Last month Calvetti Ferguson, a financial accounting and advising firm specializing in the fields of energy, construction, hospitality and multinational businesses, hosted an after-work conference featuring presentations by three consultants from Management Consulting and Investment Banking firm FMI. While attendees enjoyed drinks and appetizers in a private room above Houston’s Karbach Brewery, Pat Kiley and Candace Hernandez gave their take on the Houston construction market, followed by Scott Duncan’s presentation about ownership transfer techniques. Attendees had the chance to ask questions of the presenters and network with each other before and after the discussions.

Last month Calvetti Ferguson, a financial accounting and advising firm specializing in the fields of energy, construction, hospitality and multinational businesses, hosted an after-work conference featuring presentations by three consultants from Management Consulting and Investment Banking firm FMI. While attendees enjoyed drinks and appetizers in a private room above Houston’s Karbach Brewery, Pat Kiley and Candace Hernandez gave their take on the Houston construction market, followed by Scott Duncan’s presentation about ownership transfer techniques. Attendees had the chance to ask questions of the presenters and network with each other before and after the discussions.

Mike Karlins, CPA and Calvetti Ferguson Partner, welcomed the group to what he said was the “First annual Calvetti Ferguson Construction Forum.” He introduced Pat Kiley and Candace Hernandez, who both joined FMI earlier this year as market forecasting consultants, to give their presentation 2018: Confusion, Concern and Confidence. Kiley began by saying that one of the key things business in Texas has going for it is geography. He stated “Geography is Destiny.” He pointed out that the dirt in Texas produces great things: cattle, cotton, and crude oil. He talked about four economic pillars of Houston: Oil and Gas, the Texas Medical Center, the Port of Houston, and NASA. In addition to these, he said that Houston has become a true international city for the Energy business.

Kiley began by saying that one of the key things business in Texas has going for it is geography. He stated “Geography is Destiny.” He pointed out that the dirt in Texas produces great things: cattle, cotton, and crude oil. He talked about four economic pillars of Houston: Oil and Gas, the Texas Medical Center, the Port of Houston, and NASA. In addition to these, he said that Houston has become a true international city for the Energy business.

Kiley said that the major drivers of construction over any time period are job creation and population growth. He said that Houston is forecasted to grow from 6.7M people to 9.5M people by the year 2040, and grow from about 3.3M jobs to 4.5M. Kiley stated that if the combined growth rate of residential construction, non-residential buildings, and non-residential structures continues to hold, those in the construction industry “have a very bright future.”

