Employment hits 5-year high in August; Manpower poll implies more hiring next quarter Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Nonfarm payroll employment rose by 142,000, seasonally adjusted, in August and 2,482,000 (1.8%) over 12 months, the Bureau of Labor Statistics (BLS) reported on September 5. Construction employment rose by 20,000 for the month and 232,000 (4.0%) over the year to 6,068,000, the highest total since May 2009. Residential construction employment (residential building and specialty trade contractors) climbed by 13,200 for the month and 123,100 (5.7%) for the year. Nonresidential employment (building, specialty trades, and heavy and civil engineering construction) increased by 6,400 in August and 108,600 (3.0%) year-over-year. All five residential and nonresidential segments added workers for the month and year. Average hourly earnings for all employees in construction rose 2.1% from August 2013 to August 2014, similar to the rate for the previous six months but up from 1.7% a year earlier. The unemployment rate for jobseekers who last worked in construction fell to the lowest August level in seven years: 7.7%, down from 9.1% in August 2013 and 17.0% in August 2010. (Industry unemployment data are not seasonally adjusted and should only be compared year-over-year, not across months.) Since August 2010 the number of unemployed construction workers has dropped by 805,000, not seasonally adjusted, while construction employment rose by 543,000, implying that over 260,000 experienced workers in the past four years left the industry for employment elsewhere, further training or schooling, retirement, or left the workforce. However, in the latest 12 months, employment increased by more than the unemployment drop of 80,000, suggesting that contractors have begun to attract workers (back) into the industry. Contractors are invited to complete the 2014 AGC of America Workforce Survey to report their hiring experience.

“For Quarter 4 2014, employers have a positive [hiring] outlook in all 13 industry sectors included in the survey” of 18,000 employers, ManpowerGroup Inc. reported [4] last Tuesday. Among construction employers, 17% expect to increase hiring, while 10% expect to decrease it, for a net employment outlook of 7%, a “slight increase” in the expected hiring rate from three months ago.

The value of nonresidential construction starts jumped 25% in August from August 2013 and 8.3% for the first eight months of 2014 combined, compared with the same months of 2013, Reed Construction Data reported last Friday, based on information it collected. Heavy engineering starts leaped 20% for the month and 13% year-to-date. Nonresidential building starts climbed 28% and 5.7%, respectively, with commercial building starts up 40% and 0.4% and institutional buildings up 16% and 7.9%.

“‘There’s a genuine demonstrated need for new infrastructure, and yet states and municipalities are just extremely cautious about borrowing,’ said Scott Pattison, executive director of the National Association of State Budget Officers,” the Wall Street Journal reported on September 5. “‘From their perspective, revenue is coming in below expectations, growth is slow compared to before the recession, the feds are creating uncertainty, so we’re going to continue to be cautious.’…Officials are postponing anything that isn’t critical or important to public safety for a year or two until economic conditions improve, said Jamison Feheley, head of banking for public finance at J.P. Morgan Chase & Co. Even when public officials push ahead, voters are rejecting more debt, with the value of approved bonds falling to about two-thirds of those proposed in the three years immediately after the [financial] crisis, from an average of more than three-quarters in the three years prior. And while that total rose to 72.3% in 2013, school districts were still below that level and less likely to get voter approval than utilities, transportation or general-purpose debt, according to Bond Buyer data.”

Employer costs for employee compensation (wages, benefits and required payments such as unemployment and workers’ compensation) in construction averaged $35.10 per hour in the second quarter, up 2.1% from a year ago, BLS reported last Wednesday. Compensation in construction exceeded the private industry average of $30.11 by 17%. Although the share of costs that went for wages and salaries was similar in construction (69.5%) and in the entire private sector (69.0%), the mix of other costs differed. Retirement and savings costs averaged $1.96 per hour (5.6% of total costs) in construction vs. $1.23 (4.1% of total costs) for the private sector as a whole. Workers’ compensation averaged $1.25 per hour (3.6%) in construction, triple the $0.43 average (1.4%) for the private sector.

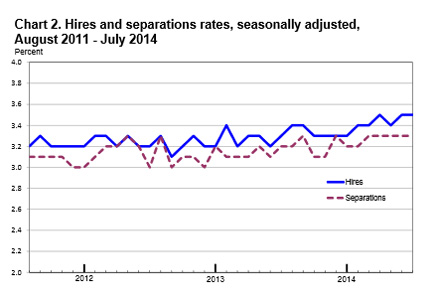

Seasonally adjusted construction hiring and separations both jumped in July, according to preliminary data in BLS’s Job Openings and Labor Turnover Survey (JOLTS) report released last Tuesday. The number of employees hired during the month increased to 366,000 from 268,000 in June and 307,000 in July 2013. Both the number and the rate of hires (6.1% of total employment as of the end of the month) were the highest since February 2013. Separations include layoffs and discharges, quits and other separations (retirements, transfers to other locations, deaths, and separations due to disability). The rate of layoffs and discharges in construction rose to 3.4% in July, not seasonally adjusted, from 3.0% in July 2013. The not seasonally adjusted rate for quits edged up to 2.2% from 2.1%; for other separations, to 0.2% from 0.1%. The number and rates of job openings, seasonally adjusted, dipped from June but remained higher than in July 2013 or most months since then. JOLTS data are sometimes substantially revised in the following month, so it is too early to assume July data mark a turning point.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.

AGC's Data DIGest: September 5-15, 2014

by Ken Simonson | September 15, 2014

Add new comment