The following article originally appeared in the December newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.On November 12th, Dr. Bill Gilmer gave his forecast for 2016, and despite Houston's attempts to diversify since the 1980's, oil remains a dominant factor in the Houston economy. As such, the price of oil will directly impact how fast Houston recovers from the recent downturn. And while Dr. Gilmer does not yet see a recession for the Houston area, he does expect continued slow growth going forward, with lower job growth and population growth projections in 2016.

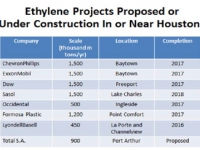

The following article originally appeared in the November newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.As the year comes closer to an end, and the downturn becomes more prevalent, a more common projection of 2017/2018 for recovery continues to emerge. However, Houston will not be lifeless over the next few years, but rather a slower, normal pace, that may give contractors the breathing room they needed after 2014’s frenetic pace.City of Houston permits show residential permitting down nearly 10% from a year ago, which tracks with Metrostudy’s projection of 2015 starts being down 10% from 2014 at year end. Even with a 10% decline, Houston’s single family market is easily still the leader in US, and has the tightest supply of lots of the major Texas metros, making it very difficult for Houston to oversupply lots going forward. The Grand Parkway, particularly south of the Westpark Tollway, has remained the strongest area, with Northeast Houston also showing strength in part due to the downstream activity and the Generation Park development. Looking ahead, onerous new closing regulations, lot shortages, higher labor costs, financing difficulties and home affordability are all challenges that point toward a decline into 2015 and 2016 before a recovery is expected.

November 06, 2015

The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.“It’s lean and mean until 2017” according to Jesse Thompson, Business Economist at the Federal Reserve Bank of Dallas, Houston branch. While his comments were directed specifically to the oil and gas industry, in many ways, he could be speaking to the Houston economy. Economists continue to look longer range for a recovery in Houston, as the prospect of oil recovering also extends. Patrick Jankowski, Vice President of Research at the Greater Houston Partnership, recently noted that Houston is still roughly 20,000 jobs below its peak in December 2014, and with more oil and gas layoffs expected in the fourth quarter, is unsure whether a historically strong fourth quarter will be enough to offset the losses.

October 12, 2015

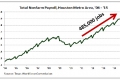

The following article originally appeared in the September newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.With the latest ride from oil prices, the forecasted recovery in Houston has been pushed back to the second half of 2016 at the earliest. Houston year to date, seasonally adjusted job growth is at 12,000 (July 2015) – well off the pace of the last few years. While Goldman Sachs, this past Friday, issued a release which still forecasts average oil prices at $50 to $60 per barrel for the next few years, we are hearing of “early retirement” packages being offered to Houston employees as the oil and gas industry prepares for more job losses this coming January through either another round of layoffs, bankruptcies or mergers.Other industries are beginning to feel the ripple effect of lower oil, with their indices slowing, although still positive.

September 02, 2015

The following article originally appeared in the August newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.With oil prices again on a bit of a roller coaster, the outlook for Houston becomes cloudier.Well permits and rig counts have hit bottom, total production has been declining since April, and is expected to continue to decline, potentially at a faster pace, according to Jesse Thompson with the Houston Branch of the Federal Reserve Bank. With developing countries reducing their demand for oil, through efficiencies, and domestic GDP growth underperforming its 2015 target through the first two quarters, lower oil demand and lower oil prices over the next year or two are an increasing possibility.

August 05, 2015

The following article originally appeared in the July newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Has the bottom been reached for oil and gas?Oil prices appear to have settled around $60/barrel and the rig count and well permits seem to have bottomed in April, showing positive signs in May, for the first time in months, that the decisiveness and deep cuts that quickly permeated the oil and gas industry earlier this year could be over.

July 08, 2015

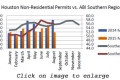

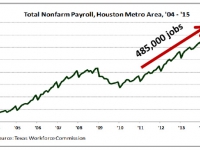

The following article originally appeared in the June newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.The Census Bureau recently announced Houston as one of the top ten population gainers in the US in 2014, alongside several other Texas cities. Unfortunately, that distinction will likely not be repeated in 2015, as economists continue to lower their projections for our region. Dr. Bill Gilmer, with the Institute for Regional Forecasting, recently released his revised forecast with two scenarios. The first has oil prices recovering by the beginning of 2016, and puts Houston’s job growth at 13,000 jobs for 2015. The second scenario has oil prices recovering in mid-2016, which puts Houston’s job growth at 13,000 jobs for 2015 and again for 2016. After experiencing over 100,000 jobs added in 2014, Houston’s growth has certainly stalled.Construction continues at a steady pace, but the drop off is coming. The most recent City of Houston permits show a drop of more than 20% in new non-residential construction when compared to a year ago. Renovation work continues to exceed 2014 levels, but the drop in new construction is a combination of unsustainable levels of construction in some markets in 2014 normalizing, along with the uncertainty surrounding the oil prices and its impact on Houston.

June 02, 2015

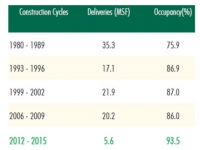

The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Despite reports that continue to worsen, the current construction market is still vibrant in Houston.CBRE’s first quarter reports for office, industrial (warehouse) and retail were recently released, showing a continuation of the strong 2014 market into 2015. In the first quarter office market, 15.9 million square feet (msf) was under construction, with 64% of that pre-leased - a continued sign that the office market is not overbuilding. Vacancy rates inched up to 12.6%, but rental rates continue to rise as supply remains tight.

May 15, 2015

The following article originally appeared in the April newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Stronger signals of the slowdown in Houston are increasingly prevalent. As the oil price bounces around the $50 mark, the effect of the lower cash flow in the oil and gas companies is rippling through the city.The Architecture Billings Index, a national leading indicator for construction, is flat – which is indicative of the mentality of the market today. Pause. Wait and See. Everyone knows the tidal-wave impact of the oil and gas prices is coming, but no one can tell how damaging it will truly be. And while 2015 still looks to be a relatively strong year, 2016 has much less optimism.

April 14, 2015

The following article originally appeared in the March newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.As Pat Kiley mentioned in his article Interval Training – Is It Good For Construction Companies?, the Houston construction market is entering a slowdown period. This slowdown is due to the unsustainably high levels of 2014, the lower oil prices, and the lower job and population outlook going forward. However, Houston IS still growing, albeit at a slower pace. We are not experiencing a recession, but rather an extended period of slower growth than we have become accustomed to.

March 20, 2015