraging substitution away from those goods. Note: Higher input prices may force some companies to close their doors, reducing any demand for construction activity.

- Supply Chain Effects: The imposition of the tariffs may force companies to revamp their supply chains, finding domestic suppliers, reducing or eliminating cross border trade. The need for new production facilities in (domestic) locations may stimulate construction activity.

- Overall Market Demand: The ultimate effect on market demand depends in large part on whether the U.S. is a net exporter of the industry’s final goods. The imposition of retaliatory tariffs will raise prices of a nation’s exports, reducing the growth in foreign demand even as domestic tariffs on foreign goods lift the prices of U.S. goods.

Heavy industries along the Gulf Coast are integrated in different ways and to different degrees; but it is possible to discuss selected industries in terms of their production costs, supply chains and export markets.

Key Gulf Coast Industries

An analysis of the impacts of tariffs on key Gulf Coast Industries is offered below. The industries build transportation equipment, fabricate metal products, synthesize chemical products, and supply liquefied natural gas to international and domestic markets. Others refine crude petroleum, generate electric power and transport crude and refined petroleum.

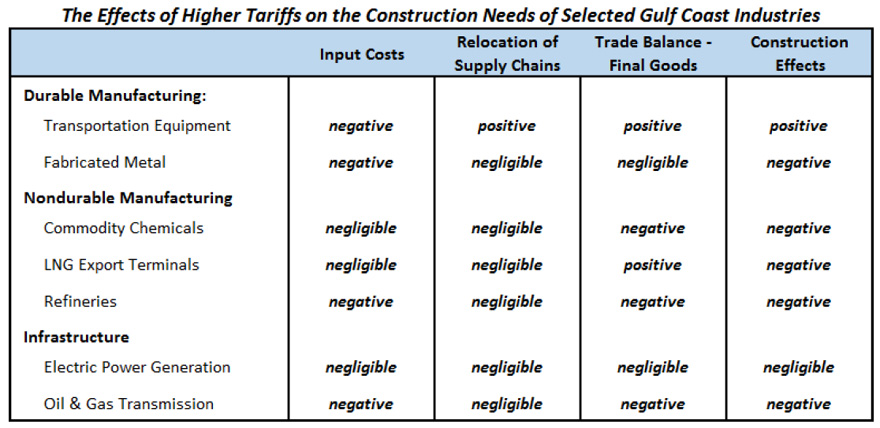

The table below distinguishes three principal effects – on production costs, supply chains, and export

volumes.

- Higher production costs mean intermediate and final goods output are less competitive both domestically and internationally, reducing the need to invest in new capacity.

- High supply chain impacts imply that a substantial reworking of the network of suppliers is needed, reducing inputs from foreign companies. Any relocation of suppliers to the U.S. suggests the need to lift U.S. productive capacity.

- Foreign tariffs on U.S. production reduces international demand for U.S. goods while U.S. tariffs on foreign goods lift domestic demand. A critical point is whether the industry in in question is a net importer of exporter of final goods.

The three principal effects can be cross-cutting or reinforcing, leading to unambiguous or indeterminate implications for construction. For example, the combination of higher input costs (reduced construction), high supply chain impacts (enhanced construction), and lower net export volumes (reduced construction) is cross-cutting. As a result, the overall effect would be classified as “indeterminate”. Alternately, for industries whose production costs are little affected (no impact on construction), whose foreign suppliers are few (no impact on construction), but whose export volumes are reduced (lower construction), the effects of tariffs are negative.

Transportation Equipment: The Gulf Coast states have significant facilities devoted to fabricating transportation equipment, including automobiles, ships, and airplanes. For example, both Texas and Alabama have large automobile manufacturing facilities. Texas is also the location of significant aerospace industry employment. Finally, the Gulf Coast possesses large ship building facilities such as those in Pascagoula, Mississippi and Mobile, Alabama. The primary work at these yards is building U.S. Navy ships, but there is also on-going construction of oil and gas platforms as well as the repair and maintenance of vessels transporting crude and refined petroleum.

The largest segment of transportation, however, is the automobile industry. Supply chains for automobiles are significantly cross-border. The cross-border patterns established during the maquiladora program have created a network of extensive trade flows between North American nations, suggesting that modifications to supply chains will be needed since higher tariffs will encourage companies to relocate facilities to the U.S. (higher construction). At the same time, the large amount of steel in automobiles suggests higher input costs, raising both U.S. and international prices. Finally, the negative trade balance in auto indicates that the combination of domestic and foreign tariffs would lift overall de mand for U.S. vehicles, lifting the need for domestic capacity. The effects of retaliatory tariffs on U.S. automobile exports would be to raise international prices and reduce U.S. sales abroad (lower construction). On net however, the construction effects are likely to be positive.

Metal Fabrication: The metal fabrication sector includes nine industries ranging from forging and stamping through architectural and structural metals manufacturing to machine shops, turned products, and screw, nut and bolt fabrication. Its employees comprise primarily machinists and welders. There is appreciable manufacturing due to special valves and piping associated with oil field equipment.

