The following article originally appeared in the November newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the November newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

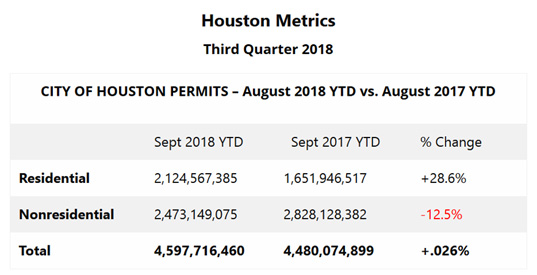

The picture in Houston remains the same. Residential construction, particularly single-family dwellings, is having a banner year while nonresidential building is basically stagnant. The chart to the right reflects the City of Houston permits through September 2018, compared to the same period a year earlier.

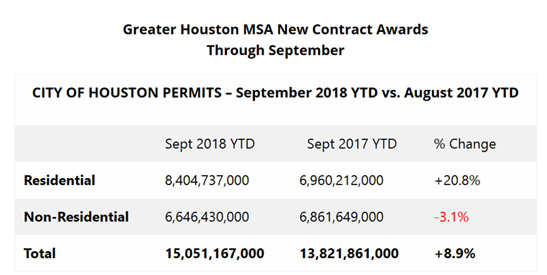

The second chart is the new contract awards for the nine-county Houston MSA, with the same comparison. This broader picture is better for the nonresidential sector, though still negative.

There is a positive change in the sublease general purpose office space market as of the end of the third quarter, according to NAI Partners. Over-vacancy decreased to 21.5% versus 22.1% a year ago. There was positive absorption of 789,303 square feet, the most since the oil downturn in the second half of 2014. Sublease space represented 180, 622 of the positive absorption.

Thera are other signals that the economy is improving for Houston. The rig count, new car and truck sales, hotel occupancy, and revenue per available room are all improved on a year-over-year comparison. So are retail sales, Port of Houston shipments, and air passengers. Oil prices too, well above $60 per barrel for WTI for several months now, allow exploration companies to make money in all fields. And we have had significant job growth in the last 12 months: over 100,000 new jobs. Absent any dramatic slowdown in the national economy, not expected until 2020, things should be positive for Houston construction firms; there should be growth, incremental not explosive.

Challenges remain, however. The skilled labor shortage is real for most firms, and wage pressures are building. Integrating millennials, a growing percentage of the overall workforce, has become a focus of senior management. Some companies are far ahead and are reaping tangible, differentiating rewards, especially in using technology solutions in the building process. Tariffs make pricing work extremely difficult; escalation clause proposals are still resisted. Succession planning is occurring in many firms. It is causing senior executive teams to strengthen their cultures and reinvent their approach to executive development.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: November 2018

by Pat Kiley | November 30, 2018