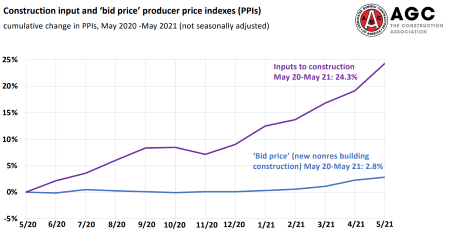

The gulf between contractors’ costs and pricing widened again in May. The producer price index (PPI) for nonresidential building construction—a measure of the price that contractors say they would charge to build a fixed set of buildings—increased 0.5% from April and 2.8% year-over-year (y/y) since May 2020, while the PPI for material and service inputs to construction industries jumped 4.3% and 24.3%, respectively, the Bureau of Labor Statistics (BLS) reported on Tuesday. An index that measures the price of goods inputs to all construction soared 4.6% for the month and 24.3% y/y; both increases were the largest in the 35-year history of the series. AGC posted tables and charts showing PPIs relevant to construction. Some y/y increases were particularly large because of depressed prices in May 2020 but large increases from April to May also were a factor. PPIs that contributed to the input increases include diesel fuel, which soared 16% in May and 199% y/y; lumber and plywood, up 16% and 111%, respectively; steel mill products, 2.4% and 76%; copper and brass mill shapes, 8.0% and 60%; aluminum mill shapes, 2.7% and 29%; plastic construction products, 2.8% and 17.5%; truck transportation of freight, 3.9% and 16%; gypsum products, 2.1% and 14%; asphalt felt and coatings, 3.1% and 11%; insulation materials, 2.4% and 7.0%; and brick and structural clay tile, 1.8% and 5.7%.

The gulf between contractors’ costs and pricing widened again in May. The producer price index (PPI) for nonresidential building construction—a measure of the price that contractors say they would charge to build a fixed set of buildings—increased 0.5% from April and 2.8% year-over-year (y/y) since May 2020, while the PPI for material and service inputs to construction industries jumped 4.3% and 24.3%, respectively, the Bureau of Labor Statistics (BLS) reported on Tuesday. An index that measures the price of goods inputs to all construction soared 4.6% for the month and 24.3% y/y; both increases were the largest in the 35-year history of the series. AGC posted tables and charts showing PPIs relevant to construction. Some y/y increases were particularly large because of depressed prices in May 2020 but large increases from April to May also were a factor. PPIs that contributed to the input increases include diesel fuel, which soared 16% in May and 199% y/y; lumber and plywood, up 16% and 111%, respectively; steel mill products, 2.4% and 76%; copper and brass mill shapes, 8.0% and 60%; aluminum mill shapes, 2.7% and 29%; plastic construction products, 2.8% and 17.5%; truck transportation of freight, 3.9% and 16%; gypsum products, 2.1% and 14%; asphalt felt and coatings, 3.1% and 11%; insulation materials, 2.4% and 7.0%; and brick and structural clay tile, 1.8% and 5.7%.

The prices used to calculate PPIs were generally in effect around May 11. Since then, numerous additional increases have been announced, some effective immediately. Gerdau Long Steel North America announced on Monday that it was “increasing the transactional price of concrete reinforcing bar products” $80 per net ton, “effective with new orders received today.” This followed an announcement by Commercial Metals Company on June 11 that “Effective immediately, we are increasing the transactional price for reinforcing steel products from our East Region Mills” by $80/ton. A reader forwarded a message on Tuesday that all steel tubing mills had raised prices $125/ton. Nucor Buildings Group announced on Tuesday that it “will be implementing a 12.0% price increase (+/-), across all of our brands, effective on all building orders quoted on or after June 29.” An editor with the chemical industry news service ICIS reported a variety of supply-chain problems affecting plants producing construction plastics and their ingredients, including slow recovery from the February freeze in Texas, other plant startup or production issues, and lead times that “have been extended because of delays and cancellations from rail and truck carriers.” Readers are invited to email information about construction costs and supply-chain issues to ken.simonson@agc.org.

Copper and lumber futures on the CME’s Comex exchange both declined further this week from all-time highs set in May. The July contracts are down 45% for lumber and 11% for copper from their respective peaks. These decreases should affect prices for construction materials but not uniformly and with a lag that depends on demand, production, freight costs and inventories.

“A record 83% of multifamily developer respondents reported construction delays in the jurisdictions where they operate,” the National Multifamily Housing Council (NMHC) reported on June 9, based on its May 17-June 1 survey of 135 firms. “Of this group, 80% reported experiencing delays in permitting, up slightly from the 77% in round six [conducted March 27-April 1] and comparable to the results seen in the earlier rounds. Survey respondents reporting construction delays also indicated a significant pause in starts, with a similar 80% still reporting delayed starts over one year into the pandemic. The main reasons cited for delays in starts were permitting, entitlement, and professional services (70%); projects not being economically feasible at this time (56% [, up from 30% in round six]); and economic uncertainty (27%).

Two measures of construction starts (dollars) posted divergent year-to-date results for the first five months of 2021 compared to January-May 2020. Total construction starts fell 1% in May at a seasonally adjusted annual rate, but unadjusted starts soared 13% year-to-date, Dodge Data & Analytics reported on Wednesday. Nonresidential building starts leaped 10% in May but were down 5% year-to-date (institutional, -9%; commercial, -7%; manufacturing, 42%). Nonbuilding starts rose 5% for the month and 8% year-to-date (highway and bridge, -10%; environmental public works, 37%; utility/gas, 25%; miscellaneous, 11%). Residential starts tumbled 10% in May but jumped 30% year-to-date (single-family, 37%; multifamily, 12%).

Construction starts, not seasonally adjusted, inched up 0.5% y/y in May from May 2020, when many projects were halted due to the pandemic, data firm ConstructConnect reported on May 17. Year-to-date starts for January-May 2021 dipped 0.4% from the same months in 2020. Year-to-date nonresidential starts slumped 14%: nonresidential building starts plunged 20.5% (commercial, -45%; institutional, -16%; and industrial [manufacturing], -17%), while engineering (civil) starts fell 3.8% (including road/highway, -1.3%, and water/sewage, 12%). Residential starts soared 21% (single-family, 32%, and apartments, -2.5%).

Housing starts (units) increased 3.6% at a seasonally adjusted annual rate from April to May and 50% y/y from the pandemic-depressed May 2020 level, the Census Bureau reported on Wednesday. Year-to-date starts for January-May 2021 climbed 25% from the same months in 2020. Single-family starts rose 4.2% for the month and 31% year-to-date. Multifamily (five or more units) starts rose 4.0% for the month and 12% year-to-date. Residential permits slipped 3.0% from April but jumped 33% year-to-date, as single-family permits declined 1.6% for the month but rose 38% year-to-date, while multifamily permits declined 7.7% from April but gained 21% year-to-date.