CMD, Dodge, Lodging Econometrics reports imply spending gain; higher ed faces hurdle Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Editor’s note: Construction Citizen is proud to partner with AGC America to bring you AGC Chief Economist Ken Simonson's Data DIGest. Check back each week to get Ken's expert analysis of what's happening in our industry.

Several recent private indicators point to expanding construction activity ahead. The value of nonresidential construction starts grew 11% from October 2013 to October 2014 and 7.5% year-to-date for the first 10 months of 2014 combined compared to the same period last year, CMD (formerly Reed Construction Data) reported last Thursday, based on data it collected. Nonresidential building starts increased 9.8% year-over-year and 5.7% year-to-date, with commercial building categories up 25% and 4.8% respectively, and institutional buildings up 5.2% and 7.6%. Heavy engineering starts climbed 9.8% and 5.7%.

The Dodge Momentum Index, “a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year,” rose 7.6% from September to October, Dodge Data & Analytics (formerly McGraw Hill Construction) reported on November 10, based on data it collected. The “index had declined in each of the previous three months, and the increase in October returns the index to the rising trend seen during the first half of this year. The Momentum Index now stands 18% above last year, which indicates that overall healthy economic growth is working its way through to the construction sector.” Both components rose by similar percentages for the month: institutional building, up 8.8%, and commercial building, up 6.8%.

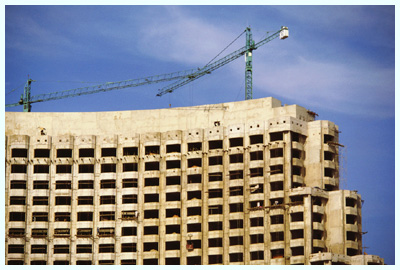

“The Hotel Construction Pipeline surged forward to a five-year high” in the third quarter of 2014 with 3,516 projects and 443,936 rooms under construction, expected to start within 12 months, or in early planning, consultancy Lodging Econometrics reported last Wednesday, based on data it collected. “The Pipeline has posted double-digit year-over-year …increases for four consecutive quarters in both projects and rooms. In [the third quarter of 2014, year-over-year] increases are up 25% and 24% respectively, signaling a breakout into the expansion phase of the current real estate cycle which is likely to continue another two-to-three years.” Projects and rooms under construction soared 50% and 46% year-over-year, while projects and rooms scheduled to start in the next 12 months jumped 36% and 34%. The Census Bureau reported on November 10 that private lodging construction climbed 15% from September 2013 to September 2014 and 18% year-to-date.

Higher-education construction is encountering both financial and demographic challenges. “Net tuition revenue growth for US nonprofit colleges and universities in fiscal 2015 will be the weakest in a decade, according to a report Monday from Moody's Investor Service, based on a survey of 290 public and private not-for-profit institutions. “The tuition survey notably states a significant 55% of public universities are projecting they will not increase net tuition per student by at least the 2% rate of inflation in fiscal 2015, compared with 40% last year. We expect this trend to continue over the next two to three years, as many states limit tuition increases at their public universities in return for modest increases in state support. While Moody's projects overall enrollment will rise by 1%, 37% of public and 45% of private universities are indicating enrollment declines. Reduced numbers of high school graduates has made the competition for freshman students particularly intense in the Midwest and Northeast.” College enrollment declined by “463,000 between 2012 and 2013, marking the second year in a row that a drop of this magnitude has occurred,” the Census Bureau reported on September 24. “The cumulative two-year drop of 930,000 was larger than any college enrollment drop before the recent recession,” based on data going back to 1966. Higher-education construction spending rose 0.8% YEAR-TO-DATE through September, with private higher-ed down 3.0% and state and local higher-ed up 1.2%, Census reported on November 3.

“Total state tax collections declined by 1.2% in the second quarter of 2014 compared to the same quarter in 2013,” the Rockefeller Institute of Government reported on November 5. “This decline follows a slowdown in growth in the second half of 2013 and the first quarter of 2014….Despite this downward trend, preliminary data suggest that state tax collections will resume relatively strong growth in overall tax collections…in the third quarter of 2014 and beyond. According to preliminary data from 45 states for the third quarter of 2014, total tax revenues increased by 4.0% compared to the same period in 2013…. In their analysis of the second quarter, the Institute's experts conclude that the 6.6% declines in personal income tax collections ‘are not necessarily an indication of a slowing economy, and are partially attributable to the disappearance of the temporary shifts in income tax collections driven by the federal fiscal cliff’ (when many taxpayers shifted income from tax year 2013 to tax year 2012 to minimize federal tax liability). Regionally, the Great Lakes region had the largest decline in the second quarter, at 6.5%, while the Far West showed growth of 1.1%. Local property tax revenues grew by 2.7%, marking the ninth consecutive quarter of growth in this sector in nominal terms.” Investment research firm Thompson Research Group reported on November 3, “Tax collections for our core states continue to hit new highs with 7 of 13 states reporting [year-over-year] increases in all tax categories for Q1’15 (July-September). General fund tax collections rose 4.4% in Q1’15, and are up 22.5% from the 2010 lows. Fuel tax collections for our core states rose 2.2% in Q1’15. Fuel collections are up in 15 of the past 18 quarters. Tax collections are important to state construction both directly through public agency budgets and as a basis to support bond issues. More bond issues were on the ballot this month than in recent years, and a higher percentage appear to have passed, especially for school construction.

The Data DIGest is a weekly summary of economic news; items most relevant to construction are in italics. All rights reserved. Sign up at www.agc.org/datadigest.

AGC's Data DIGest: November 10-17, 2014

by Ken Simonson | November 19, 2014

Add new comment