Editor’s note: AGC Houston held their 2014 Annual Chapter Meeting last week where attendees heard about the chapter’s 2013 successes and accomplishments and also received economic and construction industry updates from featured speakers. Ken Simonson, Chief Economist for the Associated General Contractors of America, offered the following update about the improving economy and what that means for construction companies in 2014.

Editor’s note: AGC Houston held their 2014 Annual Chapter Meeting last week where attendees heard about the chapter’s 2013 successes and accomplishments and also received economic and construction industry updates from featured speakers. Ken Simonson, Chief Economist for the Associated General Contractors of America, offered the following update about the improving economy and what that means for construction companies in 2014.

Last week, AGC of America put out our annual survey that over 800 companies participated in, and for the first time in the five years that we've done this survey, there was much more optimism about the current year than there was pessimism. We asked first to say when they thought the market would turn positive, and a plurality, 37%, said 2014. Over two-thirds of the firms said it would be this year or next year, and previously a majority had always said that things weren't going to turn up for at least two years. Now here in Houston, the good times have already been rolling, and the breakout on Texas contractors definitely shows more optimism about the current year and about most business segments than the national survey. The national survey showed that for ten out of eleven market segments, there were more firms that thought business would improve this year than thought it would decline. The only exception was Marine Construction, but in Houston, it was thought even Marine would do better, and in many cases there were majorities of more than 50% who were positive compared to those who were negative about the current year.

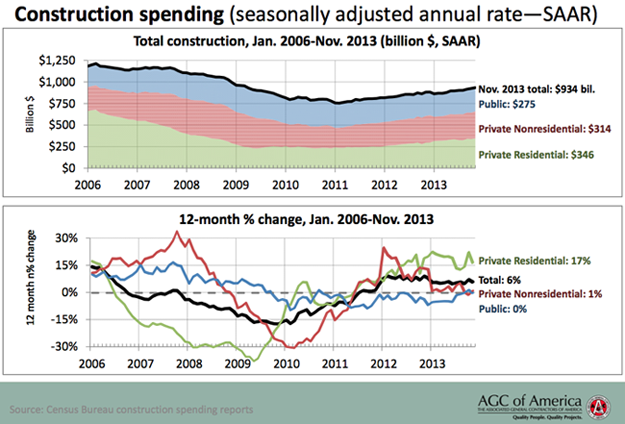

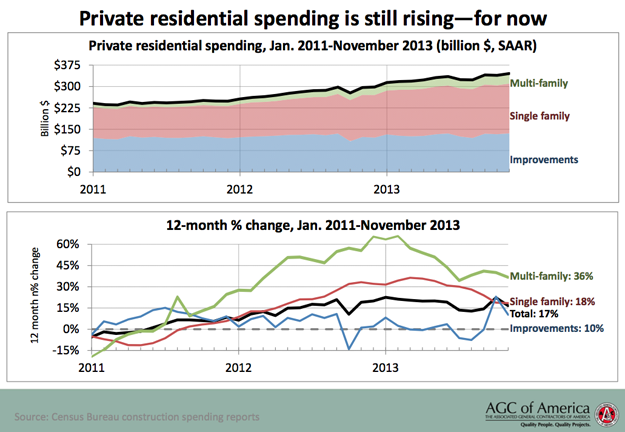

I want to talk a little about what I see going on in the national construction market. The above graphic shows the overall construction market decline very sharply from the peak way back in 2006 to the beginning of 2011 and up through November of last year. These are the latest figures we have. We've had almost three years of steady growth, but the tangle of lines down below shows that while overall the market has been growing, different segments behave very differently. The green wedge at the top and the line below, which is tracking year after year change, has been the most positive. That's private residential construction. As of November, it was up 17% compared to November of 2012. The red segment that's in the middle at the top is private non-residential construction, and that was doing extremely well at the beginning of 2012. It's still been growing, but last year very faintly. In fact, the November to November figures came in at just 1% growth. Public construction, shown by the blue line at the bottom has actually been declining for three years. Finally in November, it got to zero, but that's the best it has been for quite awhile.

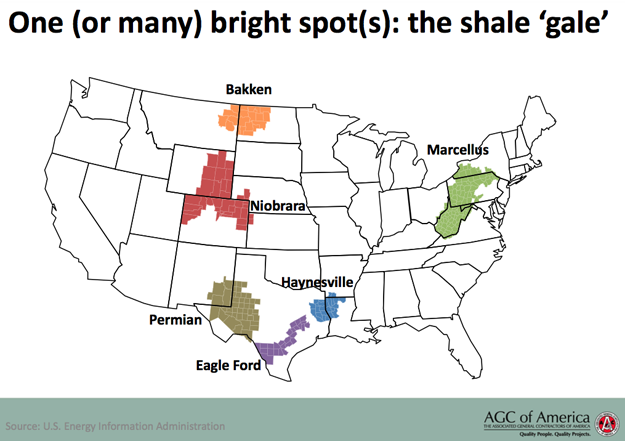

What I see happening in 2014 is that construction will be led by three segments. Houston is well-represented on all of these three trends. First, the massive shale gale.

