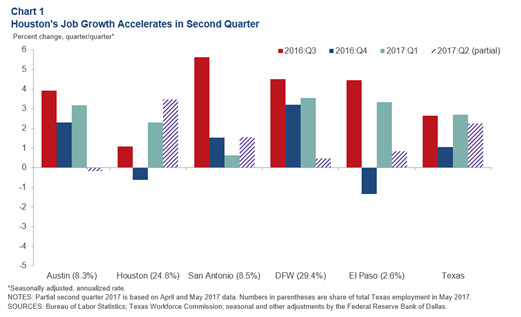

The following article originally appeared in the July newsletter to clients of Kiley Advisors, now a part of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission. On June 2, the Dallas branch of the Federal Reserve Bank released its latest economic update for the region. Texas, overall, is growing at a moderate pace and “boosted by the recent stability in oil prices, Houston employment expanded for a fifth consecutive month in May, registering the fastest year-to-date growth among the major metros,” as evidenced in the chart to the right.

On June 2, the Dallas branch of the Federal Reserve Bank released its latest economic update for the region. Texas, overall, is growing at a moderate pace and “boosted by the recent stability in oil prices, Houston employment expanded for a fifth consecutive month in May, registering the fastest year-to-date growth among the major metros,” as evidenced in the chart to the right.

However, Houston’s unemployment rate of 5.1 (actual) is still well above Texas’ 4.4 and the United States’ 4.1. And the recent slide in oil prices is only going to prolong Houston’s recovery, making the forecast of Patrick Jankowski, vice president of research at the Greater Houston Partnership, of a bathtub-like recovery increasingly probable. Revisions to the Houston employment numbers in April brought the unusually strong numbers down, while local economists still expect the year-end total employment growth numbers to be around 40,000-50,000, which is slower than our normal pace, but significantly better than the relatively zero job growth experienced in 2016.

There are many other positive indicators for our region. The Purchasing Manager’s Index remains well above 50, signaling an expansion in the market, and auto retail sales in May were the best since August, suggesting consumer confidence is improving. The American Institute of Architects’ Billings Index jumped up, as did its project inquiries and design contracts indices, all indicators of growth nationally, with the southern region, where Texas is located, being especially strong. City of Houston permits, while still down slightly from a year ago, show a significant shift from renovation-type work to new construction. CBRE continues to track the strong light industrial and retail markets. Despite several retail chains announcing closures, a recent Time magazine article revealed Americans are now spending more at restaurants than at grocery stores, with no signs of reversing trend. CBRE is even hinting that multifamily could be poised for growth as early as next year.

Houston’s Monthly Metrics: July 2017

by Candace Hernandez | July 14, 2017