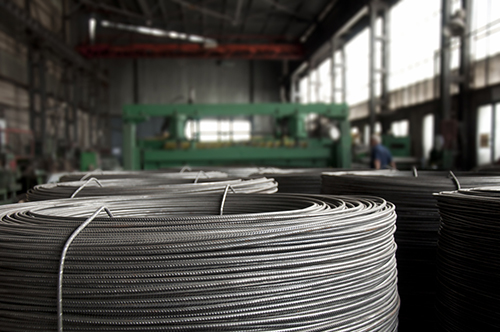

Materials cost increases continue to intensify in magnitude and suddenness, while availability of materials appears to be worsening.. On March 25, Firestone Building Products notified customers of price increases ranging from 6% for TPO roofing membrane to 75% for glass fiber felt sheets, effective April 25. In addition, “Any announced vendor surcharges will be passed along with their market announcements. Metal will be priced at time of shipment.” Steel tube suppliers raised prices $150 per ton on March 25. On Thursday, door and window manufacturer YKK AP announced a 15% price increase, effective May 2. On March 18, Marino\\Ware, a manufacturer of cold-formed steel framing products, announced it “will raise prices 10% on all products, effective May 2.” Multiple sources reported ready-mix concrete suppliers in Tennessee, Alabama, and Florida were cutting production due to reduced supplies of cement. The newsletter Steel Business Briefing reported on Monday, “U.S. domestic rebar prices continued to hold at all-time highs on March 25, as supply remains extremely tight in the South/Southeast, especially in Florida where mills have no availability and distributors have already booked out on May rollings.” Readers are invited to send price and supply-chain information to ken.simonson@agc.org.

Materials cost increases continue to intensify in magnitude and suddenness, while availability of materials appears to be worsening.. On March 25, Firestone Building Products notified customers of price increases ranging from 6% for TPO roofing membrane to 75% for glass fiber felt sheets, effective April 25. In addition, “Any announced vendor surcharges will be passed along with their market announcements. Metal will be priced at time of shipment.” Steel tube suppliers raised prices $150 per ton on March 25. On Thursday, door and window manufacturer YKK AP announced a 15% price increase, effective May 2. On March 18, Marino\\Ware, a manufacturer of cold-formed steel framing products, announced it “will raise prices 10% on all products, effective May 2.” Multiple sources reported ready-mix concrete suppliers in Tennessee, Alabama, and Florida were cutting production due to reduced supplies of cement. The newsletter Steel Business Briefing reported on Monday, “U.S. domestic rebar prices continued to hold at all-time highs on March 25, as supply remains extremely tight in the South/Southeast, especially in Florida where mills have no availability and distributors have already booked out on May rollings.” Readers are invited to send price and supply-chain information to ken.simonson@agc.org.

Construction employment, seasonally adjusted, totaled 7,628,000 in March, an increase of 19,000 from the downwardly revised February total, according to AGC’s analysis of Bureau of Labor Statistics (BLS) data posted today. The March total was an increase of 220,000 (3.0%) year-over-year (y/y) from March 2021 and topped the pre-pandemic peak of 7,624,000 set in February 2020 for the first time. Residential construction employment, comprising residential building and specialty trade contractors, rose by 7,600 in March and 103,000 (3.4%) y/y, putting the total 161,000 (5.4%) higher than in February 2020. Nonresidential construction employment—at building, specialty trades, and heavy and civil engineering construction firms—rose by 11,300 for the month and 117,600 (2.7%) y/y but remained 157,000 (-3.4%) below the February 2020 level. The number of unemployed jobseekers with construction experience dropped 28% y/y to 598,000, and the industry’s unemployment rate declined from 8.6%, not seasonally adjusted, in March 2021 to 6.0% last month.

Average hourly earnings for “production and nonsupervisory employees” in construction (mainly, hourly craft workers) increased by 6.2% y/y to $31.68, seasonally adjusted, in March 2022, BLS reported today. The increase was the steepest since December 1982. However, the average for the overall private sector rose even faster, by 6.7% y/y to $27.06. Although the average for construction topped the all-private average by 17% in March, this “premium” has narrowed sharply from an average premium of 20-23% annually from 2005 to 2019. Since the pandemic began, other sectors have raised starting wages dramatically, offered signing and retention bonuses, and--for some jobs--flexible hours or work locations, inducements that are not possible for onsite construction jobs. These conditions imply construction firms are likely to have a harder time attracting and retaining workers or will have to raise pay even more.

There were 364,000 job openings in construction, not seasonally adjusted, at the end of February, a jump of 125,000 (52%) from February 2021, BLS reported on Tuesday in its latest Job Openings and Labor Turnover Survey (JOLTS) release. That was the largest February total, by far, in the 22-year history of the series Hires increased by 8% y/y to 342,000. Layoffs and discharges totaled 130,000, a drop of 67,000 (-34%) y/y, and the layoff rate was 1.8% of employment, the lowest February rate in series history. The excess of openings over hires implies the industry would have hired at least twice as many workers if they had been available. Quits soared 29% y/y across the total nonfarm sector (the so-called “great resignation”) but dipped 1% (-1,000) in construction. Together, the rising openings and flat quits figures suggest construction firms are having trouble attracting new employees but are doing better than other sectors at retaining current employees.

Construction spending (not adjusted for inflation) totaled $1.70 trillion in February at a seasonally adjusted annual rate, up 0.5% from the upwardly revised January total and 11% y/y from February 2020, the Census Bureau reported today. However, without a deflator, it is impossible to say how much of the gain is in units vs. price. Spending exceeded the February 2020 rate, just before the pandemic hit, by 14%. Trends differed sharply among segments over the month, year, and two years. Private residential construction spending increased 1.1% for the month, 17% y/y, and 40% from February 2020. Single-family spending climbed 2.5%, 20%, and 50%, respectively; multifamily, 0.1%, 7.8%, and 23%; and owner-occupied improvements, -0.7%, 15%, and 31%. Private nonresidential construction spending rose 0.2% for the month and 9.7 % y/y but still lagged the February 2020 rate by 3.4%. The largest private nonresidential segment—power—rose 1.4% for the month but declined 1.7% y/y (including electric power, up 1.6% for the month but down 2.1% y/y, and oil and gas field structures and pipelines, 0.8% and -0.3%, respectively); followed by manufacturing, up 0.6% in February and 35% y/y (including chemical and pharmaceutical, 0 and 0.7%, and computer/ electronic/electrical, 1.1% and 229%); commercial, down 1.3% for the month but up 19% y/y (including warehouse, -0.9% and 22%, respectively, and retail, -2.6% and 19%); and office, -0.1% and 6.6%. Public construction spending decreased 0.4% for the month, rose 1.5% y/y and declined 5.6% over two years. The largest public segment, highway and street construction, lost 1.3% for the month but climbed 8.3% y/y. Public education construction skidded 1.3% and 7.9%, respectively. Public transportation construction fell 1.3% in February and rose 0.4% y/y.