The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Did Houston already go into a recession? Jesse Thompson, Business Economist at the Federal Reserve Bank of Dallas - Houston Branch, noted the Houston Business Cycle Index shows that Houston entered a recession late 2015/early 2016. He provided a chart (right) showing the correlation between rig count and Houston’s core oil and gas related employment noting “further revisions will like confirm what we’ve already observed: that Houston’s economy is contracting, and that Houston may or may not be out of it yet.”However, fueling the recovery discussion is the renewed optimism in the Purchasing Managers Index’s oil and gas respondents, who for the first time in several months, seemed happier and more upbeat. The PMI itself increased to 46.1 in August – still in an overall contraction phase, but production, sales and new orders were all noticeably up, a leading indicator.

The following article originally appeared in the September newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.The latest City of Houston permit data provided the local newspapers with headlines announcing that commercial construction was up 40% while residential construction floundered. However, upon closer inspection, the increase in the value of new permits is a direct result of medical, school and public work construction projects, while nearly all other sectors are relatively flat or slightly down compared to a year ago. Also trending is an increasing amount of renovation work versus the new construction, a trend likely to continue in the months ahead.The drop in residential permits isn’t as bad as suggested either. Builders are finding creative ways to offer homes in a lower price range. Metrostudy is projecting housing starts will end up down about 14% this year when compared to a year ago, but that drops Houston from the largest new home volume market nationally to the second largest, behind Dallas-Ft Worth.

September 07, 2016

The following article originally appeared in the August newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.A tale of two market segments. As the second quarter numbers begin to role in, the precipitous drop of Class A general purpose office space construction and the rocketing growth of retail construction become increasingly clear. While the office market is breaking records in the amount of sublease space available (a 20 year high according to CBRE), and experiencing its first quarter of negative absorption in over five years, retail is thriving, with the strongest single quarter absorption since 2007 – nearly 1.5 msf, a record high occupancy rate and over 3 msf under construction, of which 85% is preleased.

August 04, 2016

The following article originally appeared in the July newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.While Brexit and its implications globally are still being analyzed and debated, the United Kingdom’s decision to separate itself from the European Union is seen as a positive, and necessary, move. While it will stunt the growth of Europe in the short term, to paraphrase Dr. Bill Gilmer with the Institute for Regional Forecasting, the train wreck is unavoidable so at least they are off the train.

July 07, 2016

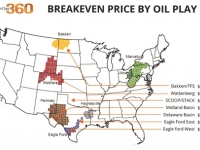

The following article originally appeared in the June newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.When it comes to oil, $50 is not enough. Those were the sentiments of Jesse Thompson, Business Economist for the Federal Reserve Bank of Dallas, Houston Branch. Complimenting that opinion, Dr. Bill Gilmer, Director of the UH Bauer Institute for Regional Forecasting, earlier this month during his bi-annual symposium, noted that a non-volatile $60 price for oil would result in increased activity. The chart above shows the breakeven price, further supporting their claims.

June 08, 2016

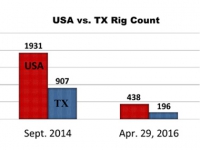

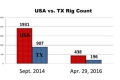

The following article originally appeared in the May newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.When asked how much further the rig count will drop, the running joke is that we think it won’t go negative. Now at over a 75% decline, both nationally and in Texas, from September 2014 (pictured right) the current rig count reflects the complete reversal of the oil and gas industry dynamics from less than two years ago.Dr. Bill Gilmer, Director of the Institute for Regional Forecasting, noted that in the last seven quarters, Houston has been hit much harder and faster, when compared to the five years in the 1980’s (1982-1986) when oil last saw a comparable downturn. The difference? Saudi Arabia’s behavior. :

May 09, 2016

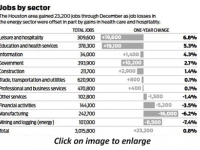

The following article originally appeared in the April newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.Local economists remain cautiously optimistic when discussing Houston’s future. The revised employment numbers reduced Houston’s job growth in 2015 from 23,200 to 15,200 jobs. The revisions included losses of 23,800 in manufacturing and 17,700 jobs in mining and logging, while construction gained 12,600 jobs – thanks, in large part, to the industrial work in East Houston. The Census Bureau recently announced population growth of 160,000 from mid-2014 to mid-2015 in the Houston MSA, with a 12.4% growth in population from 2010 – 2015. After January’s expected job losses – as retailers routinely shed holiday employees and others delay layoffs until after the holidays –the next few months could indicate the pace of employment for the remainder of 2016. All would agree, Houston’s employment growth will be slower in 2016 than experienced the past five years, but nearly all still forecast growth.

April 08, 2016

The following article originally appeared in the March newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.The tone is turning decidedly more negative when discussing the outlook for Houston. Local economists are anxiously awaiting this Friday’s revisions to the 2015 employment numbers, to determine whether Houston did indeed gain jobs last year. Either way, the leading indicators are not good. The rig count has continued to decline, now nearly 75% lower than it was in September 2014, both nationwide and in Texas, according to Baker Hughes. And at $30 oil, no one, not even the stripper wells, are making money, according to Jesse Thompson, Economist at the Houston Branch Federal Reserve Bank. The reason, he notes, for the increased production is that drillers are now focusing solely on their most productive areas.

March 03, 2016

The following article originally appeared in the February newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.As the year-end numbers come in, Houston is beginning to noticeably slow down. After gaining more than 100,000 jobs in 2014, in 2015 Houston managed to only add 23,200 – a number that will likely be revised down by the Texas Workforce Commission in the months ahead. As Dr. Gilmer noted this past November, the word is now out that the jobs are no longer in Houston, setting our city up for another slow year. For construction, it typically can take two to three years to feel the full impact of a market change as sudden as Houston has experienced in the energy sector. As such, 2016 – and especially the first half of 2016 – appears to remain robust.

February 11, 2016

The following article originally appeared in the January newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.21,900. That is the amount of expected job growth in Houston in 2016, unveiled by Patrick Jankowski, Senior Vice President of Research at the Greater Houston Partnership (GHP), on December 7th at their annual economic outlook event. When compared to the past five years, 2016’s forecast is a significant slowdown in job creation. Jankowski compared it to our own freeways, noting that after speeding outbound on I-10 at 90 mph towards San Antonio, when you hit a construction zone and are forced to slow down to 20 mph, it can feel like you’re standing still, despite continually moving forward. That construction zone pace is Houston’s future next year. Slow, but moving forward.For the construction industry, with the exception of the industrial market which continues to thrive, this slowdown may be just what the doctor ordered. The frenetic pace of 2014 left many understaffed and turning away work. Good work. Work that, any other year, they would be ecstatic to have.

January 11, 2016