The following article originally appeared in the June newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

The following article originally appeared in the June newsletter to clients of Kiley Advisors, LLC for the purpose of providing the latest leading indicators and industry issues to those clients. Reprinted with permission.

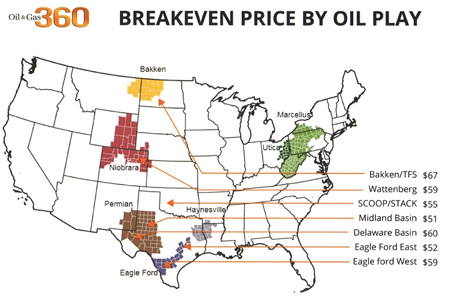

When it comes to oil, $50 is not enough. Those were the sentiments of Jesse Thompson, Business Economist for the Federal Reserve Bank of Dallas, Houston Branch. Complimenting that opinion, Dr. Bill Gilmer, Director of the UH Bauer Institute for Regional Forecasting, earlier this month during his bi-annual symposium, noted that a non-volatile $60 price for oil would result in increased activity. The chart above shows the breakeven price, further supporting their claims.

So when will we see stable oil prices at $60/bbl? Stop a random person on the street and their guess is as good as anyone else’s. The Energy Information Administration has a confidence index, where they project the price of oil with a 95% certainty based on the feedback from economists, often resulting in wide ranges from $20 to $100 in oil. Last year, they missed the mark. But given that oil was sub $30 in January, we seem to be on the right track.

For Houston, other sectors are starting to noticeably feel the effects of the precipitous drop in the energy sector. 2016 employment numbers have been weak; City of Houston permits are down; auto sales are markedly down – a signal of consumer confidence – and the purchasing manager’s index, a leading indicator, continues to contract. Dr. Gilmer recently revised his employment forecast down (see chart) while cautioning that the energy market will dictate when the uptick will occur. For contractors, the sooner the better. Dodge Analytics contract awards are trending down approximately 15% compared to a year ago, and reports of rising material costs do not bode well as we look to the coming months.