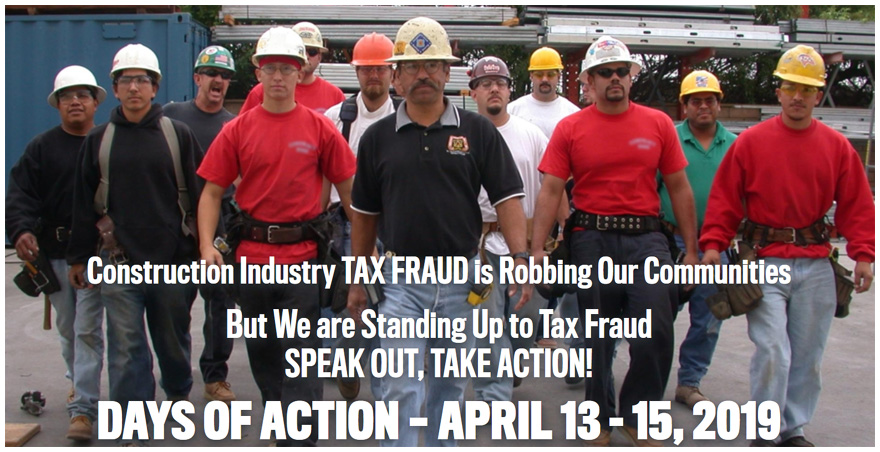

Tax fraud is an epidemic in the construction industry, and it is costing communities billions of dollars in lost revenue. Regional Councils affiliated with the United Brotherhood of Carpenters and Joiners of America (UBC) in the United States and Canada are planning days of action to bring more attention to this crisis. Actions are planned for April 15, when individual tax returns are due in the U.S., and the days leading up to it.

Tax fraud is an epidemic in the construction industry, and it is costing communities billions of dollars in lost revenue. Regional Councils affiliated with the United Brotherhood of Carpenters and Joiners of America (UBC) in the United States and Canada are planning days of action to bring more attention to this crisis. Actions are planned for April 15, when individual tax returns are due in the U.S., and the days leading up to it.

“April 15 is Tax Day in the U.S., but January 31 is the deadline for sending out W-2s,” said Frank Spencer, Second General Vice President of the UBC. “But hundreds of thousands of construction workers will never see a W-2, because their bosses are paying them off the books.”

“In addition to fleecing the taxpayers, these cheating contractors are also shortchanging their workers,” Spencer continued. “When these workers get hurt, they don’t have workers’ comp. When they get laid off, they don’t have unemployment. When they retire, they have nothing – no social security or other retirement plan – all because their employers were committing fraud.”

The annual tax losses are enormous. For example, according to various studies:

- The federal government loses $115 million in Tennessee alone;

- New Jersey loses some $26.3 million in state taxes;

- In Texas, the losses amount to a staggering $1.06 billion;

- Tax fraud in Ontario, Canada, costs the province $1.5 billion.

“Legitimate contractors like us compete against these companies that don't pay taxes,” said Victor Roach, President of Western Partitions, Inc. of Wilsonville, Oregon. “And that’s very hard to do. It puts us obviously at a disadvantage.”

Many construction employers on all types of projects, including taxpayer funded work, are not properly withholding or paying income or employment taxes for their workers, Spencer said.

“Tax fraud in the construction industry affects all of us,” said Spencer. “That’s money that can take care of our veterans, rebuild roads, bridges and schools, pay police, firefighters or teachers, or pay down the national debt. It can shore up Medicare and Social Security so people can retire in dignity. We are being cheated out of all of that because of the high degree of tax fraud.”

To bring more attention to the trouble tax fraud causes in our communities, UBC affiliates are planning a variety of actions in their areas, stretching from Los Angeles to Boston and from Austin to Toronto. They will include demonstrations, lobbying efforts, job site actions and more.

Please visit www.StandingUpToTaxFraud.net for more information on construction industry tax fraud and actions planned by UBC Regional Councils. Updates will be added as April 15 approaches.