The following article originally appeared in the April newsletter to clients of FMI Corporation, for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

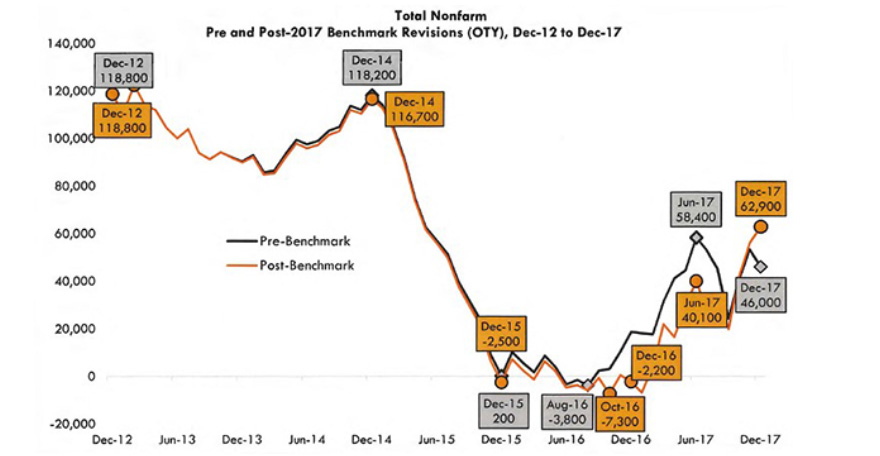

The annual benchmark revisions to the employment numbers were released by the Bureau of Labor Statistics (BLS) last month. This is the BLS’s opportunity to go back and correct any incomplete data from the past, and this time, they revised Houston’s numbers all the way back to 2013. The new employment numbers (see chart above) show Houston had job losses in both 2015 and 2016 before ramping up to over 60,000 jobs in 2017. While there are some concerns that the jump in 2017 is overly optimistic, the boost is likely, in part, due to Harvey as several sectors, including construction, saw job growth in the fourth quarter last year. History tells us that the boost in job creation will slowly retreat over the next year as recovery efforts subside, putting a drag on the employment numbers for 2018.

Also, new U.S. Census Bureau population estimates show Houston’s population is growth slowed from 125,005 (July 2015 – July 2016) to 94,417 (July 2016 – July 2017). The slowdown came almost exclusively from domestic in-migration, a result from our slower economy. While our 13-county region has added 950,000 residents since 2010, this slower pace, while not unexpected, will have implications for future construction and development needs.

Halliburton is forecasting oil production to dip below demand in 2018 and then remain above demand for 2019. They anticipate this will keep oil prices above $60 for 2018 before dropping into the upper $50’s in 2019. Sand, labor shortages and pipeline capacity remain issues. The tax reform passed earlier has many people making plans in the plants. The impact of the new tariffs is unknown. Contractors have already begun receiving notices of rising steel and aluminum prices, on top of already increasing prices, to cover the new tariffs, and margins are again expected to be squeezed as contractors try to pass on those increases to the owners where they can.

The light industrial market remains strong with “clear height” becoming an issue as the warehouses get higher and higher – one recently went to sixty feet according to CBRE. The trend is being driven by automation and has become pervasive enough that CBRE may change the way the space is tracked in the future (moving from square feet to cubic feet).

Businesses and residents are monitoring the discussions around the new floodplain and its requirements and cost implications. Construction Dive recently reported that Mayor Turner has said all new buildings within the city limits should be built two feet above ground and those in the 500-year floodplain should be built two feet above the expected flood level. Beginning this year, Harris County has said most new homes have to be built to a 500-year floodplain standard even if they are within a 100-year floodplain. Questions remain around what happens to improvements to existing buildings that would require this code compliance. The school districts, for one, have properties scattered across the region that will need extensive additions and repairs over time that these new standards could wreak havoc upon.

There is also concern that some of those displaced by Harvey will not return to their homes and stay in apartments instead. John Burns Consulting reports that while the apartments are slightly overpriced in Houston, single family homes are even less affordable, with the median home price increase outpacing income growth over the last year. This means that those who were on the bubble or looking to re-enter may have an issue with affordability and decide to continue renting. On a positive note, it could bring multifamily projects back much sooner. The downside is it could have further tax implications for the school districts.

If these challenges weren’t enough, school districts are also facing Governor Abbott’s proposed tax plan that would limit local entities from collecting more than 2.5% in additional property tax revenue than the previous year unless they receive a super majority (2/3) of voter approval. As such, many districts are looking to get bonds passed sooner rather than later.

Image source: Workforce Solutions

If there are metrics or topics you would like FMI to include in upcoming newsletters, or if you would like to discuss any of the information contained herein in more detail, please contact FMI at 713-840-1775.

Houston’s Monthly Metrics: April 2018

by Candace Hernandez | April 20, 2018