The Energy Information Administration tracks where the shale activity is happening or is most promising, and this shows six of the leading formations, and lo and behold, three of them are in Texas. It doesn't even count what's happening on the Oklahoma border in Woodford or still going on in Fort Worth, so clearly Texas is well-positioned.

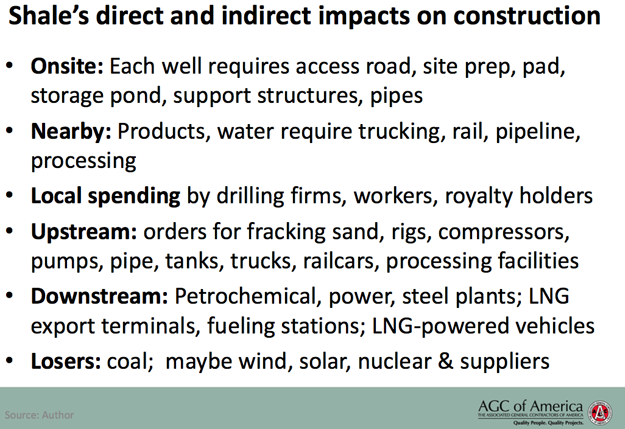

Now, the drilling itself doesn't count as construction, it's mining, but shown above are all the ways that the construction industry benefits, and no place is feeling these multiple effects more than Houston. In fact, I think we're just at the cusp of the major building activity that will result from the oil and gas revolution that's going on in this country. The American Chemistry Council keeps a tally on petrochemical-related projects that have been announced. They're up to, as of last month, 135 projects, totaling between $70-80 billion. Now, not all of those are going to break ground. We had an announcement last month that Shell backed out of one that it was going to do in Louisiana, and the timing on others is uncertain, but it does look like 2014 is going to be the year a lot of them get going. I think that's going to create more business in Houston for not just the process and the transportation and storage projects, but also the headquarters, the consulting businesses, and the many other kinds of services.

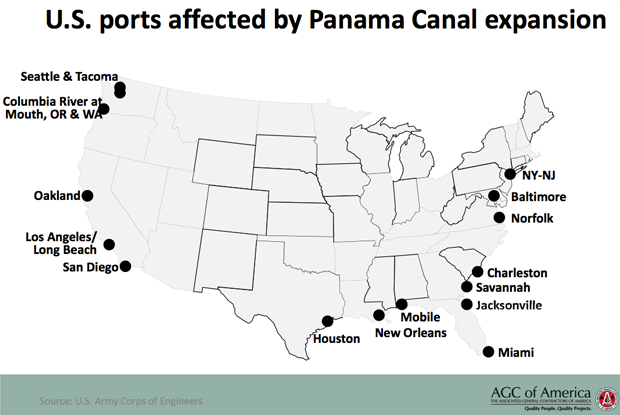

The second trend that's affecting construction in many parts of the country is the Panama Canal expansion. There is some doubt as to whether that project will get back on track. They've run into some major financing issues, but meanwhile, all of these ports shown by the black dots are doing construction of various types, and so whether the widened canal opens on time or not, there's a major impact going on in construction. In Houston, you can see it along the ship channel, along the railroad lines, and through distribution also.

The third positive trend is what's happening with residential construction. This is picked up just about everywhere in the country, led by multi-family, which in the last twelve months was up 36% with single family up a hefty 18%. However, nationally, I think single family is going to slow down and perhaps level off by the end of this year. Houston, however, is still getting population growth and a huge demand for additional housing, which is spurring both single and multi-family construction. The census bureau announced late last month that Texas, once again, had population growth that was double the national rate in 2013 at about 1.5% compared to under 0.75% for the country as a whole. So I think residential construction will also be stronger in Houston than nationally.

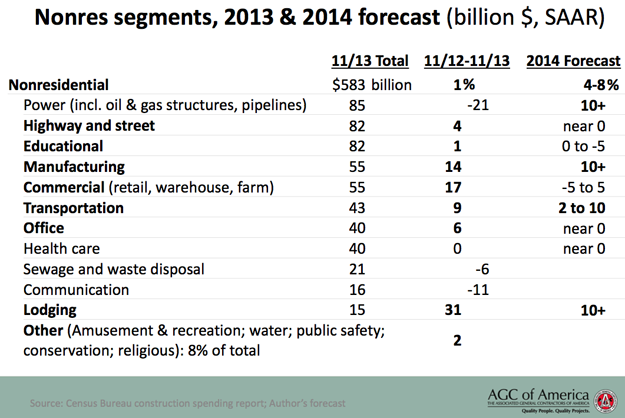

Above is a look at what's happened to non-residential construction in the last twelve months, public and private combined, as classified by the census bureau. I've ranked these categories in descending order or current size.

Watch for more of Simonson’s report in upcoming posts here on Construction Citizen.

Add new comment