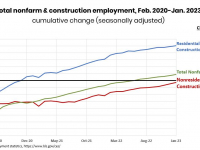

Construction employment, seasonally adjusted, totaled a record-high 7,918,000 in February, an increase of 24,000 from the January total and 249,000 (3.2%) year-over-year (y/y),...

Construction spending (not adjusted for inflation) totaled $1.83 trillion in January at a seasonally adjusted annual rate, down 0.1% from the upwardly revised December rate and up...

March 06, 2023

Two reports on construction starts in January point in different directions. Total construction starts in current dollars (i.e., not inflation-adjusted) slumped 27% from December...

February 27, 2023

Contractor input costs continue to divergeContractors’ input costs diverged widely in January, as one-month or year-over-year (y/y) increases in fuel, paving materials, gypsum,...

February 20, 2023

Nonresidential building projects in planningThe Dodge Momentum Index slid 8.4% in January after 10 consecutive monthly increases but climbed 32% year-over-year (y/y), Dodge...

February 13, 2023

Construction employment, pay rise in January; job openings set December record but spending slips

February 03, 2023

Seasonally adjusted construction employment rose from November to December in 30 states and the District of Columbia and declined in 20 states, according to AGC’s analysis...

January 30, 2023

Contractors’ input costs declined sharply, on balance, in December, as decreases in fuel, lumber, steel, and trucking costs outweighed increased prices for copper, aluminum, and...

January 23, 2023

Construction employment, seasonally adjusted, totaled a record-high 7,777,000 in December, an increase of 28,000 from the November total and 248,000 (3.3%) year-over-year (y/y),...

January 17, 2023

Contractors are generally optimistic about the outlook for nonresidential and multifamily construction in 2023, but optimism is less widespread than a year ago, based on the 2023...

January 05, 2023