The following article originally appeared in the July newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to...

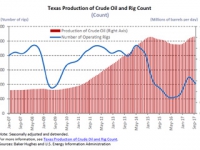

Leading indicators and economists agree that Houston is growing again. Employment numbers are up, exports are up, and auto sales are up (a consumer confidence indicator); even oil has seen a recent spike (albeit for how long) in price, which typically bodes well for Houston.

June 07, 2018

As CBRE’s first-quarter numbers begin to roll in, we can see that Houston is continuing its gradual recovery toward historical averages. Houston posted nearly 95,000 new residents in 2017, the second-largest increase in the U.S., with one-third of those coming from net in-migration – meaning people still see opportunity in Houston and are moving here. While our employment numbers are still below our long-term average, the population growth is helping to drive growth and demand in our area.

May 16, 2018

Candace Hernandez writes about the latest leading indicators and industry issues for Houston-area clients of FMI.

April 20, 2018

Candace Hernandez writes about the latest leading indicators and industry issues for Houston-area clients of FMI. She begins with good news: “As the year-end numbers come in, Houston’s economy continues to show that it is improving and accelerating.”

March 22, 2018

The latest Texas Workforce Commission employment numbers show a stronger than expected 2017. After adding only 18,700 jobs in 2016, Houston rebounded with a healthier 46,000 employment growth December over December, thanks, in large part, to Harvey recovery efforts. Construction employment, which was trending to be down 10,000 jobs for the year pre-Harvey, ended the year only 800 jobs below December 2016.

February 19, 2018

The second Friday in December, as the snow from the storm the night before still lingered, Patrick Jankowski, vice president of research at the Greater Houston Partnership, outlined his employment forecast for Houston in 2018 – 45,000 in employment growth. A month earlier, Dr. Bill Gilmer from the Institute for Regional Forecasting at the University of Houston gave an employment growth range of 20,000 to 70,000 with the weighted average hitting at 41,000 jobs.

January 23, 2018

While the worst still appears to be behind us, resulting in possibly the mildest recession Houston has ever experienced, the bathtub-shaped recovery that Patrick Jankowski, vice president of research at the Greater Houston Partnership, outlined a year ago continues to hold true. Jankowski characterized it as a wide bottom followed by a quick recovery. And the wide bottom persists.

December 26, 2017

While Harvey remains a popular topic of conversation, the numbers surrounding the devastation from Harvey continue to be revised downward. The latest revised numbers from Moody Analytics bring the number down to $65 billion, much less than originally reported. Unlike storms from the past, which brought wind damage and prolonged power outages, Harvey was a rain event, primarily affecting residences. Most businesses were down only a handful of days, minimizing their losses.

November 08, 2017

Houston has been in the headlines a lot after Hurricane Harvey came through our region and dumped up to nearly 52 inches of rain in some places. While a few outliers wrote about Houston’s no zoning “Wild West” expansion, the majority focused on the resilience of our city, the get ‘er done mentality that had strangers helping strangers, and the compassion of our neighbors who dropped everything to lend a hand. As the water recedes, the damage has become clear, and it is, remarkably, much less than expected. This storm’s damage was mostly located in our homes.

October 03, 2017