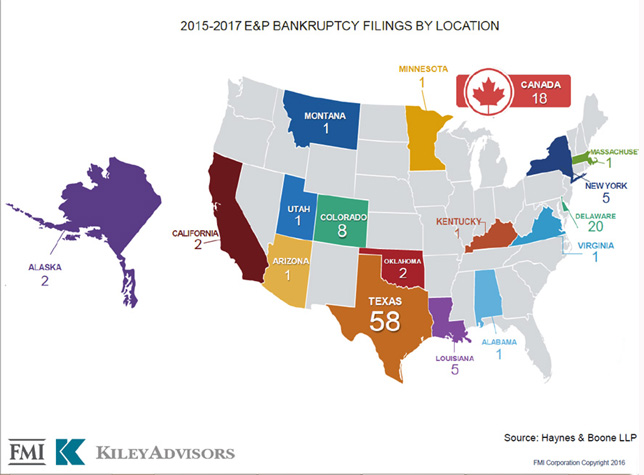

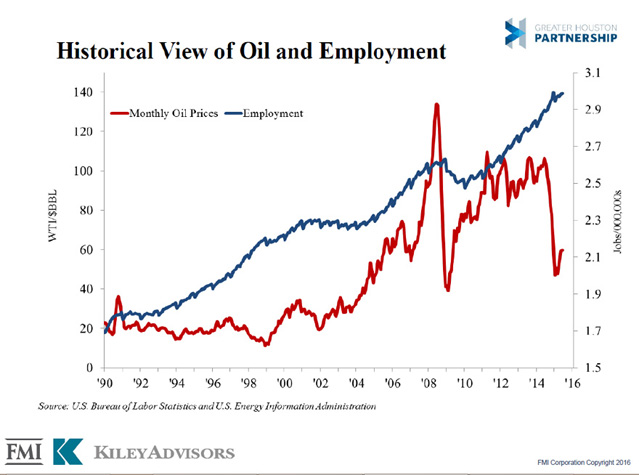

Kiley reported that overall, global growth is improving, which is good for our region, noting the increased global demand for oil. He reminded everyone that around Thanksgiving of 2014, Saudi Arabia said “We are not playing anymore,” which resulted in oil prices per barrel dropping from $77 to $26 by February 2016. Now, he said, the prices are in the mid- to low-40s, and even over $50 for a few days recently. That decrease in oil  prices through 2016 resulted in over $1 trillion of capital expenditures being cancelled or postponed, and the number of rig counts plummeting. During this downturn, 58 Exploration & Production companies filed bankruptcy in Texas, representing $36 billion of wiped-out debt. Kiley says that growth in the oil industry in the United States and in Texas is now beginning to return.

prices through 2016 resulted in over $1 trillion of capital expenditures being cancelled or postponed, and the number of rig counts plummeting. During this downturn, 58 Exploration & Production companies filed bankruptcy in Texas, representing $36 billion of wiped-out debt. Kiley says that growth in the oil industry in the United States and in Texas is now beginning to return.

Kiley’s remarks on the state of the Energy Business also touched on how the price of oil relates to job creation, and global concerns which affect the world’s and our country’s GDP such as North Korea, ISIS, lower birth rates as our population ages, and antimicrobial resistance.

Next, Candace Hernandez talked about job growth and unemployment rates in Texas compared to the United States, and even between cities within Texas. She remarked that Houston currently lags behind some other areas largely due to the area’s dependency on the energy market. She did, however, state that some signs indicate that  Texas is gaining momentum in jobs. She noted several factors that explain why the job markets in Dallas and Austin have remained strong – again, largely due to the diversity of the industries in those cities. Yet, the numbers are improving in Houston, even though some people replaced energy-related jobs with lower-paying professions. She commented that as several large industrial projects are being completed in East Houston, it will remain to be seen whether many of the workers who came to Texas to work on those projects will remain or will return to the regions from which they came.

Texas is gaining momentum in jobs. She noted several factors that explain why the job markets in Dallas and Austin have remained strong – again, largely due to the diversity of the industries in those cities. Yet, the numbers are improving in Houston, even though some people replaced energy-related jobs with lower-paying professions. She commented that as several large industrial projects are being completed in East Houston, it will remain to be seen whether many of the workers who came to Texas to work on those projects will remain or will return to the regions from which they came.

Hurricane Harvey had a huge impact on Texas. Hernandez quoted an article by Jeff Goodell in Rolling Stone magazine which reported that 19 trillion gallons of water fell from the sky in five days which was about a million gallons per person in southeast Texas. The region’s response to the hurricane garnered tremendous positive press for Houston as the community stepped up to begin rebuilding. A short-term boost in construction jobs is expected. Hurricanes Irma and Maria will have an indirect impact on Texas as some support and aid will be redirected to other areas in need, especially as Americans experience what Hernandez called “donation fatigue.” Hernandez continued her report with specific details on single-family, multifamily, office, public works, and industrial construction measured in dollars spent per year.

Hernandez continued her report with specific details on single-family, multifamily, office, public works, and industrial construction measured in dollars spent per year.

Pat Kiley continued the presentation with a discussion on the Texas Medical Center and the medical industry’s share (25% to 30%) of Houston’s commercial construction market. He talked about the innovations in the medical industry which are being worked on in the region.

