Contractors’ input costs rose more than their bid prices in February, according to Bureau of Labor Statistics (BLS) data posted on Wednesday. The producer price index (PPI) for material and service inputs to new nonresidential construction rose 0.4% for the month and 2.7% year-over-year (y/y). The increases were driven in part by large one-month jumps in the PPIs for flat glass, up 4.0% (the largest rise in 40 years); aluminum mill shapes, 2.9%; steel mill products, 2.6%; copper and brass mill shapes, 2.3%; and paving mixtures and blocks, 2.2%. These outweighed decreases in a few PPIs that benefited from a recent drop in oil and natural-gas prices, such as diesel fuel, -3.1%; truck transportation of freight, -0.8%; and plastic construction products, -0.5%. The PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—rose 0.1% for the month and 17.0% y/y. PPIs for new, repair, and maintenance work by subcontractors all rose: roofing contractors (0.5% for the month and 22.2% y/y), electrical contractors (0.3% and 20.0%, respectively); plumbing contractors (0.2% and 12.3%); and concrete contractors (0.2% and 8.3%). AGC posted tables of construction PPIs. Recent turmoil in financial markets drove down futures prices for oil and metals but it remains to be seen if these declines will flow through to construction materials or affect demand for projects. Readers are invited to send information on either point to ken.simonson@agc.org.

Contractors’ input costs rose more than their bid prices in February, according to Bureau of Labor Statistics (BLS) data posted on Wednesday. The producer price index (PPI) for material and service inputs to new nonresidential construction rose 0.4% for the month and 2.7% year-over-year (y/y). The increases were driven in part by large one-month jumps in the PPIs for flat glass, up 4.0% (the largest rise in 40 years); aluminum mill shapes, 2.9%; steel mill products, 2.6%; copper and brass mill shapes, 2.3%; and paving mixtures and blocks, 2.2%. These outweighed decreases in a few PPIs that benefited from a recent drop in oil and natural-gas prices, such as diesel fuel, -3.1%; truck transportation of freight, -0.8%; and plastic construction products, -0.5%. The PPI for new nonresidential building construction—a measure of the price that contractors say they would bid to build a fixed set of buildings—rose 0.1% for the month and 17.0% y/y. PPIs for new, repair, and maintenance work by subcontractors all rose: roofing contractors (0.5% for the month and 22.2% y/y), electrical contractors (0.3% and 20.0%, respectively); plumbing contractors (0.2% and 12.3%); and concrete contractors (0.2% and 8.3%). AGC posted tables of construction PPIs. Recent turmoil in financial markets drove down futures prices for oil and metals but it remains to be seen if these declines will flow through to construction materials or affect demand for projects. Readers are invited to send information on either point to ken.simonson@agc.org.

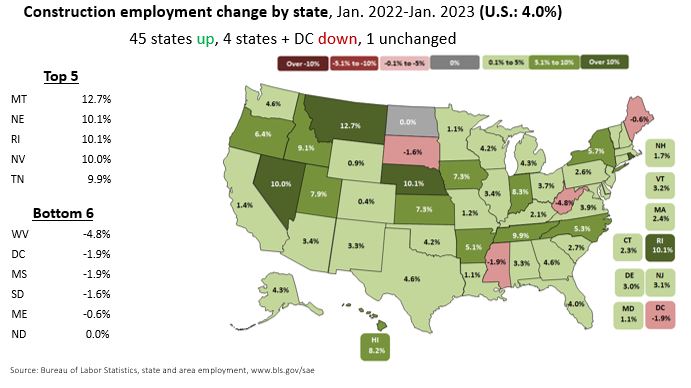

Seasonally adjusted construction employment rose from January 2022 to January 2023 in 45 states, declined in four states and the District of Columbia, and was unchanged in North Dakota, according to AGC’s analysis of data BLS posted on Monday. Texas added the most jobs (34,800 or 4.6%), followed by Florida (23,600, 4.0%) and New York (21,900, 5.7%). Montana had the largest percentage increase (12.7%, 4,400 jobs), followed by Nebraska (10.1%, 5,800), Rhode Island (10.1%, 2,100), and Nevada (10.0%, 10,200). West Virginia lost the most jobs (-1,600, -4.8%), followed by Mississippi (-900, -1.9%). The largest percentage losses occurred in West Virginia, Mississippi, and D.C. (-1.9%, -300). For the month, industry employment increased in 42 states, declined in seven states, and held steady in Mississippi and D.C. Indiana added the most jobs over the month (6,700, 4.2%), followed by Texas (5,900, 0.7%), New Jersey (4,000, 2.5%), Iowa (3,900, 4.7%), and North Carolina (3,900, 1.5%). The largest percentage gain occurred in Iowa, followed by Indiana, Montana (4.0%, 1,500 jobs), Kansas (3.0%, 2,000), and Idaho (2.7%, 1,800). California—buffeted by a series of severe storms—experienced the largest monthly loss of construction jobs (-7,300, -1.8%), followed by Florida (-2,400, -0.4%) and Colorado (-1,200, -0.6%). West Virginia had the largest percentage loss for the month (-1.8%, -600 jobs), followed by California, Colorado, and Maine (-0.6%, -200). (For D.C., Delaware, and Hawaii, which have few mining or logging jobs, BLS posts combined totals with construction; AGC treats the changes as all from construction.)

Construction employment, not seasonally adjusted, rose from January 2022 to January 2023 in 306 (85%) of the 358 metro areas (including divisions of larger metros) for which BLS posts construction employment data, fell in 29 (8%), and was unchanged in 23, according to an analysis AGC released today. (AGC treats as construction-only the totals for metros in which BLS reports combined totals for mining, logging, and construction.) Dallas-Plano-Irving added the most jobs (13,600 combined jobs or 9%), followed by Houston-The Woodlands-Sugar Land (9,200 construction jobs, 4%) and Phoenix-Mesa-Scottsdale, Ariz. (8,400 construction jobs, 6%). The largest percentage gains (23% each) were in Janesville-Beloit, Wis. (700 combined jobs) and Wausau, Wis. (500 combined jobs). The largest loss occurred in Sacramento--Roseville--Arden-Arcade (-6,200 construction jobs, -8%), followed by the Los Angeles-Long Beach-Glendale division (-4,000 construction jobs, -3%) and Minneapolis-St. Paul-Bloomington, Minn.-Wisc. (-3,300 combined jobs, -4%). The largest percentage losses (-17% each) occurred in Lake Charles, La. (-2,400 construction jobs) and Monroe, Mich. (-400 combined jobs), followed by Gulfport-Biloxi-Pascagoula, Miss. (-14%, -1,300 combined jobs).

Housing starts (units) in February jumped 9.8% at a seasonally adjusted annual rate from the January rate but were 18% lower y/y, the Census Bureau reported on Thursday. Single-family starts rose 1.1% for the month but fell 32% y/y. Multifamily (five or more units) starts soared 24% and 14%, respectively. Residential permits climbed 14% for the month but slumped 18% y/y. Single-family permits increased 8% from January but plunged 35% y/y. Multifamily permits rose 24% and 17%, respectively.