What does the imposition of tariffs mean for metal fabrication? The increases in production costs due to U.S. tariffs on imported steel lift prices all along the supply chain, reducing demand and suggesting that some small metal working shops could become unviable. Higher U.S. prices for fabricated metal products due to retaliatory tariffs also suggests a loss of international competitiveness, reducing demand for U.S. products. On the other hand, given the many metal fabricators already located in the U.S., there will likely be little construction activity due to relocation to the U.S. So in the end, the net effects on construction are probably negative.

Commodity Chemicals: The chemical industry includes five subsectors: basic chemicals, specialty chemicals like adhesives, sealants and additive, agricultural chemicals including fertilizers, pharmaceuticals, and consumer products like soaps, detergents, and cosmetics. The U.S. has a negative trade balance in pharmaceuticals, but more favorable balances among the other sectors. Gulf Coast firms are champion producers of commodity chemicals, benefitting from low feedstock costs for natural gas. Large oil and gas companies have been adding chemical plants along the Texas-Louisiana Gulf Coast and have plans to add more.

The chemical industry’s input cost vulnerabilities are small since most raw natural gas and crude oil production for the chemical industry is domestic. Further, since processing occurs domestically, there would be no need to revamp supply chains by relocating facilities from abroad.

However, the situation is different with respect to international markets. American industry exports commodity chemicals to much of the rest of the world, and margins for commodity products are typically slim. Industry sales abroad will be sensitive to the higher prices resulting from foreign tariffs on American goods. In the end, demand for U.S. chemical exports would likely be reduced, reducing at least the expected increases in demand (and construction) for U.S. commodity chemicals.

Liquefied Natural Gas: The boom in U.S. natural gas production has put downward pressure on natural gas prices, providing opportunities for LNG exports from the United States. Export terminals are technically part of the chemical industry, since they process natural gas, transforming it into liquids for transport to U.S. cities or overseas.

Since natural gas is domestically produced and in plentiful supply, neither U.S. nor foreign tariffs are likely to substantially affect domestic supply chain costs. Also, since foreign natural gas or natural gas processing is not part of the industry supply chain, few installations would need to be relocated to the United States.

Of more concern is that retaliatory tariffs could lift the price of U.S. liquefied natural gas to foreign buyers, giving commercial advantages to producers in other countries. The United States is just one source of very significant new supplies. With the effects on both input costs and supply chains as negligible, the negative effects of retaliatory tariffs would predominate.

Refined Petroleum Products:

Oil refineries and natural gas plants are technically part of the chemical industry – the refineries crack crude petroleum into its constituent hydrocarbons. In the process, they create diesel, gasoline, and other distillates.

The trade in petroleum is international, but there is little trade in intermediate petroleum products, so that the opportunities to relocate foreign facilities to the U.S. are limited. Domestic tariffs on petroleum imports is also unlikely – the U.S. imports millions of barrels of crude oil per day, but the imposition of tariffs on those quantities seems unlikely for multiple reasons. The effects of high foreign tariffs on U.S. refined petroleum exports are another story. Refining margins for petroleum products are slight. Foreign tariffs on U.S. production could eliminate the U.S. pricing advantage, shifting demand to foreign

producers.

Electric Power Stations: Electric power generation and consumption is primarily domestic –International flows are confined to New England (with Canada), the Pacific Northwest (with Canada) and Southern California (with Mexico). Steady gains for U.S. natural gas and renewables in the electricity generation mix simply displace other domestic feedstocks. There is essentially no significant foreign participation in the electricity generation supply chain. The exception is solar generation, where President Trump placed tariffs on foreign photovoltaic panels in early January 2018, which has raisedU.S. prices for photovoltaic panels. However, these effects are likely modest. In other words, domestic and retaliatory tariffs will have little effect on input prices, supply chains, or export volumes.

Oil and Natural Gas Transmission: The oil and gas transmission industry would be affected by rising tariffs in ways quite similar to the refining industry. There is little in the way of intermediate oil and natural gas products produced outside the country, so there would be little need to relocate facilities. Input cost effects would be similarly small for the industry’s products – tariffs on steel would raise construction costs, but not industry output. Foreign tariffs on U.S. oil and gas would however, reduce the international competitiveness of U.S. energy industries, slowing demand growth.

Final Comments

A summary of the expected effects of domestic and retaliatory tariffs on construction for selected Gulf Coast industries suggests the overall effects of increased protectionism will be negative. For transportation products, the combination of higher input costs, high foreign participation in the supply chain, and higher output prices leads to positive results for industrial construction, primarily because the current trade balance is unfavorable. Where the U.S. has competitive advantage, however, or where U.S. industries are insulated from foreign forces, the results are different.

In the case of metal fabrication companies, the U.S. has many firms that produce significant intermediate goods for domestic markets, so higher input prices plus tariff enhanced prices for final goods would hurt demand for their products and services. For commodity chemicals, liquefied natural gas, refined petroleum products, and pipelines, the construction impacts are negative because retaliatory tariffs would raise the prices of U.S. products abroad, reducing the compettiveness of U.S products and slowing demand growth, where the U.S already enjoys some competitive advantages. Finally, the electricity generation industry is insulated from direct impacts since its inputs, supply chains, and output markets are primarily domestic.

Learn more at www.ConstructionIndustryResources.com.