The following article originally appeared in the July newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission. The construction market continues to tease a brighter future. Contractors are regularly reporting that, while still temporarily in pain, more work is on the horizon. Multiple code-named projects are in the works, and Houston leading economic indicators are pointing to continued growth, which should stir up some projects, as developers who have been sitting on the sidelines, are encouraged to act.

The construction market continues to tease a brighter future. Contractors are regularly reporting that, while still temporarily in pain, more work is on the horizon. Multiple code-named projects are in the works, and Houston leading economic indicators are pointing to continued growth, which should stir up some projects, as developers who have been sitting on the sidelines, are encouraged to act.

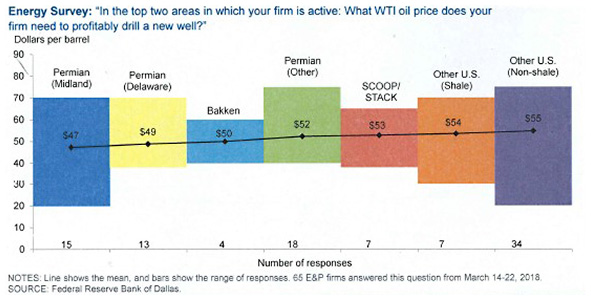

In a recent energy survey (see chart) by the Federal Reserve Bank of Dallas, E&P firms were asked what West Texas Intermediate oil price do their firms need to profitably drill a new well. Responses range from $20 to $70 in the Permian (Midland) area, with the average price being $47 per barrel. With oil prices well above that, the Permian Basin continues to produce more crude than pipeline capacity can hold, depressing prices for West Texas Intermediate (WTI) and creating a cheaper feedstock for U.S. refiners. Refinery profits are projected to rise this year and remain strong. The new requirements for marine tankers will help bolster the refineries.

With tariffs now in effect, it should come as no surprise that the Port of Houston had a huge uptick in steel imports in May, as companies tried to beat the tariffs. Contractors began seeing price increases in anticipation of these tariffs since they were first announced at the beginning of the year. We have heard reports of contractors losing jobs over the higher material prices, as owners rebid or shelf the project until the full impact is understood. As Ken Simonson, economist for the Associated General Contractors, noted, the producer price indexes for inputs to construction has risen 7.4% year over year, much higher than the 4.2% producer price index for new nonresidential building construction, which implies a growing cost squeeze for contractors. Passing on these increases is tough, especially in Houston, as we have many companies going after the same preferred projects who must also remain competitive.

The residential market is finally seeing the median home price reduce, as developers offer more first-time homebuyer products in the market, according to John Burns Consulting. CBRE Hotels recently published a report showing the occupancy spike from Harvey is quickly evaporating and should remain in the low 60% range until 2022 as new supply comes online. As our economy recovers, the availability of a future workforce to support Houston’s growth remains a primary concern.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houstons Monthly Metrics: July 2018

by Candace Hernandez | July 26, 2018