The following article originally appeared in the January newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission. The second Friday in December, as the snow from the storm the night before still lingered, Patrick Jankowski, vice president of research at the Greater Houston Partnership, outlined his employment forecast for Houston in 2018 – 45,000 in employment growth. A month earlier, Dr. Bill Gilmer from the Institute for Regional Forecasting at the University of Houston gave an employment growth range of 20,000 to 70,000 with the weighted average hitting at 41,000 jobs. Both projections, thoroughly researched and scrubbed over, are heavily contingent on the price of oil in the year ahead. In Jankowski’s presentation, he stressed that what is good for the U.S. and the global economy is good for Houston, as we are a global city, with thousands of companies doing business around the world. In looking at the breakdown of Jankowski’s projected employment growth by sector, the base employment markets – those serving outside of the city such as manufacturing – are projected to do much better than nonbasic employment sectors – those sectors which rely on the local economy, like construction.

The second Friday in December, as the snow from the storm the night before still lingered, Patrick Jankowski, vice president of research at the Greater Houston Partnership, outlined his employment forecast for Houston in 2018 – 45,000 in employment growth. A month earlier, Dr. Bill Gilmer from the Institute for Regional Forecasting at the University of Houston gave an employment growth range of 20,000 to 70,000 with the weighted average hitting at 41,000 jobs. Both projections, thoroughly researched and scrubbed over, are heavily contingent on the price of oil in the year ahead. In Jankowski’s presentation, he stressed that what is good for the U.S. and the global economy is good for Houston, as we are a global city, with thousands of companies doing business around the world. In looking at the breakdown of Jankowski’s projected employment growth by sector, the base employment markets – those serving outside of the city such as manufacturing – are projected to do much better than nonbasic employment sectors – those sectors which rely on the local economy, like construction.

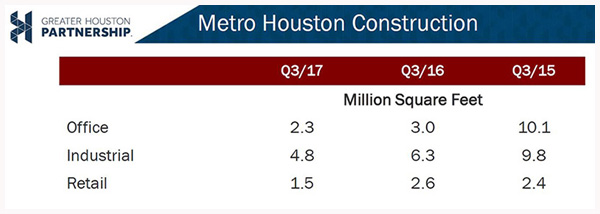

As Jankowski outlines in the chart above, the falloff in construction in the office, industrial and retail construction markets is sizable. Granted, and particularly in the case of office and industrial, the starting point was an anomalous high. Nevertheless, these markets are considerably slower than a few years ago and are expected to remain around their current levels in 2018. Likewise, multifamily, vibrant in 2015, finally began to slow in 2017 and will likely remain depressed in 2018, as those displaced from Harvey return to their homes, creating vacancy in the market. Heavy industrial, also a superstar over the last few years, is expected to decline as well, with the value of construction work projected to fall nearly 12%, according to Industrial Information Resources.

Hurricane Harvey’s impact has been primarily on the residential market. An influx of day labor workers can be seen around town, and so the true scope of repair costs will never be known. The long-term trend of a decline in homeownership rates continues, as investors swoop in and buy up damaged properties for renovation and landlord opportunities. For the commercial sector, Harvey has been, for the most part, a blip. Along with the World Series, it brought in some additional sales tax revenues to help METRO and the city, but for most contractors, did not dramatically impact their backlogs. Where Harvey’s impact could be seen going forward is at the polls. Both METRO and the Harris County Flood Control plan to go for bonds next year. Likewise, there are already discussions about the redrawing of the flood plan, and some homeowners are being required to raise their home level as a part of their rebuild process – a costly step. When consumers feel poorer, they spend less. They eat out less. They cut expenses where they can and look for lower-cost alternatives. They delay the purchase of big-ticket items. The same mentality can affect business spending as well. There are butterfly-effect implications for the Houston economy, as those nonbase industries will have consumers looking to spend less until they feel their balance sheets are again restored.

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: January 2018

by Candace Hernandez | January 23, 2018