Kiley concluded by naming strategic issues which all construction companies must address. These included the skilled craft workforce shortage, new technologies such as 3D printing, the trend toward prefabrication building offsite, and the “war for talent.” To that last point, he mentioned that many traditional attitudes toward building a career in construction are changing. People considering working for a company ask themselves “Will I lose ground if I go to work for that company or will I maintain a career edge?” Coaching and mentoring is expected. Kiley then mentioned that “the majority of construction firms will need to replace the majority of their senior leadership team in the next ten years.” This led directly into the topic for the final speaker of the afternoon.

Kiley then mentioned that “the majority of construction firms will need to replace the majority of their senior leadership team in the next ten years.” This led directly into the topic for the final speaker of the afternoon.

Scott Duncan’s presentation was titled Ownership Transfer and Management Succession: Techniques That Work. He said that in his experience, the transfer of company ownership is a topic even more difficult to talk about than politics. He said that often owners do not start to plan for succession until far too late for a successful transfer.

Duncan pointed out that construction companies in particular are not usually businesses which get bought out by other companies. This is because they are often people-based – the decisions of the company have been typically made by the one owner who now wishes to sell the company. Additionally, the construction industry is highly cyclical, making it less appealing from an investor’s point of view. Finally, the nature of most construction companies is that they have a low percentage of equity as part of the company. The value of these companies does not  lie primarily in the equipment they use.

lie primarily in the equipment they use.

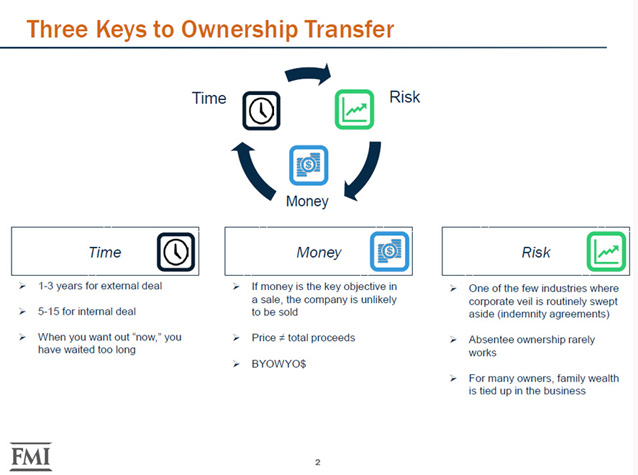

Duncan proposed that there are three factors to consider when succession planning: time (how much time the transfer will occur over), risk, and money. It is not usually possible to have more than any two of these go the way the owner would like. He talked about each of these factors and why they affect the others. The end conclusion it that it is often not a good option to find an outside buyer for a construction company.

Duncan then outlined two specific internal transfer methods: “a Subchapter S Buyout” and an “Oldco / Newco” (sometimes called a sister/brother) type of buyout. They are only two of several ways that transition can be achieved. In the end, he said that one needs to start planning for succession when one is in one's 50s – long before one is ready to retire – in order to have a successful transition or buyout.

Duncan concluded with five important recommendations for company owners to consider. From his presentation slide:

- Get started early. The transfer of ownership can require a decade or more, which is often substantially longer than owners anticipate. Getting an early start on the process (even if not implemented immediately) is more advantageous than waiting until your options are limited by time.

- Understand your options. When considering ownership transfer and management succession, it’s important to understand what options are available to you. Does an ESOP fit your business profile? Is a third-party sale feasible? How long will an internal transfer require?

- Focus on talent. Construction is a people business. Your ownership transfer options are entirely dependent on the talent within your organization. Taking a proactive approach to recruiting and retaining talent can only improve your odds of a successful transition.

- Keep it simple. While there are myriad ways in which to transfer ownership, the simplest mechanisms are often the most successful. The value of being able to explain the transfer process clearly and succinctly to new owners is critical and often overlooked.

- Don’t overlook the obvious. Every ownership transfer plan depends on the future profits of the business. Keeping a focus on the continued profitability of the business is integral to any ownership transfer effort.

The event ended with another invitation to attendees to enjoy the refreshments and continue to discuss the ideas presented that afternoon.