The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the October newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

“It’s lean and mean until 2017” according to Jesse Thompson, Business Economist at the Federal Reserve Bank of Dallas, Houston branch. While his comments were directed specifically to the oil and gas industry, in many ways, he could be speaking to the Houston economy. Economists continue to look longer range for a recovery in Houston, as the prospect of oil recovering also extends. Patrick Jankowski, Vice President of Research at the Greater Houston Partnership, recently noted that Houston is still roughly 20,000 jobs below its peak in December 2014, and with more oil and gas layoffs expected in the fourth quarter, is unsure whether a historically strong fourth quarter will be enough to offset the losses.

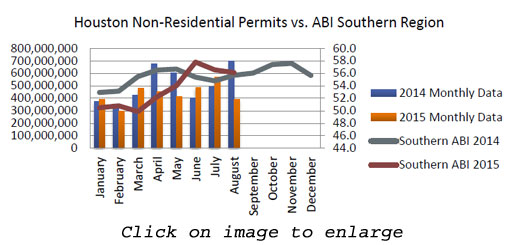

While net population growth is expected to continue around 125,000 (a combination of births and deaths plus relocations), low, or potentially no, growth in employment, will negatively affect construction going forward. City of Houston non-residential permits are slowing compared to a year ago, though not as much as expected given the robust 2014 market, and temporary meters, which signal new construction, tracked by CenterPoint Energy have also begun to slow. The Purchasing Managers Index was 47.3% in August, signaling a contraction, with Healthcare a robust outlier. Likewise, the AIA Architecture Billings Index signaled a contraction nationally, though the Southern region, which includes Texas, was still above 50, signaling an increase in billings.

Echoing those indices, CBRE is expecting 2016 to be a much softer office market and concessions to continue. Also experiencing heavier concessions is the residential market, where builders are offering $30-35k discounts on new homes, double the concessions seen a year ago, according to David Jarvis with John Burns Real Estate Consulting. Meanwhile, Bruce McClenny, with Apartment Data Services, continues to be optimistic for multifamily going forward. With a steady increase in the average rents across the city, occupancy holding at 91.2%, and 97 properties (26,609 units) under construction, McClenny does not see a risk of overbuilding until 2016, and then only sees it in the Class A properties, though it may trickle into the other classes.

Houston’s Monthly Metrics: October 2015

by Candace Hernandez | October 12, 2015