The following article originally appeared in the March newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the March newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

As Pat Kiley mentioned in his article Interval Training – Is It Good For Construction Companies?, the Houston construction market is entering a slowdown period. This slowdown is due to the unsustainably high levels of 2014, the lower oil prices, and the lower job and population outlook going forward. However, Houston IS still growing, albeit at a slower pace. We are not experiencing a recession, but rather an extended period of slower growth than we have become accustomed to.

CBRE recently reported that over 1 million square feet (msf) of sublease office space has come onto the market since December – all from oil and gas related companies. As the trend continues, landlords will begin to adjust their rates, to compete with their space in effect, and boost incentives. The other areas, however, are predicted to fare well in 2015. Multi-family properties’ current rate of construction will leave roughly 8,000 units vacant, dropping their occupancy to a still healthy 89%. Retail, while slowing a bit, still expects over 2 msf to be delivered in the first half of 2015, and light industrial is expected to show slower growth as well, after a record-breaking 2014, though 2016 looks to be a more difficult year.

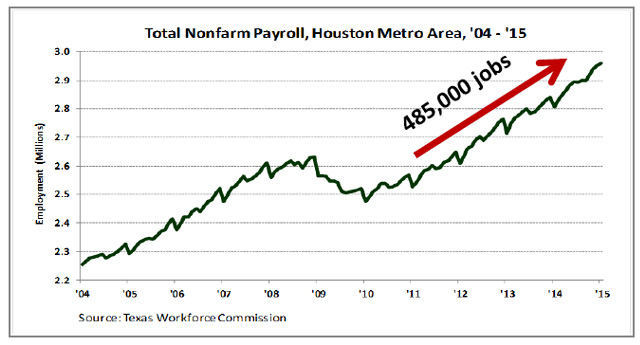

And as Houston winds itself down to a walking pace, from the full sprint of 2014, the numbers being reported are still enviable by most other metros. City of Houston permits were up slightly year over year in January. The Architecture Billings Index, a leading indicator of construction activity, remains positive in the southern region, suggesting an increase in the demand for design services. Residential continues to be strong with an estimated 32,000 homes to be delivered this year, in an attempt to catch up with the demand – though, again, 2016 is a bit hazier. And while Dr. Gilmer, with the Institute for Regional Forecasting, estimates job growth will be around 50,000 in 2015 (compared to the 100k+ in 2014), and will dip down to 40K new jobs in 2016 and 2017 before rising back to 50K in 2018, he does not expect Houston’s growth to go negative, even with sustained lower oil prices. In fact, courtesy of the Greater Houston Partnership, the graphic below shows the amazing job growth Houston has experienced just in the last five years: 485,000 is the equivalent of adding Lexington, Kentucky on top of Houston! And, if Dr. Gilmer’s forecast holds, we are set to add another 230,000 over the next five years. The message: Houston is still a desirable city, and the value our city offers is undeniable.

Houston’s Monthly Metrics: March 2015

by Candace Hernandez | March 20, 2015